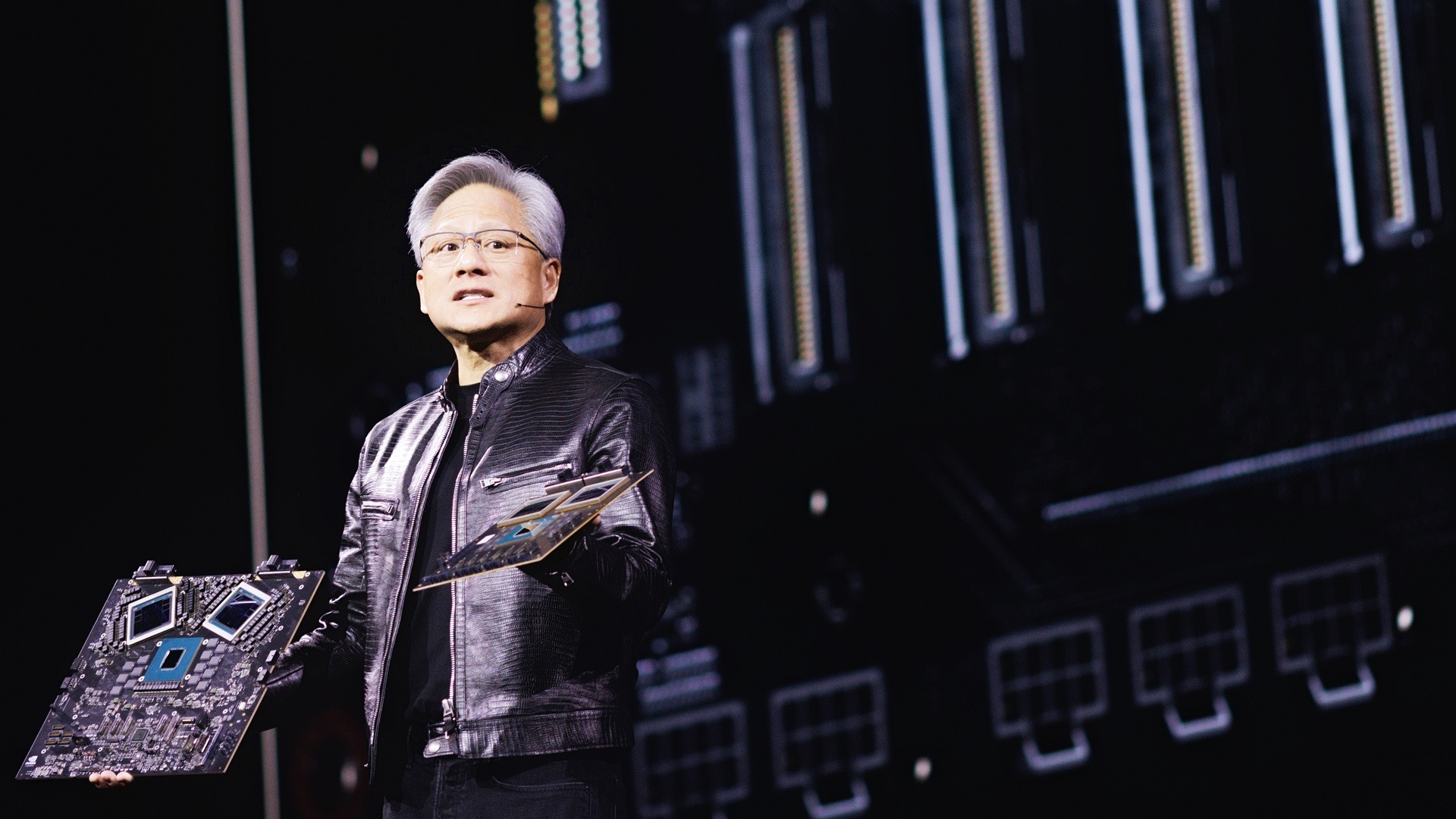

Nvidia is once again adapting its strategy to US export restrictions in an attempt to maintain a presence in the $50 billion data centre market in China. The new Blackwell architecture GPU chip, which starts mass production in June, is intended as a response to the export ban on the more powerful H20 chips. Price? $6500 to $8000 – significantly less than the recalled H20.

