The export of IT services has become one of the key elements of Poland’s foreign trade, significantly supporting the country’s current account surplus. Poland has maintained a positive balance in services trade since the mid-1990s, and in recent years services have become the main driver of the foreign trade surplus. Although the largest shares of services exports have traditionally been transport and tourism, IT (information technology) services are dynamically increasing in importance. Since 2010, exports of IT services have grown at an average annual rate of over 20% – more than twice as fast as exports of services in general. As a result, the share of IT services in Polish services exports has increased from around 5% a decade ago to nearly 13% in 2022. The Polish IT sector has become an important engine of the economy – in the last decade its revenues have almost quadrupled, the industry’s share of GDP has doubled and the value of IT services exports has increased 7.5 times. The importance of the industry can be seen even more clearly on the international stage: in 2023. Poland sold more IT services abroad than such technological powers as Japan or South Korea.

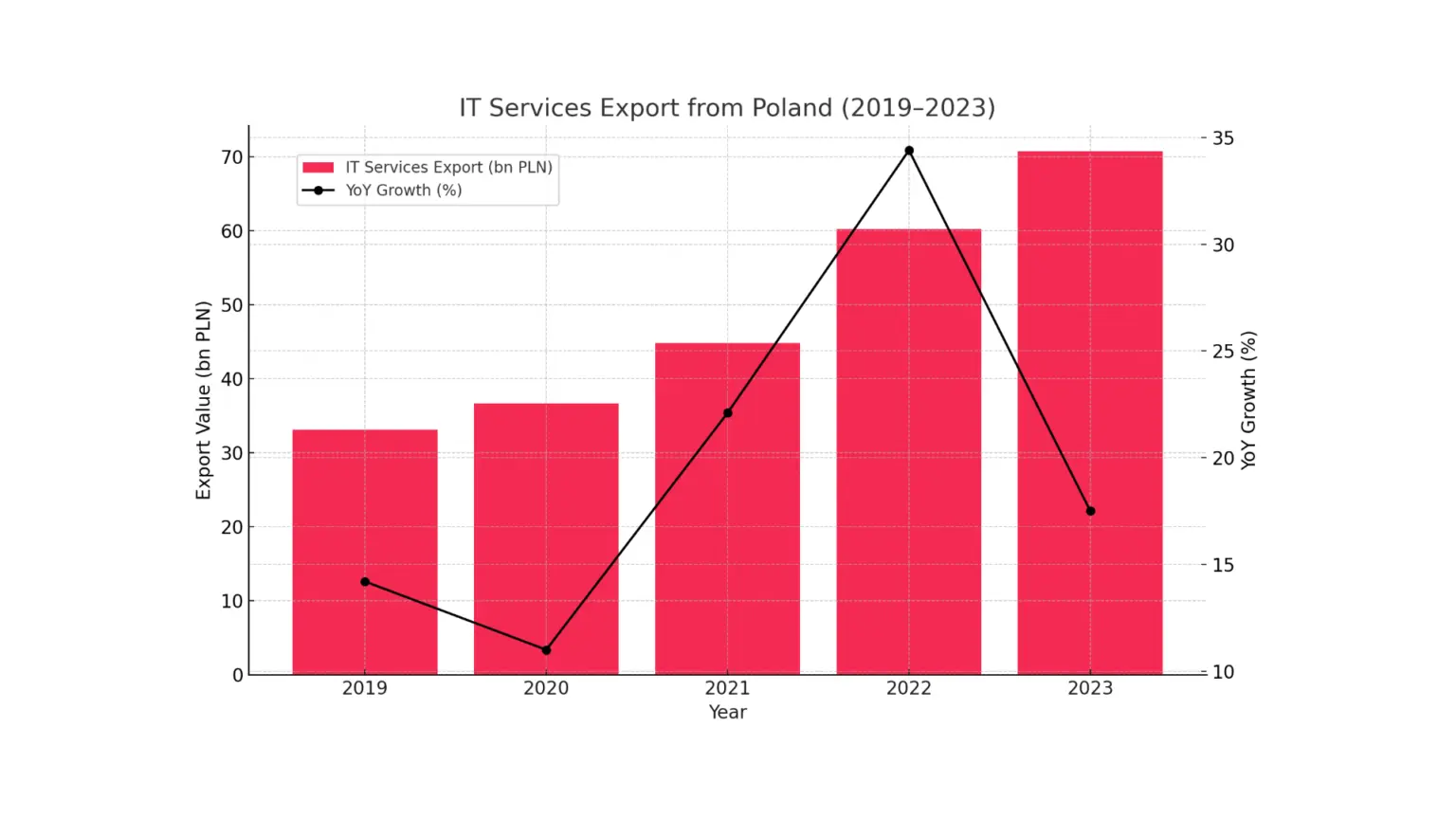

Both National Bank of Poland and CSO data show a clear and uninterrupted increase in the value of IT services exports in recent years. As the chart above illustrates, in 2019, exports of telecommunications, IT and information services (a combined category in the balance of payments statistics) amounted to PLN 33.1 billion, rising to PLN 36.7 billion in 2020. Despite the global shock of the COVID-19 pandemic, there was thus an increase of around 10.9% y/y, although this was a slightly lower rate than in earlier years. Already in 2021, however, there was an acceleration, with the value of IT services exports reaching PLN 44.8 billion, or +22.1% y/y. The year 2022 brought a real leap: exports of this category increased to PLN 60.2 billion, as much as 34.4% more than the year before. This was the highest level ever, confirming that the Polish ICT sector has made excellent use of the global boom in digital services during the pandemic. In 2023, the dynamics slowed down slightly, but were still impressive, with exports of telecommunications, IT and information services reaching PLN 70.7 billion, growing by 17.5% compared to 2022. In the latter year, IT services alone (excluding telecommunications) accounted for the bulk of this amount – PLN 64.7 billion – underlining that it is strictly IT services that are driving this category. Overall, in just four years, Poland’s IT services exports have more than doubled (from ~£33bn in 2019 to ~£71bn in 2023). It is worth noting that these increases occurred in parallel to the overall growth of services exports, so that the share of the ICT segment in total services exports was steadily increasing. According to PFR data based on Eurostat, at the end of 2022, Poland’s exports of IT services amounted to EUR 11.66 billion (about PLN 54 billion) and imports to EUR 7.04 billion, a significant surplus. Importantly, there has not been a single year of decline since 2010 – Polish IT services are enjoying growing demand abroad. Although transport and tourism generate higher volumes, IT has become the fastest-growing segment – the average growth rate of IT services exports between 2011 and 2021 (22.4% per annum) more than doubled the growth rate of all services exports (11.2%). This makes IT services play an increasingly important role in the balance of payments. For context, in 2022, the services trade surplus reached a record 171.1 billion PLN (5.6% of GDP) and services alone were the largest positive component of the current account balance – dynamic IT exports contributed significantly to this.

Export geography: key markets

