Artificial intelligence(AI) is revolutionising the global economy, becoming a key competitive advantage for businesses. The pace of its development is unprecedented, surpassing even the dynamics of internet popularisation. Companies that proactively implement coherent AI strategies gain market advantage, while those that do not, risk being left behind. Poland, in the context of the global technology race, is showing an impressive acceleration in the implementation of solutions based on artificial intelligence. According to a report by Strand Partners, commissioned by Amazon Web Services (AWS), 34% of Polish companies have already applied AI technologies, and on average, one Polish company implements new solutions in this area every two minutes.

AI adoption in Polish companies is growing rapidly. Data from the Central Statistical Office (CSO) and the European Leasing Fund (EFL) show an increase in the percentage of companies using AI from 3.7% in 2023 to 5.9% in 2024. For large companies, the rate is even higher, with one in ten organisations already using AI. EY’s survey of more than 500 companies at the end of 2024 reveals a high readiness for further AI deployments (89% of companies, up from 78%) and a prioritisation of investment in the technology (59%, up from 53%). More than half of the companies surveyed plan to increase spending on AI in the next 18 months.

The benefits of implementing AI are measurable and provide strong motivation for further investment. As many as 78% of companies that have implemented artificial intelligence tools confirm that the expected results have been achieved. What’s more, 87% of companies have seen an increase in revenue, averaging 35%, and 90% of companies have seen an increase in productivity, particularly in routine areas such as data analysis, task automation or reporting. McKinsey & Company’s research further confirms that companies that integrated AI into their operational processes increased productivity by an average of 25%, while reducing operational costs by 10%. In the recruitment sector, the implementation of AI reduced the time it took to close a process by 35% and reduced costs by 20%.