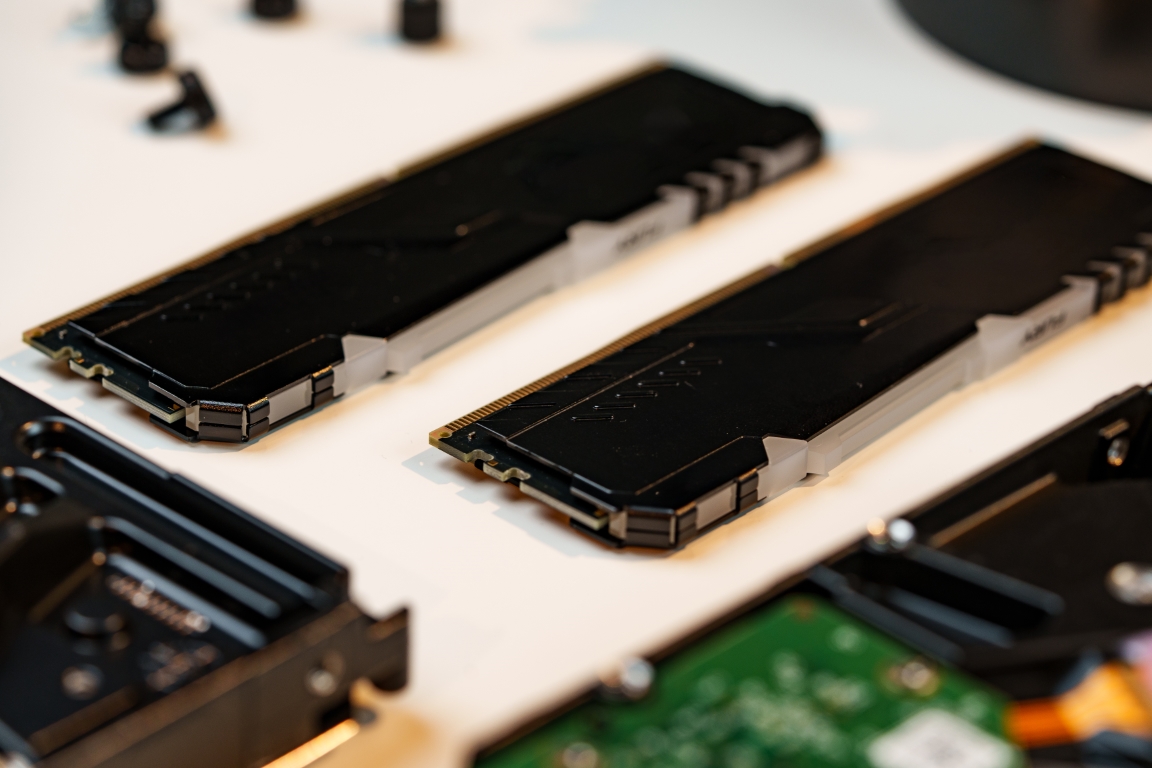

Based on the RTX 6000D and featuring GDDR7 memory instead of the more advanced HBM, the new GPU does not use TSMC’s CoWoS technology. This makes it simpler and cheaper to manufacture, but also noticeably weaker. Memory bandwidth is expected to be around 1.7 TB/s – the limit according to the latest US regulations. In comparison, the H20 offered 4 TB/s.

This is the third time Nvidia has modified its offerings specifically for China. Even before the sanctions, it had as much as 95% of the data centre GPU market share there – today it is only around 50%. The new chip is not so much to strengthen the company’s position as to stop it further losing share to Huawei and its Ascend 910B chip.

Against hardware limitations, Nvidia still holds one bargaining chip – the CUDA ecosystem. This is the developer platform that binds AI software to GPUs. For many companies using off-the-shelf AI models and tools, this is still a significant competitive advantage.

On the other hand, Chinese manufacturers, such as Huawei, are catching up faster and faster with the leaders in terms of hardware performance. Local chips, although weaker today, could approach the level of Nvidia’s limited versions within 1-2 years. If this happens and the US does not change course, Nvidia could lose not only the market, but also its role as the standard for AI in China.

Already on the horizon is the next Blackwell chip, planned for September – perhaps more powerful, but still under restriction. For Nvidia, it’s not so much a technology race as a geopolitical one, in which every launch is an attempt to retain influence without breaking the rules.