The geographic structure of IT services exports from Poland is concentrated around highly developed economies, especially in Western Europe and North America. Germany has remained the most important single customer for years – in total, Polish residents sold services (of all types) worth PLN 100.9 billion to Germany in 2023, of which a significant proportion were business and IT services. In the IT services segment, Germany also ranks first. The United States and the United Kingdom are other key markets, while Switzerland and the Netherlands also stand out in continental Europe as significant buyers of Polish digital services. According to PFR and ABSL data, Polish IT companies sell their services mainly to Germany, the US, Austria and the UK. Germany’s high position is due to both its geographical proximity and links within the EU, as well as the presence of many IT centres serving the German market. In turn, the significant share of the USA testifies to the global competitiveness of the Polish IT sector – American corporations are willing to outsource services to Polish entities or locate their technology centres in Poland. On a regional basis, EU countries remain the main recipients of Polish ICT services. In 2022, approximately 55% of the value of exports of services from the ‘other services’ category (including IT and business services) went to EU countries. In addition to Germany, Switzerland (8.7% of this category) and the UK were important partners in this area. The US accounted for about 15-16% of sales in the other services group in 2022, indicating its significant share also in the demand for IT services. It is worth noting that Polish technology companies have gained a good reputation worldwide – Polish programmers have been at the top of global quality and innovation rankings for years, which facilitates expansion into foreign markets. This helps win customers in Austria, the Nordic countries or Canada, among others, although the share of these markets is smaller. Nevertheless, geographical diversification is noticeable – Polish IT services reach customers in dozens of countries on several continents, which reduces dependence on a single market.

Macroeconomic conditions: pandemic, exchange rates, economic situation

The upward trend in IT services exports during the period under review was compounded by important macroeconomic factors. The COVID-19 pandemic initially caused global economic uncertainty, but the IT sector proved relatively resilient and even benefited in the medium term from the acceleration of digitalisation. In 2020, many companies worldwide moved their operations to remote mode and invested heavily in IT solutions, which maintained demand for IT services from Poland. Indeed, while, for example, exports of travel services collapsed in 2020, exports of IT services still grew by around 11%. This was slower than before the pandemic, but testament to the resilience of the industry. Already a year later, there was a rebound – global IT prosperity was very favourable in 2021-2022 due to massive deployments of cloud solutions, e-commerce, remote working or automation. Polish IT companies, often specialising in these areas, were able to increase sales abroad by the aforementioned 22% in 2021 and as much as 34% in 2022. Currency exchange rates also played an important role. The weakening of the zloty against the dollar and the euro in 2022 made services provided in Poland more competitively priced and, at the same time, the value of revenues calculated in zloty increased significantly. For example, according to the National Bank of Poland (NBP), exports of IT and telecommunications services in 2022 amounted to USD 13.4 billion (an increase of more than 15% y/y in USD terms), but when converted into PLN the dynamics exceeded 30% y/y. The weaker złoty meant that for every dollar earned, companies received more PLN, which partly explains the record jump in the value of exports this year. In turn, in 2023, the Polish currency strengthened slightly and global demand for IT services no longer grew so rapidly, hence the rate of growth of exports in PLN stabilised at a lower level (~17.5% y/y instead of 34% the year before).