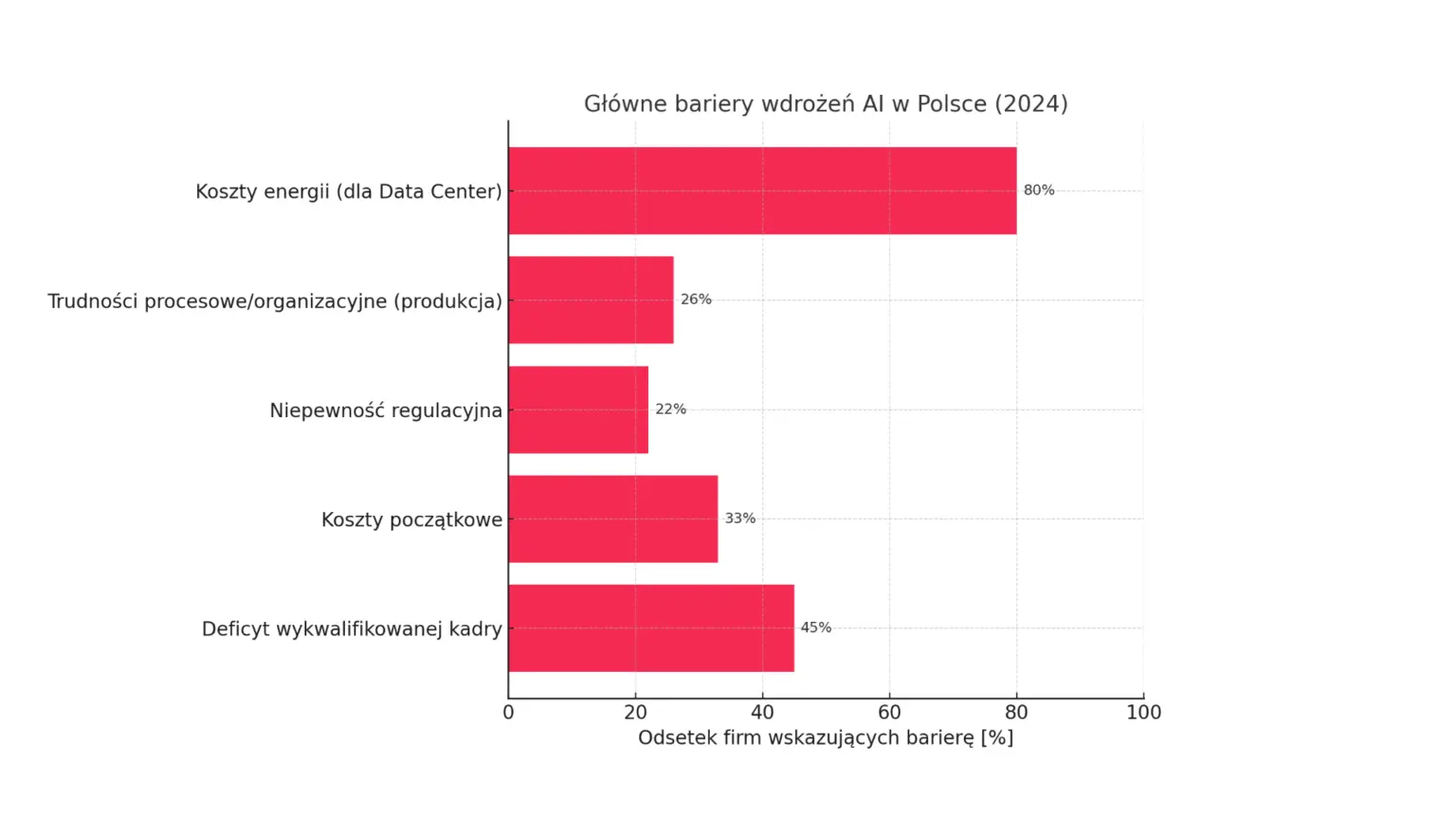

However, the rapid growth of AI is inextricably linked to the increasing demand for electricity. AI infrastructure, which relies heavily on data centres, is becoming increasingly energy-intensive, and its electricity requirements are growing exponentially. In this context, rising electricity costs are identified as the biggest challenge facing Poland’s data centres, as indicated by 80% of respondents in a survey commissioned by Kingston.

The issue of the impact of energy costs on the development of AI in Poland is of fundamental importance for the entire economy and the IT sector. Investment in disruptive technologies such as artificial intelligence has the potential to accelerate economic growth and strengthen Poland’s position in the global value chain. Countries that are the first to adapt their energy systems to the new digital reality can become transformational leaders. In contrast, regions that fail to increase energy availability or ensure competitive energy prices may be left out of the global technology race.

Analysis of the available data indicates that the strong growth in AI adoption in Poland, driven by real business benefits, is creating fundamental pressure on energy infrastructure. This changes the question posed in the title from “will the growth of AI stop?” to “how do we manage energy to sustain this growth?”. Since the business benefits of AI are so significant and widely felt, companies will push for its deployment, regardless of rising energy costs. This means that high energy prices will not stop the development of AI, but will force companies to look for solutions that optimise energy consumption or provide access to cheaper sources. This fundamental pressure on energy means that the energy sector and policymakers need to treat AI development as a key, growing energy consumer, rather than a marginal issue. It is imperative that the energy transition and grid modernisation is accelerated so that Poland can remain competitive in the global AI race and avoid the lack of adequate energy infrastructure becoming a real barrier to investment.

