2025 is not another year of evolution in the business laptop market; it is a year of revolutionary upheaval. The confluence of three powerful forces – the massive deployment of on-device AI (artificial intelligence), the imminent end of Windows 10 support and the permanent entrenchment of hybrid working models – is creating a perfect storm that redefines what a PC is and can do for the professional. It is a fundamental paradigm shift, shifting the centre of gravity from raw computing power to intelligent, integrated and secure ecosystems.

This transformation is based on three pillars. The first is the AI revolution, which shifts the burden of computing from the cloud directly to the device. With dedicated neural processing units (NPUs), laptops gain an unprecedented ability to personalise, automate tasks and deliver real-time productivity, all while maintaining the highest standards of data privacy. The second pillar is a powerful, unavoidable market catalyst: the 14 October 2025 deadline marking the end of support for Windows 10. It forces businesses around the world to upgrade their PC fleets en masse, perfectly coinciding with the release of the next generation of hardware. The third pillar is the new working paradigm. The hybrid model has become the norm, forcing manufacturers to create devices that are not only powerful, but also ultra-secure, highly mobile and optimised for continuous video collaboration.

In this new landscape, competitive advantage is no longer defined solely by processor power, measured in gigahertz, or the number of cores. The winners in 2025 will be those vendors who offer the most cohesive, intelligent and secure ecosystem, combining hardware, software and services in a way that realistically addresses the challenges of a decentralised, AI-driven working environment. This analysis delves into the market data, technology strategies and positioning of key players to identify the trends that will define the future of business laptops.