It is worth mentioning that, globally, 2023 was a tougher year for the technology industry – rising interest rates and fears of a recession led many companies to cut IT spending, while tech giants recorded declines in valuations and job cuts. This downturn also affected Polish services companies. As the PKO BP report notes, 2023 (and for many companies also 2024) saw a slowdown in the growth of sales, exports and employment in the IT sector in Poland. Rising costs, especially wages, have further reduced the profitability of companies. Despite these challenges, Polish IT exports still recorded solid growth in 2023, outpacing the dynamics of most other industries – evidence of a sustained, structural demand for digital services. In comparison, our neighbour Ukraine’s IT services exports fell by 8.4 per cent in 2023 due to war and economic turmoil. Poland avoided the decline, which is partly due to a safer business environment, but also due to customer diversification and specialisation in high-quality services.

The role of outsourcing and foreign capital

The export success of the Polish IT industry is closely linked to the role of outsourcing centres and foreign investment. Poland has for years been perceived as an attractive location for IT and business services outsourcing – it attracts a skilled engineering workforce, relatively lower labour costs compared to Western Europe and its presence in the EU (which facilitates legal and logistical issues). In practice, this means that a significant proportion of IT services exports are generated by companies linked to foreign capital, including shared service centres and branches of global technology corporations located in Poland. NBP analyses confirm that companies with foreign capital participation dominate the exports of most service categories – in 2022 it was entities with foreign investors that generated the largest surplus in services trade. Few industries are exceptions (e.g. construction or cultural services) – in the ICT sector, the predominance of foreign-owned companies is clear. According to ABSL data, almost all business service centres operating in Poland serve foreign clients. For example, Capgemini Poland – one of the largest IT employers – derives 94% of its revenue from serving foreign clients (providing services to customers in 31 countries), and Sii Poland derives around 30% of its revenue from exporting services. Such examples show that foreign investors recognise Poland’s potential and locate advanced processes here. Importantly, the nature of these investments is evolving.

An increasing proportion of export growth is being driven by the phenomenon of reshoring, i.e. the transfer of operations back to Europe from more distant locations. In recent years, we have observed that new centres opening in Poland are carrying out advanced, highly specialised tasks from the outset, while simpler processes are being automated or redirected to cheaper countries (e.g. India). This demonstrates the growing added value of Polish services – these are no longer just simple software services, but often complex R&D projects, IT consulting, cloud services, cyber security, etc. The Polish IT sector is therefore becoming an integral part of global value chains. On the one hand, the presence of foreign capital guarantees an inflow of projects, know-how and stable financing; on the other hand, it can be a challenge to keep as much of the profits and intellectual property in the country as possible. Nevertheless, the current model seems to be beneficial for the Polish economy: it provides jobs (IT centres employ tens of thousands of specialists in Poland) and stimulates the transfer of knowledge and best practices. Thanks to this, Poland is strengthening its position on the global IT services market, as evidenced by high positions in rankings of attractiveness of outsourcing locations and a growing number of international contracts executed by the Vistula

Polish IT services exports in 2019-2023 were characterised by impressive growth and resilience to crises, confirming the maturity and competitiveness of the industry. The trend is unequivocally upward – the sector is benefiting from the global digital transformation, while at the same time driving the domestic economy itself, providing growing foreign exchange inflows and a positive services trade balance. The outlook for the coming years is cautiously optimistic. After a temporary slowdown in 2023-2024, many analysts expect a gradual recovery. Macroeconomic forecasts indicate that in 2025, GDP growth rates in our key economies (Germany, USA, UK) may be higher than in 2023, which will translate into higher demand for IT services. At the same time, wage pressure in Poland is expected to ease somewhat, and the exchange rate of the zloty should remain at a level favourable to exporters. All this creates the conditions for maintaining a solid growth rate, although probably closer to a dozen or so than a few dozen per cent a year. The potential of the industry remains high – the growing role of artificial intelligence, cloud computing, automation or cyber security generates new niches in which Polish companies are already gaining competence.

According to the estimates of the Polish Development Fund, the value of the Polish ICT sector (including IT, telecommunications and IT security services) may increase to EUR 25.2 billion by 2026, indicating a continuation of the positive trend. However, risk factors need to be borne in mind. A possible worsening of the downturn in Europe or the US, increased competition from other outsourcing centres (e.g. in Asia or Latin America), or difficulties in accessing IT talent at home – all of these could limit the rate of growth. It will therefore be crucial to invest in human capital (training and attracting specialists) and to support innovation and in-house IT products in order to gradually move from a purely service-based model to one based also on in-house technological thinking. For the time being, moderate forecasts assume that growth trends will continue, although no longer as spectacular as at the peak of the post-pandemic boom. Nevertheless, given the achievements to date, the Polish IT services sector remains one of the pillars of exports of strategic importance to the economy. If it manages to remain competitive and continue to gain the trust of foreign principals, IT services exports should continue to grow, strengthening Poland’s position as a European leader in the technology industry. This will certainly be an area worth watching closely in the years to come.