Electricity price dynamics in Poland: forecasts for the business sector

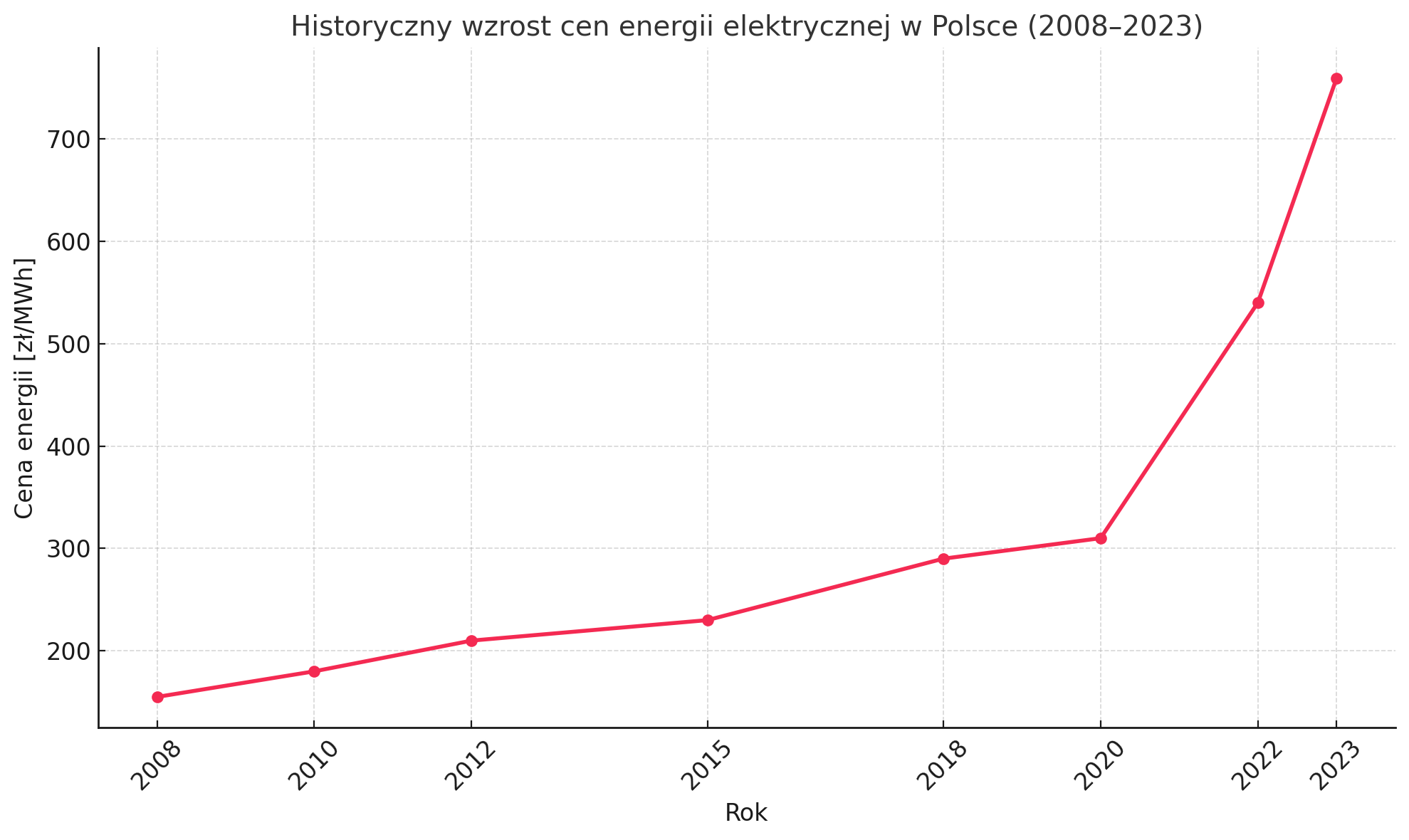

Electricity costs are an important element in calculating the profitability of investments in AI infrastructure, including artificial intelligence systems. An analysis of the dynamics of energy prices in Poland, both historical and forecast, is key to understanding the challenges facing the business sector.

Over the past 15 years, electricity prices in Poland have increased nearly fivefold, from 155 PLN/MWh in 2008 to 759 PLN/MWh in 2023. The main reason for this significant increase was the rising cost of power generation in coal-fired power plants and the dynamic increase in the price of carbon emission allowances (EU ETS), which reached around €90/tCO₂ in April 2023, stabilising at €65/tCO₂ in April 2024. Wholesale electricity prices in Poland, despite some stabilisation after sharp increases in 2022-2023, still remain at one of the highest levels in Europe. In the second quarter of 2024, the average electricity price in Poland was around 390 PLN/MWh, while the European average was 340 PLN/MWh.

