The year 2023 has gone down in history as the moment when generative artificial intelligence (GenAI) broke through into the mass consciousness. However, for systems integrators and IT directors, once the initial dust has settled, a fundamental question arises: where does the hype translate into real budgets and measurable business value?

Analysis of recent market data shows that the key to success is not a one-size-fits-all approach, but a nuanced strategy that tailors the offering to the specific level of digital maturity of each economic sector.

Analysts at the International Data Corporation (IDC) forecast that European spending on AI will reach $144.6 billion by 2028, growing at an annual rate of more than 30%. At the same time, Eurostat figures for 2024 show that overall AI adoption in businesses, although growing, is still only 13.5%.

This apparent contradiction is in fact the most important market signal: the huge gap between future intentions and the current state of deployments means that a massive order book is forming in the market. The leaders are just the first wave; the main part of the market is only now starting to mobilise its budgets.

For integrators, the conclusion is clear: the market is not saturated, it is just beginning.

The great divide: giants versus SMEs, north versus south

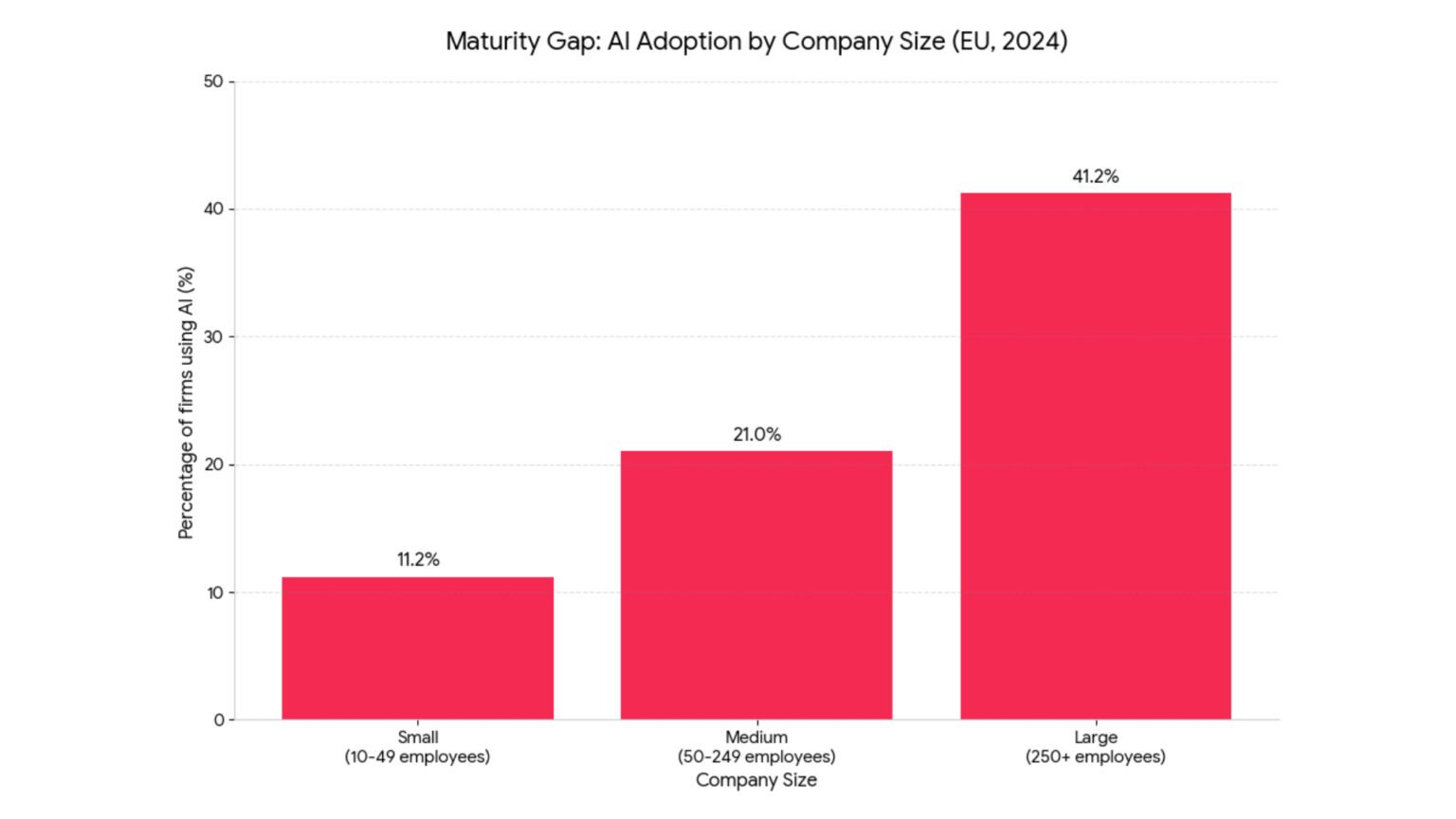

The most important dividing line that defines go-to-market strategies is the gap between large companies and the SME sector. As many as 41.2% of large companies are using AI, compared to only 11.2% of small companies.

