Small and medium-sized enterprises account for 99.8% of all active companies in Poland. Although they are the foundation of the national economy, their level of digitalisation lags behind the European average. Poland ranks only 24th in the DESI ranking, and only 40% of domestic SMEs have reached a basic level of technology use. By comparison, this figure reaches 55% in the European Union. However, these overall figures do not reflect the complexity of the market. Detailed research conducted by KPMG as part of its report ‘Advancing the Digital Transformation of Polish Enterprises‘ showed that the SME sector is not homogeneous. It can be divided into six distinct segments, each with a different approach to technology, development motivation and transformation barriers.

Digital map of Polish SMEs

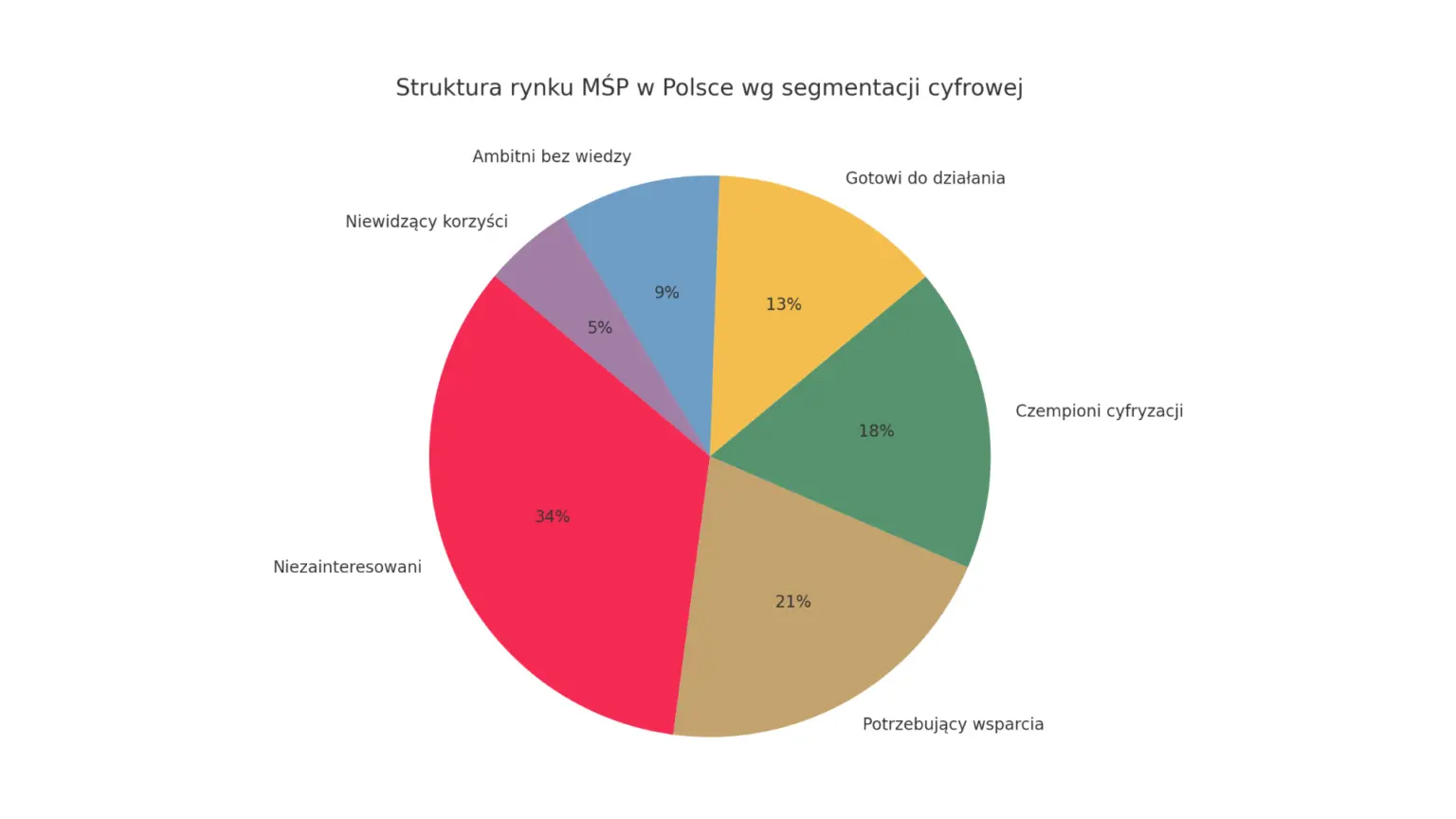

The largest group are companies identified as ‘Uninterested’, accounting for as much as 33% of the market. Their attitude towards technology is passive – they only implement new solutions when they are forced to do so, and digitisation itself makes them anxious. On the other side are the “Champions of digitisation”. – 17% of companies that treat technology as a key element of their business strategy and actively seek innovation. In between these poles, there are segments that are more diverse: ‘Needing support’ (20%), ‘Ready to act’ (13%), ‘Ambitious without knowledge’ (9%) and ‘Not seeing the benefits’ (5%).