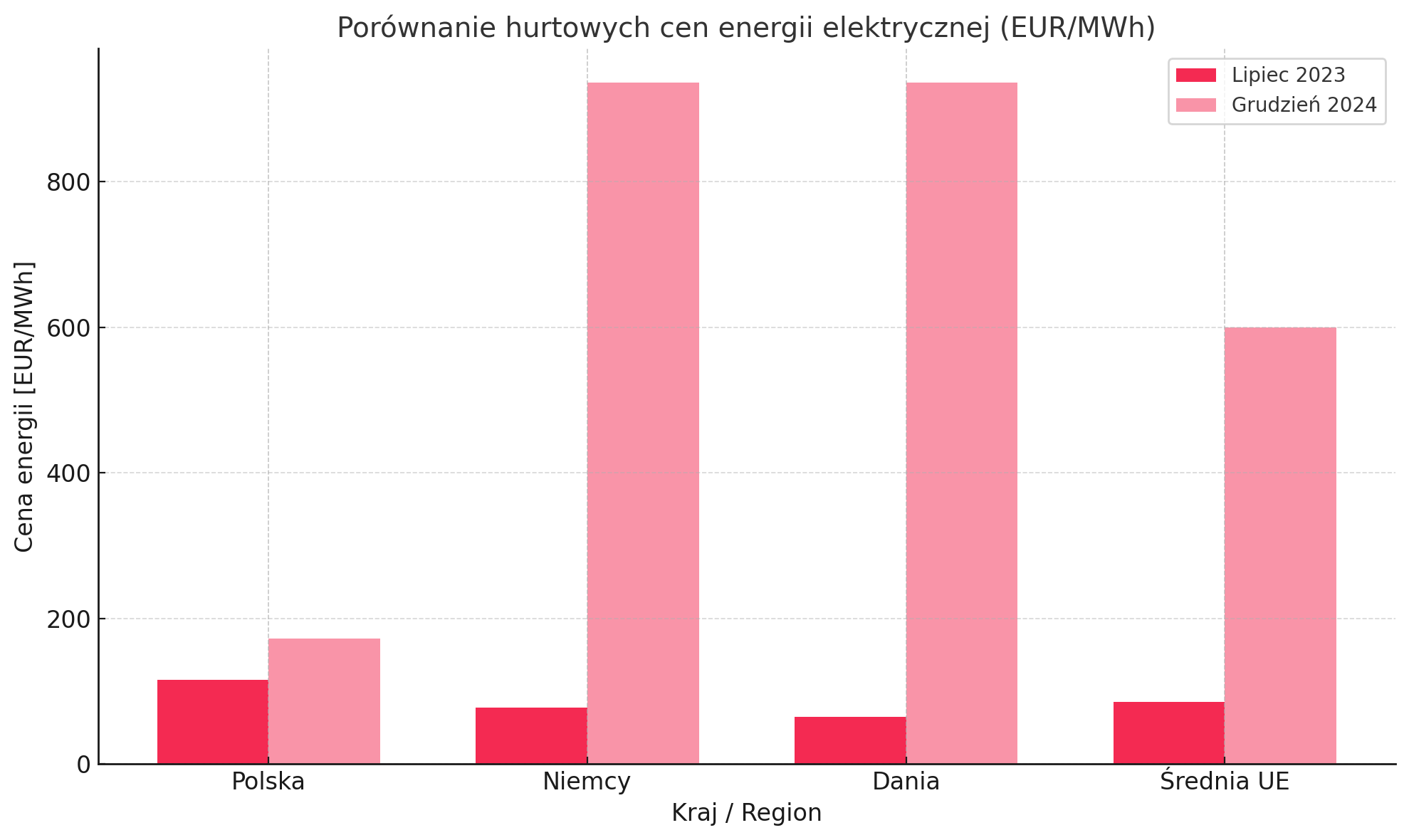

Detailed comparisons show that in July 2023, the wholesale price of 1 MWh in Poland (€115.73) was approximately 49% higher than in Germany (€77.48) and at the same time the highest in the entire European Union. Bartłomiej Derski of WysokieNapiecie.pl emphasises that such an unfavourable price difference between Poland and Germany (more than PLN 200) has not occurred in history. This is largely due to the fact that Poland pays more for CO2 emission allowances and the cost of generating electricity from Polish coal, exceeding PLN 330 per MWh, is more expensive than imported coal. At the end of 2024, small companies had the opportunity to contract energy for 2025 at a price of less than 50 gr/kWh net. Nevertheless, in December 2024, Polish energy cost an average of 172 euros per megawatt hour, which was significantly less than in Germany or Denmark, where rates reached 936 euros/MWh. Nevertheless, the cost of annual contracts for 2025 in Poland (around 100 euro/MWh) is already 9% higher than in Germany and 25% higher than in Denmark. This indicates that temporarily lower spot prices do not translate into a long-term competitive advantage.

Electricity price forecasts for 2025-2030

In the context of the forecasts, for households, electricity prices have been frozen at a net price of 50 gr per kWh until 30 September 2025. However, after this period, for companies that have not secured contracts or sent in the required statements in time, prices could rise drastically, even to 2.31 gr/kWh, although offers of 60 gr/kWh are still available on the market. Such a situation means that a lack of proactive management of energy contracts can result in significant amounts of money having to be returned to the energy retailer’s account.

Projections by Polskie Sieci Elektroenergetyczne (PSE) and the National Industrial Sector Development Plan (NRDP) for 2025-2040 indicate that energy consumption in Poland in 2030 will be 175.0 TWh. On the other hand, McKinsey experts estimate that the energy transition in Poland will reduce average electricity prices by around 70 PLN/MWh (15%) by 2030 and by around 150 PLN/MWh (30%) by 2050, which would translate into an average of 25 billion PLN in savings per year for the entire economy.

Comparison of energy prices in Poland with other EU countries for data centres

As already mentioned, wholesale energy prices in Poland were the highest in the European Union in July 2023. Europe currently accounts for around 15% of global data centre power use, but has seen its share fall by the end of 2023. Global energy demand by data centres could more than double by 2030, reaching around 945 TWh globally, of which up to 113 TWh in Europe alone.