These are two fundamentally different markets. Large corporations are implementing complex, transformational projects, while SMEs are looking for solutions with a lower threshold of entry and a quick return on investment.

The map of AI adoption in Europe is also not uniform. At the head of the peloton are digitally mature Scandinavian countries such as Denmark (27.6%) and Sweden (25.1%).

In the middle of the pile are the largest economies such as Germany (14.2%), and at the other end of the spectrum are large but still catching up markets such as Poland (5.9%) and Romania (3.1%). These represent a huge ‘green field’ for core services, related to data preparation and business intelligence implementations.

The vanguard of data: large-scale monetising sectors

At the forefront of the AI revolution are sectors that are inherently data-intensive. For integrators, these are the target markets for the most advanced and high-margin projects.

The Information and Communication (ICT) sector is the undisputed leader, with as many as 48.7% of companies actively using AI. Crucially, for 43.5% of them, the main focus is research and development (R&D).

These companies are not optimising processes, but creating new products and business models driven by AI. Opportunities for integrators here lie in highly specialised consulting, creating customised machine learning models and implementing MLOps platforms.

Financial and Professional Services is the second pillar of the vanguard. IDC forecasts indicate that finance will be the largest single sector in terms of AI spending. This group is defined by an absolute focus on measurable return on investment (ROI).

Specific use cases include advanced analytics for fraud detection, where European banks are doubling the detection rate of compromised cards , and neobank bunq has accelerated the training of its models 100-fold.

Other applications include hyper-personalisation of products and automation of regulatory compliance processes. Customers in this sector expect robust, secure and regulatory-compliant solutions.

Emerging contenders: where scale meets opportunity

In between the vanguard and emerging markets is a group of sectors of huge economic importance that are only now beginning to invest in data on a large scale.

Retail and E-commerce is the third largest industry in terms of AI spending in Europe. The target is clear: 52.9% of retailers are implementing AI in marketing and sales. The battle for the customer is being won in the field of personalisation.

The example of a European retailer that increased online sales by 11% in six months by implementing advanced analytics confirms the effectiveness of this strategy.

For integrators, the sector offers a double opportunity: sophisticated e-commerce players are looking for sophisticated recommendation engines, while more traditional retailers need fundamental projects such as implementing a modern CRM system or building a customer data platform (CDP).

Manufacturing is a real giant of the European economy. Although the overall adoption rate of AI remains below 16%, it is this sector that accounts for the largest share of value added in the EU (24.1%). Moreover, more than half (51%) of European manufacturers are already implementing AI solutions.

The key to unlocking this market is predictive maintenance. Companies such as Siemens and Coca-Cola European Partners are already using AI to analyse sensor data to predict machine failures and minimise unplanned downtime.

“Green fields”: untapped markets for fundamental growth

At the other extreme of digital maturity are sectors that represent the largest untapped market for integrators able to offer fundamental services.

Transport and Logistics has a low AI adoption rate (less than 16%), while generating unimaginable amounts of data. The main challenge here is fragmentation and low data quality.

A case study of a European logistics company revealed that operational data was spread across more than 15 Excel files, making any profitability analysis impossible. For integrators, this is a dream market for services in the ‘data readiness’ category.

The first step is not to sell a complex AI model, but to implement a central data warehouse and BI tools that address pressing issues such as lack of visibility and control.

The construction industry shows one of the lowest digital adoption rates (6.1%). Before AI finds widespread use here, the sector needs basic digitalisation, such as the implementation of ERP or CRM systems.

The sales message should not focus on ‘artificial intelligence’, but on ‘visibility’, ‘control’ and ‘efficiency’ in project management.

Healthcare is a unique ‘green field’. Although overall adoption figures are low, it is one of the fastest-growing sectors in terms of AI investment, with a projected global growth rate of 44% CAGR.

The potential is revolutionary: AI-assisted diagnostic imaging, drug discovery and robot-assisted surgery. However, progress is hampered by extreme data privacy requirements and complex regulations.

This is a market for professionals who can demonstrate deep domain knowledge in medical regulation and data security.

Compass for the integrator: how to match strategy to market?

The AI and Big Data market in the EU is not a monolith, but a patchwork of sectors with varying degrees of maturity. Success depends on tailoring the strategy to each of them:

- Engaging the Vanguard (ICT, Finance): The approach should be consultative and partnership-based. The focus should be on co-creation of innovation, custom development and strategic advice. Key services are MLOps, development of specialised AI models and data governance consultancy.

- Gaining Pretenders (Trade, Production): A solution-oriented approach is key. Conversations should be based on industry-specific use cases with proven ROI (e.g. predictive maintenance, personalisation). The offering should be hybrid, combining advanced analytics with foundational work.

- Cultivating Green Fields (Logistics, Construction, Healthcare): Strategy is based on education. Conversations should start with data strategy, not AI. The focus should be on selling core services (cloud migration, data warehousing, BI implementations) that build the foundation for future, more advanced projects.

Ultimately, the AI and Big Data market in Europe offers huge opportunities, but rewards those who approach it with strategy and understanding. Rather than trying to sell one technology to everyone, the most successful integrators will act as translators – translating the technology’s potential into tangible solutions to business problems, tailored to each client’s unique context and maturity level.