The market landscape in 2025 – a rebound in the shadow of uncertainty

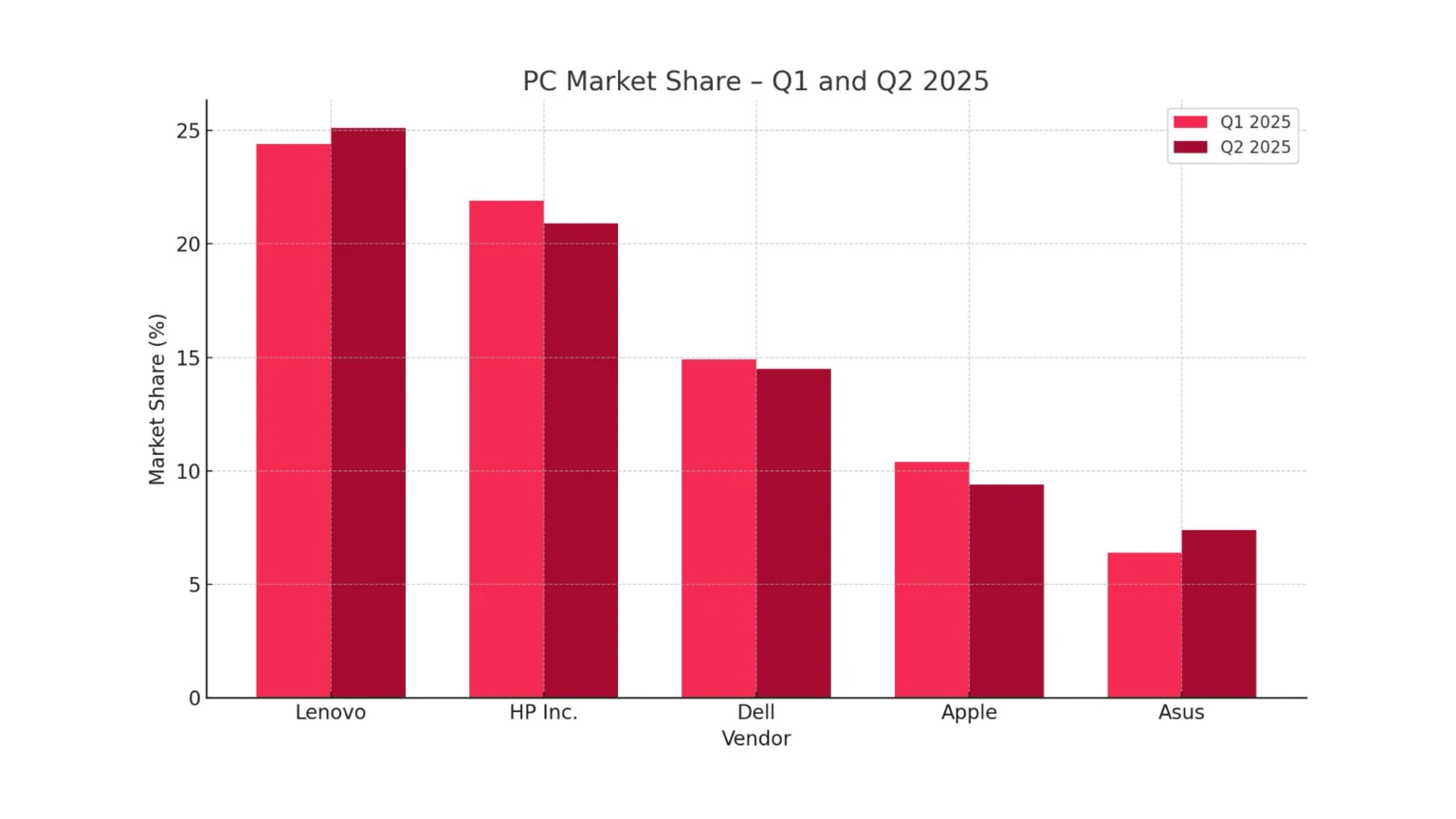

The first half of 2025 has brought a long-awaited recovery to the PC market. After a period of stagnation, global PC shipments recorded solid growth, increasing by 9% year-on-year in the first quarter and by 7% in the second quarter. At first glance, these figures signal the return of healthy demand and the start of a new buying cycle.

An analysis of the leading manufacturers shows varying dynamics. Lenovo maintained its position as the undisputed leader, recording impressive shipment growth of 11% in Q1 and 15.2% in Q2 2025, demonstrating the effectiveness of its product and operational strategy. HP Inc. steadily took second place, maintaining a solid market share. The real star of the first half of the year, however, turned out to be Apple, which demonstrated a spectacular growth rate, with shipments increasing by 22% in Q1 and 21.3% in Q2. Such results point to the growing acceptance of the Mac platform in commercial and professional environments, which have traditionally been a bastion of Windows systems. In contrast, Dell, the third largest player, reported a 3.0% decline in shipments in Q2, which may signal some challenges in aligning its portfolio to the current product cycle or stronger competition from rivals.

Although the figures point to recovery, a deeper analysis reveals a more complex picture. The seemingly strong growth figures for the first half of 2025 do not fully reflect organic demand from end users. They are largely the result of strategic stockpiling by manufacturers and distribution channels in response to growing geopolitical uncertainty and the threat of new trade tariffs, particularly in the US.[4, 5] Manufacturers have been deliberately accelerating orders to get ahead of potential tariff increases on electronics, meaning that high delivery numbers may be significantly ahead of actual end demand. This creates the risk of excess inventory in the distribution channel, which could lead to price pressure and a potential market correction in the second half of the year.

The Polish IT market reflects global recovery trends, but with its own unique characteristics. In the first quarter of 2025, PC sales in Polish distribution grew by an impressive 18.1% year-on-year, but this growth was driven primarily by the consumer segment. The business sector showed more restraint, revealing the existence of a ‘value proof gap’. In the Polish market, there is a clear discrepancy between the global marketing hype around AI PCs and the actual purchasing decisions of companies. While global forecasts predict that AI laptops will account for nearly 60% of the market as early as 2025, first-quarter data from the Polish market shows that sales of the latest AI-optimised chips were “lower than expected”. Business customers were more likely to opt for tried-and-tested and often cheaper older-generation processors.

The AI PC revolution – the birth of a new category of device

The year 2025 marks the point at which the term ‘AI PC’ moves from the marketing buzzword phase to a real, defined product category. The de facto market benchmark that has defined what a modern AI PC is has become the Microsoft Copilot+ PC standard. This is a new class of Windows-based device designed from the ground up for local processing of AI tasks. In order for a laptop to carry this designation, it must meet stringent technical requirements: a neural processing unit (NPU) performance of at least 40 trillion operations per second (TOPS), a minimum of 16 GB of RAM and a fast SSD of at least 256 GB.

The role of the NPU is fundamental. Unlike traditional architectures, where AI tasks overloaded the main processor (CPU) or graphics card (GPU), the NPU is specifically designed to efficiently perform these calculations with significantly lower power consumption. This translates into longer battery life and quieter operation – key attributes in a mobile business environment.

Practical business applications are becoming more and more tangible. Video conferencing is becoming smarter with features such as real-time noise cancellation and automatic speaker framing. Office applications such as Microsoft Teams and Outlook offer automatic transcriptions and summaries of meetings and email threads, freeing up staff time. In Excel, it becomes possible to generate complex reports from simple natural language commands.