Poland’s short-term price freeze for households, while politically justified, masks deep, structural challenges for the business sector, especially for energy-intensive industries such as AI. These companies, after 2025, could face drastic cost increases that threaten their profitability. The price freeze policy for residential consumers creates an illusion of stability in the energy market that does not reflect the real costs of generation and wholesale prices for business. Companies, especially those with large AI infrastructures, cannot count on similar shielding mechanisms in the long term. The lack of proactive management of energy contracts therefore becomes not only an operational error, but a strategic risk to the profitability of AI projects. This forces companies to think about long-term sourcing strategies, such as PPAs, rather than relying on government interventions. This situation highlights the urgent need to accelerate the energy transition in Poland. As long as the energy mix remains coal-based and burdened by EU ETS costs, wholesale prices will remain high and the AI sector will operate in an environment of cost uncertainty. The lack of stable and competitive energy prices may slow down the inflow of foreign investment in large AI data centres that seek optimal operating conditions around the world.

Despite temporarily lower spot prices compared to some EU countries, Poland has structurally higher wholesale energy prices and higher annual business contract costs. This poses a systemic barrier to the global competitiveness of the Polish AI sector and may inhibit the development of large infrastructure projects. This structural difference in energy prices puts Poland at a competitive disadvantage. Global companies, especially hyperscalers that plan to build large data centres, make location choices based on the long-term stability and cost competitiveness of energy. If Poland offers higher contract prices, it becomes less attractive, which may limit the inflow of key AI investments. The decline in Europe’s share of global data centre power usage is a wake-up call. In order for Poland to become a leading AI hub in Europe, it is necessary not only to transform energy, but also to achieve regionally competitive energy prices. Investments in RES and nuclear power are crucial not only for sustainable development, but, above all, to provide an economic basis for the further unfettered development of AI.

AI development in Poland: trends and barriers

The development of artificial intelligence in Poland is characterised by a dynamic pace, as confirmed by numerous market data. The percentage of companies using AI has increased from 3.7% in 2023 to 5.9% in 2024, and in large enterprises, one in ten organisations is already using these technologies. A report by Strand Partners, prepared for AWS, indicates that 34% of Polish companies have implemented AI solutions, and the dynamics are so high that, on average, another Polish company starts using AI every two minutes.

Companies that have decided to implement AI report significant benefits. As many as 87% have seen an increase in revenue, by an average of 35%, and 90% have experienced an increase in productivity, especially in routine areas such as data analysis, task automation or reporting. The EY study confirms that AI contributes to process optimisation, improved data analytics, improved cyber security and product and service development. Additionally, McKinsey & Company analysis shows that companies that have implemented AI in their operational processes have increased productivity by an average of 25 per cent, while reducing operational costs by 10 per cent. In the recruitment sector, the implementation of AI reduced the time to hire by 35% and reduced the associated costs by 20%.

The Polish Development Fund (PFR) has developed a Map of Polish AI Solutions, grouping solutions also in the area of sustainable development. Key Polish companies developing AI include Infermedica, Molecule.one, DeepFlare (medicine and biotechnology), Authologic, Nethone (finance, cyber security), Nomagic, AI Clearing (industry and logistics), Synerise, Cosmose AI (customer service and marketing) and Eleven Labs, Addepto (generative AI and future technologies). Bitrix24 and HubSpot are also popular platforms with AI features in Poland.

Investments in AI and infrastructure development

Poland is actively investing in the development of AI infrastructure. The construction of 13 ‘AI Factories’ is planned to become key access points to the shared computing power needed to train language models and process data on a massive scale. These factories will be available to both businesses and research units. Spending on AI in Poland has increased by an average of 20% over the past year, placing the country close to the European average. An important part of the R&D ecosystem is the NCBR’s IDEAS, a centre established by the National Centre for Research and Development, whose mission is to support the development of AI in Poland by bringing together the academic and business communities.

Barriers to AI development

Despite the rapid growth in adoption and demonstrable benefits, Poland faces what can be described as a ‘triple barrier’ to AI fully flourishing: energy, human resources and regulation. These barriers are not isolated, but reinforce each other, creating a complex ecosystem of challenges that requires coordinated action.

