Although global IT spending is expected to grow by nearly 8 per cent in 2025 – to $5.43 trillion – the market is not in an upbeat mood. Gartner, which at the beginning of the year was still forecasting a jump of nearly 10 per cent, has just lowered its estimates. The data shows clearly: despite the positive momentum, digital business investment is in limbo. It is not a question of cuts. Rather, it is about growing caution.

This paradox is best illustrated by the concept of the ‘uncertainty pause’ that Gartner analysts attribute to today’s situation. IT budgets remain stable, but new purchasing decisions are on hold. Economic uncertainty, trade tensions and rising hardware costs mean that boards would rather wait than risk misallocating resources. This is the new normal to which the entire technology sector must adapt.

Mood cooler than results

Despite the macroeconomic turmoil, many companies started 2025 with more optimism than the year before. The Gartner survey found that more than 60% of IT leaders were positive about the first quarter. However, only a quarter of respondents expected to end the year ahead of plan.

This signals that the market is acting cautiously. Companies are not cancelling projects – but postponing them. Decisions take longer to analyse, more business justifications are needed and return expectations are rising. Geopolitics does not help: tensions around tariffs and international trade are causing anxiety that directly affects purchasing decisions in IT departments.

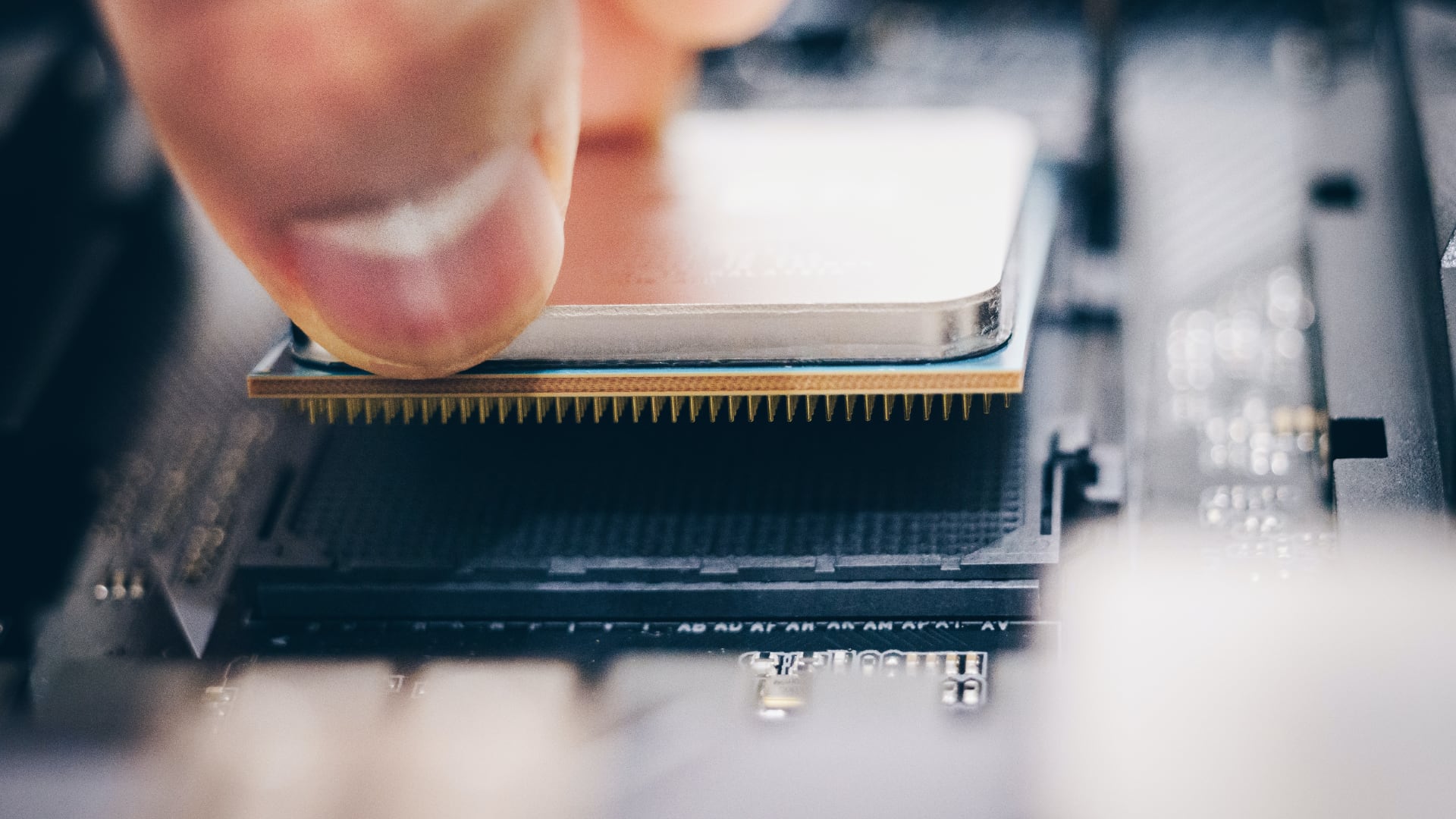

Infrastructure suffers the most

The biggest slowdown is seen in the area of infrastructure. Hardware prices are rising and disruptions in supply chains – although no longer as acute as during the pandemic – are still causing logistical difficulties. Companies are reducing or delaying the upgrade of their own server rooms, data centres or endpoint equipment.

This is bad news for infrastructure integrators and hardware suppliers. Multi-year upgrade projects are now being replaced by a ‘keep what works’ approach. There are no spectacular implementations – rather, there are SLA extensions and ad hoc purchases.

Cloud and services stay the course

Ongoing expenses such as cloud subscriptions and managed services, on the other hand, remain stable. In an OPEX model, where costs are predictable and fit well into the annual budget, companies still feel comfortable. Especially as most AI and SaaS service providers have started to offer generative AI functions as part of existing packages – without additional licensing costs.