The sudden rise of AI PCs is being driven by two powerful, coinciding developments. First, the end of Windows 10 support on 14 October 2025 acts as a powerful commercial catalyst, forcing companies to upgrade their hardware fleets. At this point, Copilot+ PCs are positioned as the logical, standard choice for any hardware replacement. Secondly, we are seeing a fundamental architectural shift: the re-decentralisation of computing. Moving AI computing from the cloud to the end-device addresses growing business concerns about privacy, speed, reliability and cost control associated with the cloud model.

The war for silicon – who is driving the intelligence on board?

At the heart of the AI PC revolution is a new generation of processors, and competition between processor makers has become a key battleground. In the AI PC era, the key performance indicator has become NPU power, expressed in TOPS (Trillions of Operations Per Second).

Each of the four major players in the silicon market has adopted a different strategy. Intel, with its new generation of Core Ultra (‘Lunar Lake’) processors delivering 47 TOPS, is focused on defending its dominant position in the commercial segment by leveraging its mature x86 ecosystem. AMD, with its Ryzen AI 300 series (‘Strix Point’) offering 50 TOPS, is positioning itself as an aggressive contender, targeting the crown of performance leader, including in integrated graphics. Qualcomm, with its Snapdragon X Elite (45 TOPS), is making a breakthrough, bringing the highly energy-efficient ARM architecture to the Windows world and promising revolutionary battery life. Finally, Apple, with its M4 chip (38 TOPS), continues its strategy of full vertical integration, focusing on optimising the synergy between hardware and software rather than the race for the highest nominal TOPS value alone.

Behind the façade of numbers lie deeper dimensions of competition. The real battle is to create the most efficient development platform, as it is the software, not the hardware, that will ultimately deliver value to the user. Qualcom’s entry into the Windows market with ARM architecture also creates a fundamental dilemma for IT decision-makers: whether to bet on the guaranteed compatibility of the x86 platform, or risk potential problems with emulating legacy applications in favour of the ARM platform’s significantly longer battery life.

The battle for the ecosystem, not just the hardware

Faced with such fundamental changes, major laptop manufacturers are struggling to create a coherent ecosystem.

Lenovo is pursuing a two-pronged strategy. “AI Engine+” in the Legion series is targeted at gamers and optimises performance in real time. “AI Now” in the ThinkPad series, on the other hand, is a personal assistant for professionals, running locally on the device and emphasising privacy. This strategy is supported by the solid financial performance of the Intelligent Devices Group (IDG) division, which reported strong double-digit revenue growth.

HP is focusing on an integrated ‘HP AI Companion’ platform to create ‘intelligent workflows’ and personalise the user experience, with a strong focus on security and on-device computing. The company has taken a flexible approach, offering processors from Intel, AMD and Qualcomm in its AI PC laptops, with the HP Wolf Security suite as a key component of the offering. The success of this strategy is evidenced by 9% revenue growth in the commercial segment in the second quarter of fiscal 2025.

Dell is taking a more evolutionary approach to the AI revolution, gradually integrating intelligent features into its proven business lines such as Latitude and Precision. The company is focusing on practical benefits: optimising performance, enhancing security and improving user interaction. This conservative strategy, reflected in flat revenue in the commercial segment in Q2 2025, seems primarily aimed at maintaining the trust of existing large enterprise customers.

Apple bases its strategy on deep ecosystem integration and uncompromised privacy. The ‘Apple Intelligence’ suite is woven into the core of the operating systems, with most operations taking place locally on the device. The company’s focus is on the fluidity and real-world usability of AI features that draw strength from awareness of the user’s personal context. Impressive double-digit growth in Mac shipments in the first half of 2025 is evidence that this strategy is resonating with the market.

The year 2025 marks a turning point that requires IT decision-makers to rethink their purchasing strategies. AI is becoming standard, the platform market is fragmenting (x86 vs. ARM) and security is becoming an integral part of hardware.

Choosing the right business laptop requires a new, holistic approach. The traditional purchasing model, based mainly on technical specifications, is no longer sufficient. IT decision-makers need to think like strategists, basing the decision-making process on a three-dimensional matrix that takes into account the specific needs of the organisation: the performance axis (including NPU and energy efficiency), the ecosystem axis (the trade-off between x86 compatibility and ARM battery performance) and the security axis (the depth of integration of hardware solutions).

The traditional total cost of ownership (TCO) metric also needs to be redefined. The new TCO needs to take into account the return on investment (ROI) resulting from increased employee productivity through AI features and the risk-avoidance value of on-device computing.

Looking to the future, current trends can be expected to deepen further. Artificial intelligence will become even more personalised and sustainability will play an increasingly important role in decision-making.