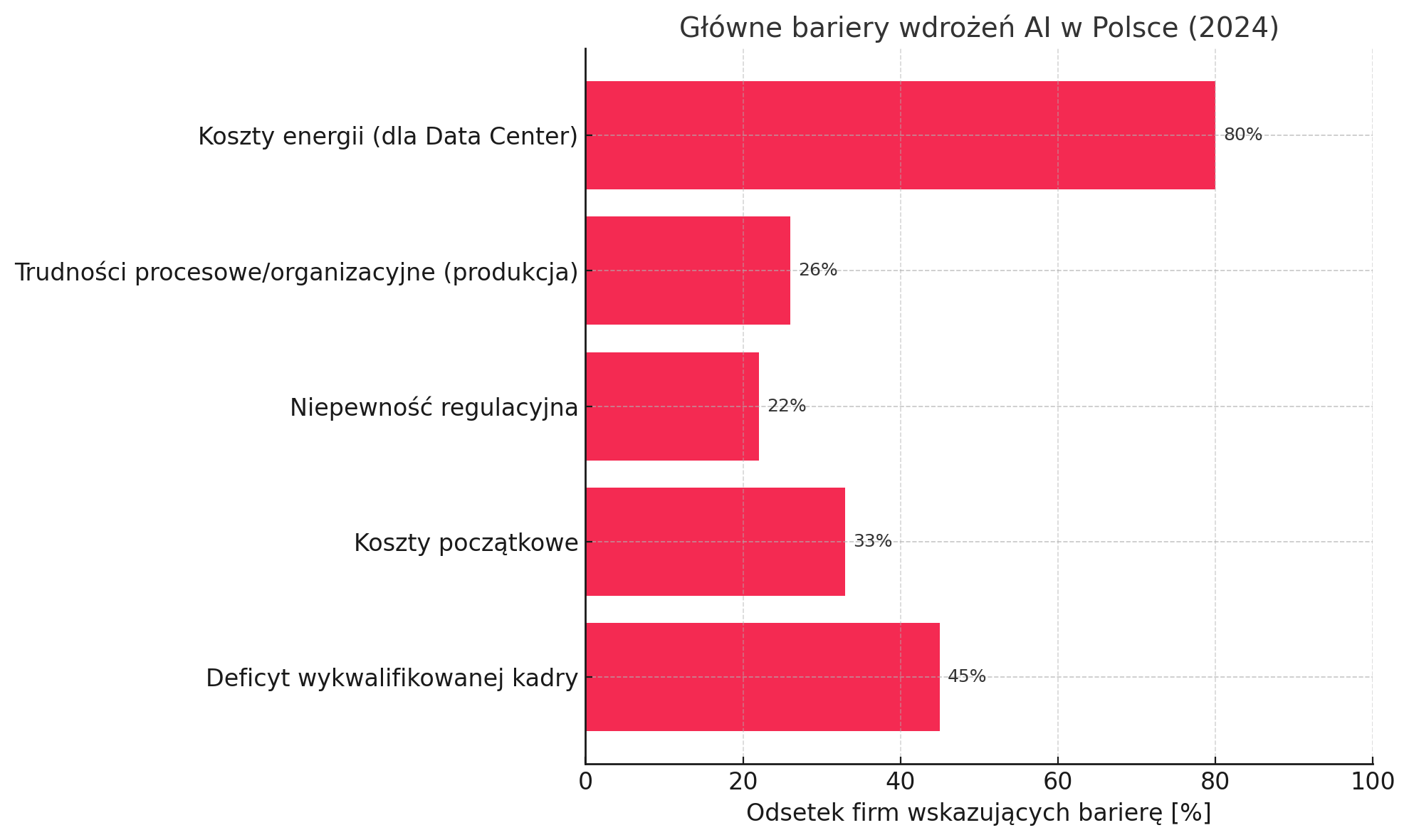

Firstly, a lack of suitably qualified staff is cited as the main barrier to further AI expansion by 45% of companies. In response to this deficit, employers are offering attractive bonuses and salaries, on average 42% higher for AI experts. Secondly, initial costs are a challenge for 33% of companies. Although cost concerns are decreasing in manufacturing (from 33% to 10%), process and organisational difficulties are increasing in importance (26% in manufacturing). Thirdly, regulatory uncertainty affects 22% of companies, and in the start-up sector the problem is felt by up to 80% of entities. In the services sector, regulatory uncertainty is cited (17%) and in commerce, data security (26%). Kingston’s survey for data centres in Poland confirms that, in addition to rising energy prices, a lack of qualified staff and cyber security regulations are challenges.

High energy costs may discourage investment in physical AI infrastructure, such as the construction of large data centres, which in turn may reduce demand for AI professionals or make Poland less attractive for talent. Regulatory uncertainty may slow down both investment in energy-efficient AI solutions and the development of innovative projects that could reduce energy demand. In turn, a lack of human resources may hinder the implementation and optimisation of energy-efficient systems, exacerbating the problem of energy costs.