From a sales channel perspective, this is good news. In the cloud and services space, customer relationships and the ability to scale quickly are becoming key. It is less about the number of units sold and more about the ability to ensure continuity, optimisation and cost predictability.

GenAI as an add-on, not a project

Generative artificial intelligence – a hot topic for more than a year – is also part of the new enterprise strategy. Gartner emphasises that AI is being deployed today not as a separate investment, but as an add-on to existing platforms. IT departments prefer a plug-and-play approach rather than complex integrations.

This is a significant shift for software providers. Rather than separate budgets for AI, companies are looking to extend functionality within systems already paid for. In practice, this means fewer tenders, less sales time and more pressure to deliver demonstrable value within existing commercial relationships.

How to sell in times of pause?

It is crucial for the IT sales channel to adapt to the new dynamics. Above all – to avoid aggressively pushing big transformation projects. Today’s customer expects specifics: measurable savings, simplification of processes, fast return on investment.

Instead of promises of long-term benefits, what counts is what works immediately. A “proof of value” model works well – rapid implementation that shows an effect within a few weeks. This is the way to break the pause and regain sales momentum.

It is also worth remembering that decisions have not disappeared – they have merely shifted. A well-run commercial process may take twice as long today, but it still ends with a signed contract. Building trust and delivering value at every stage of customer contact becomes crucial.

Outlook: prfzession, not recession

Gartner’s lowered forecasts do not imply a collapse of the market – rather, they indicate a correction of expectations. If the macroeconomic situation stabilises in the second half of the year, many stalled projects can be expected to return in Q4 or early 2026.

For now, however, it is necessary to learn to operate in an environment of extended sales cycles, greater pressure on ROI and increasingly informed purchasing decisions. This is the time for those companies that can deliver technology that is not only state-of-the-art but, above all, makes business sense.