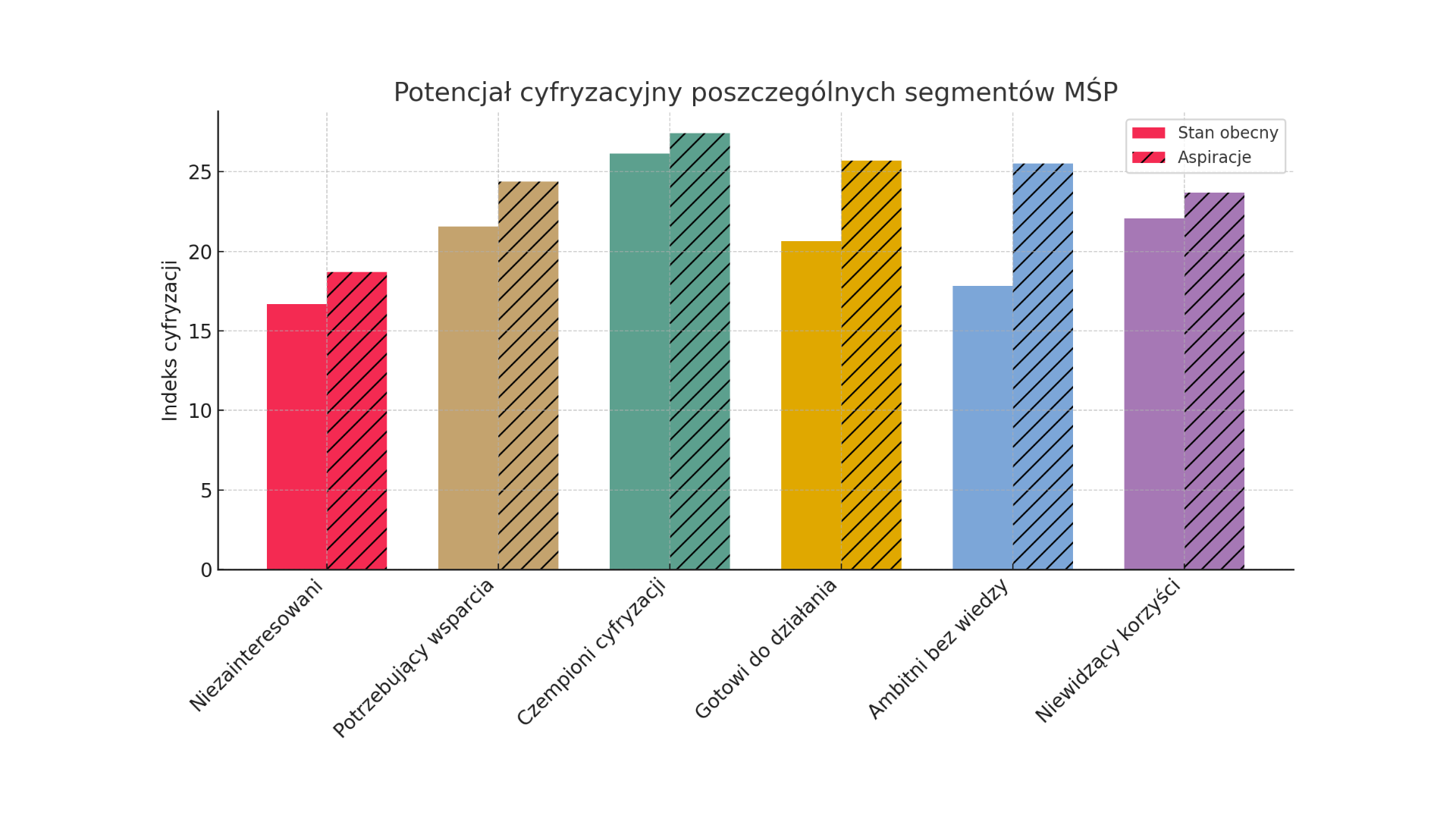

A juxtaposition between the current level of digitalisation and the digital aspirations of the different groups reveals their development potential. The biggest differences between the current state and declared plans concern the ‘Ambitious without knowledge’ and the ‘Ready for action’. These are companies that are aware of the need for change and want to grow, but often lack knowledge, resources or the right technology partner.

What distinguishes each segment and how to talk to them?

“Uninterested” are usually long-established companies, operating locally, often in a B2C relationship. Their digitalisation is limited to basic areas such as finance or workflow. They are apprehensive about digital transformation and a key barrier is a lack of internal need for change. For this group, effective sales should be based on external impulses – such as regulatory changes – and simple financial messages. The offer should be as simple as possible and tailored to minimum expectations.

A completely different approach should be taken with the ‘Ambitious without knowledge’. These younger companies are aware of the benefits of digitalisation and are strongly motivated to change, but face competence and budgetary constraints. An effective way to reach this segment is to take on the role of advisor and educator. Educational content such as webinars, tutorials or free audits are valuable support tools. The recommended offer should be scalable and flexible, allowing development according to the pace and capabilities of the company.

“Not seeing the benefits” are companies that have already invested in technology and are using a relatively broad set of tools (8 out of 12 respondents on average), but do not see the point of further transformation. Their attitude is one of scepticism, and digitisation raises concerns especially among employees. For this group, concrete evidence – especially well-documented case studies from their industry – is crucial. It is not worth talking about revolution – it is better to focus on optimisation, integration of existing systems and improving efficiency.