Poland’s success in AI development does not depend solely on individual investments by companies or government programmes such as ‘AI Factories’. It requires a holistic approach that simultaneously addresses all these interrelated barriers. Neglecting one area, such as the lack of stable energy prices, can undermine the effects of actions in other areas, such as investments in human resources or regulation. This means that Poland needs to create a coherent ecosystem to support AI, where energy, education and regulatory policies are synchronised to ensure long-term international competitiveness.

Energy intensity of AI infrastructure

The development of artificial intelligence is inextricably linked to the increasing demand for computing power and, consequently, electricity. Data centres, the backbone of AI infrastructure, are becoming some of the largest consumers of electricity in the world.

Global and Polish energy demand by data centres

Global data centres are consuming increasing amounts of energy. The International Energy Agency (IEA) forecasts that they could consume 80% more energy by 2026 than they did in 2022, even allowing for efficiency gains. Goldman Sachs analysts estimate that by 2030, data centre energy consumption will more than double from 498 TWh to 1,076 TWh, equivalent to the energy consumption of all of Japan today. IDC and Deloitte make similar predictions, pointing to the exponential growth in data centre energy demand driven by AI.

In Poland, the power allocated to data centres in 2023 was 173 MW, an increase of almost 43% year-on-year. The forecast for 2030 indicates a minimum of 500 MW, representing a compound annual growth rate (CAGR) of 25%. Polskie Sieci Elektroenergetyczne (PSE) predicts that the share of data centres in national electricity consumption will be around 4.2-4.5%. Moreover, large data centres, such as those that Microsoft will launch in Poland, may require even more than 100 MW. Annual energy consumption at this level would be enough to charge all the electric cars in Poland twice over.

AI contributes to energy consumption both during the training phase of the models and during the inference phase. The training phase of AI models is extremely energy-intensive, requiring enormous computing power and taking weeks or months, involving hundreds or thousands of graphics processing units (GPUs) or tensor processing units (TPUs). For example, training the GPT-3 model (which has 175 billion parameters) consumed about 1287 MWh of electricity, equivalent to the annual consumption of about 120 US households.

Inference is the operational phase in which the trained model generates predictions or responses to new data. Although training is intensive, the inference phase accounts for 70-80% of the total energy consumption in the model’s lifecycle due to its continuous and iterative nature. Each query to an AI model such as ChatGPT consumes at least four to five times more computing power than a traditional web search. A single query to ChatGPT3 consumes about 10 times more energy than a typical Google search.

To mitigate this consumption, the use of smaller AI models for simpler tasks is an effective method of saving energy – they are more cost-effective and environmentally friendly. In addition, the model quantisation technique, which reduces the precision of model weights and activations, significantly reduces memory usage and speeds up inference, resulting in lower energy consumption.

Operating cost structure of AI infrastructure

Global investment in AI infrastructure already exceeds $100 billion per year, indicating that the scale of the problem will only increase. McKinsey estimates that by 2030, companies will need to invest $5.2 trillion in data centres to support AI alone. Energy and facility maintenance costs are a key factor in this structure. Approximately 25 per cent ($1.3 trillion) of the projected $5.2 trillion investment is for ‘energisers’ – those responsible for power generation and transmission, cooling and electrical equipment.

Operating costs for on-premise solutions include significant capital expenditure (CapEx) for hardware and software, as well as ongoing energy and facility maintenance costs. In contrast, cloud solutions (cloud) offer reduced upfront costs and lower maintenance requirements, but involve ongoing operational costs (OpEx) in the form of subscription fees. In the case of on-premise infrastructure, data centre power and cooling costs can be high and volatile due to fluctuating energy prices.

AI development costs vary depending on the complexity of the project: simple solutions (e.g. chatbots) can cost between $20,000 and $80,000, advanced solutions (e.g. risk management systems) between $50,000 and $150,000, and customised, complex systems (e.g. advanced trading platforms) between $100,000 and more than $500,000. Infrastructure costs for AI workloads in the cloud start at around $2,000 per month and increase rapidly as computing power is used. Linguistic model fees (LLM), based on the number of tokens, can range from $500 to more than $5,000 per month with high volumes of interaction. In Poland, energy costs are the biggest challenge for data centres, as confirmed by 80% of respondents.

The exponential growth of AI means that data centres will become major consumers of energy, far outstripping traditional IT. The shift from training to inference as the dominant driver of energy consumption means continued high operational costs. This phenomenon forces a strategic focus on energy efficiency, renewables and optimising AI models to effectively manage the long-term financial and environmental impacts.

