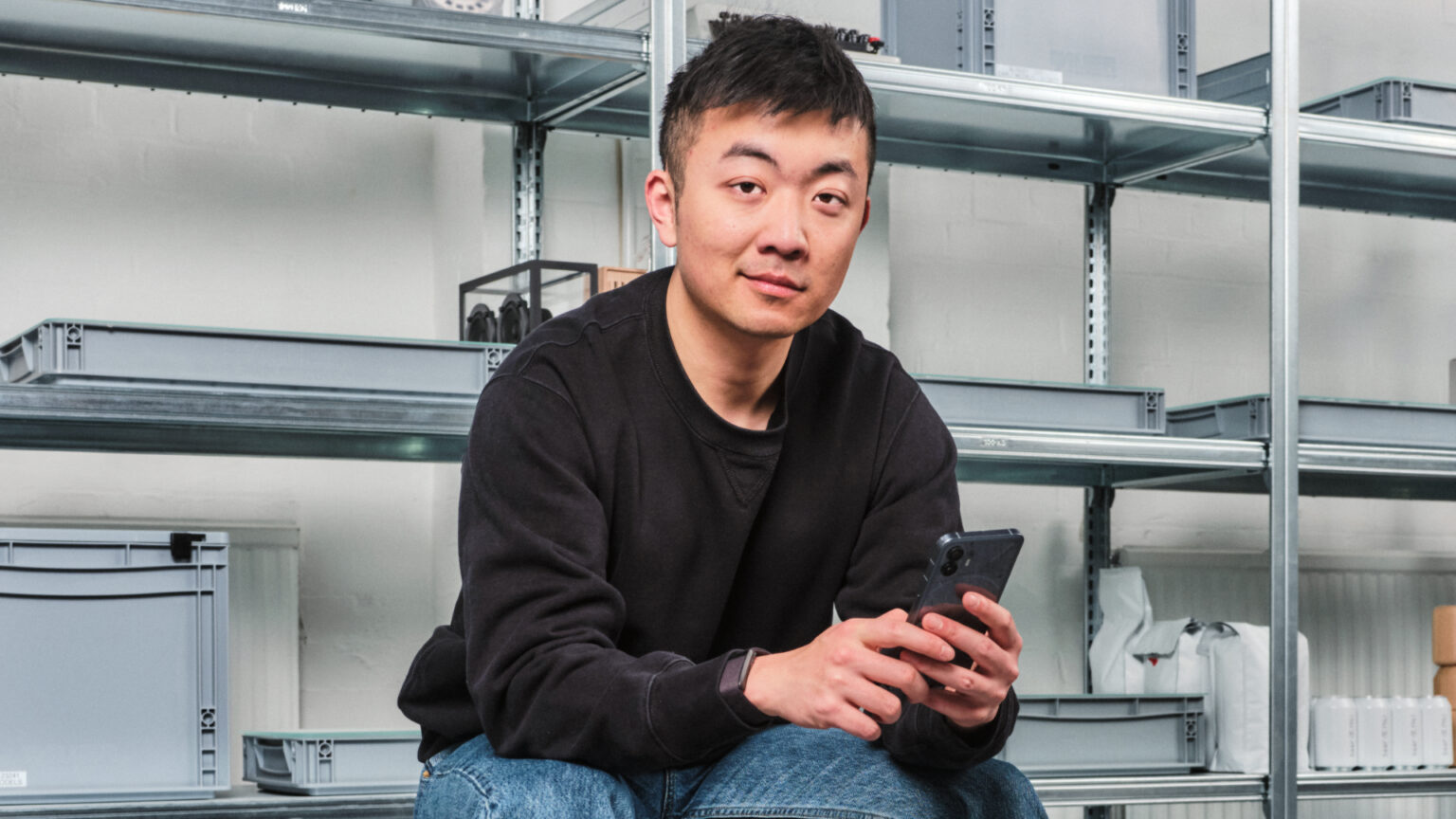

London-based startup Nothing, led by Carl Peia, has raised $200 million in a new funding round. Led by the Tiger Global fund, the company’s valuation has risen to $1.3 billion. The funds are to be used for a key goal: deep integration of artificial intelligence into its devices.

Founded in 2020 by the OnePlus co-founder, the company has quickly made its mark on the market. Since the debut of its first smartphone in 2022, Nothing has launched successive generations of phones and popular wireless handsets.

To date, the company has shipped millions of devices, with cumulative revenues exceeding $1 billion. The last significant funding round of nearly $100 million closed in 2023.

The new investment is not only fuel for further growth, but above all a strategic shift towards AI. In line with the company’s vision, artificial intelligence, in order to reach its full potential, requires a fundamental rethinking of the interaction with hardware.

Nothing intends to start with smartphones and audio accessories, creating a cohesive ecosystem in which AI will be an integral part of the software and not just an additional feature. In the long term, the company’s operating system would also drive other device categories.

The move is a bold attempt to stand out in a market dominated by the duopoly of Apple and Samsung. While a handful of European players such as Fairphone and HMD Global are looking for their niches, Nothing is betting on software innovation as a key element in the battle for customers.

Existing shareholders including GV (Google Ventures), EQT and Highland Europe also participated in the round, signalling their confidence in the brand’s long-term strategy. The capital raised will be crucial to translate the ambitious AI plans into viable features that will convince consumers.