There is great potential for growth in the ‘Needs Support’ segment. These companies are convinced of the need to digitise, but lack the resources, time and access to knowledge about available forms of support. Their main motivation is the desire to keep up with modernity. Operational implementation is a key challenge – so comprehensive offers, including both consultancy and implementation and training, will be most effective. Of particular value here is assistance in obtaining funding, especially through public programmes.

“Ready for action” is a segment that is aware of and well prepared for the next technological steps. Their main challenge is the lack of integration between existing systems – they have many solutions, but they do not form one coherent ecosystem. In this case, the merchant should be a knowledgeable partner, able to propose integration projects, infrastructure audits and training for more advanced users.

At the end are the “Digitalisation Champions” – companies that are already using most of the solutions available today and are looking for innovations that will maintain their competitive edge. These are the customers who demand a strategic approach, technological innovations and partnerships. They are open to pilot projects, AI experiments, process automation or R&D joint ventures.

What are the lessons for the IT sales channel?

Firstly, segmentation is a must. Trying to sell technology in a one-size-fits-all way is unlikely to work today. Precise customer qualification – even if only by asking a few questions about the strategy, challenges and the team’s approach to new tools – significantly increases the chance of success.

Secondly, education is the most important sales tool today. Lack of knowledge, uncertainty and competence constraints appear in all less sophisticated segments. Providers who can deliver educational content and share expertise will not only sell more, but also build customer loyalty.

Thirdly, the future belongs to services. The report clearly shows that SMEs do not have the resources to manage the digital transformation themselves. This signals that the market will grow where the offering goes beyond the provision of technology to include operational support: from consulting to implementation to managed services and IT outsourcing.