The choice between on-premise (on-premise) and cloud (cloud) AI infrastructure is increasingly driven by energy cost considerations. The cloud offers scalability and operating cost advantages, while on-premise solutions provide greater control. Higher energy prices in Poland are amplifying the financial risks associated with on-premise solutions, driving companies towards the cloud or green data centres. This dynamic could transform the local data centre market and accelerate the adoption of sustainable energy practices.

Mitigation strategies and growth prospects

With the increasing energy demands of AI infrastructure, it becomes critical to implement effective strategies to mitigate costs and ensure sustainability.

Investment in data centre energy efficiency

Energy efficiency is fundamental to the sustainability of data centres. Modern solutions include the use of closed-loop liquid cooling and the recovery of IT components for reuse, as practised by OVHcloud, for example. The goal for all new data centres by 2030 is to use only renewable energy and achieve a PUE (Power Usage Effectiveness) of 1.3 in cold climates and 1.4 in warmer climates.

Actions such as energy efficiency audits, the implementation of smart energy management systems and heat recovery can deliver significant savings and contribute to decarbonisation. An example is Beyond.co.uk, which recovers heat from server chambers to heat its own office building. At the software level, quantising AI models, which reduces the precision of model weights and activations, significantly reduces memory usage and speeds up inference, resulting in lower energy consumption. Similarly, using smaller AI models for simpler tasks is more energy efficient. New techniques, such as the AI developed by BitEnergy, can reduce AI energy consumption by up to 95%, although they require specialised hardware.

Use of RES and PPAs

Renewable energy sources are seen as the future of the data centre industry. Beyond.co.uk is an example of a company that powers its data centres with 100% renewable energy and aims for climate neutrality by 2040, being the only Polish member of the Climate Neutral Data Centre Pact. Co-location of facilities close to sources of renewable energy generation allows providers to reduce both construction expenses and energy losses associated with distribution, increasing overall efficiency and sustainability. Power Purchase Agreements (PPAs) allow companies to secure the supply of green energy, which is key to meeting the growing demand for electricity.

The role of cloud vs. on-premise infrastructure

The choice between cloud and on-premise infrastructure has significant implications for energy costs. Cloud offers scalability, flexibility, reduced upfront costs, lower maintenance requirements and access to advanced AI tools and technologies. On-premise solutions, on the other hand, provide greater control over data and infrastructure, which is beneficial for companies that process sensitive information, but lack the scalability of the cloud and require significant capital investment (CapEx). Energy costs are a key factor in comparing the two models. Power and cooling costs for on-premise data centres can be high and volatile due to fluctuating energy prices. The pay-as-you-go model for cloud services eliminates the need to forecast future capacity and offers long-term savings and flexibility.

Government support and regulation

Regulations, such as the EU AI Act, increasingly include requirements for energy consumption and transparency, which will impact companies developing or using AI technologies. Providers of general purpose AI models (GPAI models) are required to create and maintain technical documentation, including energy consumption data. Models with systemic risk are subject to additional obligations, which further incentivises minimising energy consumption.

The EU energy ecosystem is currently poorly prepared for the AI revolution, which requires the development of nuclear power. In Poland, Polskie Sieci Elektroenergetyczne (PSE) will receive more than PLN 1.3 billion in non-refundable funding from the National Reconstruction Plan (NRP) for the expansion and modernisation of key transmission lines. The government has also adopted a draft law on deregulation of the energy sector, aimed at accelerating the green transition and increasing the share of RES in the Polish energy mix. In addition, the Enea Group has raised more than PLN 9 billion for the development and modernisation of electricity grids and RES. At the European level, initiatives such as the EU InvestAI and French AI computing projects, as well as the EuroHPC Joint Undertaking, aim to develop supercomputing infrastructure and research capabilities.

Proactively adopting energy-efficient practices in data centres, such as liquid cooling and PUE optimisation, combined with a rapid transition to renewable energy sources through PPAs, is not only an environmental requirement, but also a critical economic strategy for AI development in Poland. This approach directly counteracts rising energy costs and increases Poland’s attractiveness for AI investment.

The EU AI law’s emphasis on energy transparency and systemic risk for AI models, combined with significant Polish and EU investments in grid modernisation and RES, signals a clear regulatory and strategic direction towards sustainable AI. This creates both compliance obligations and competitive advantages for Polish companies that prioritise energy efficiency and green infrastructure, potentially shaping the future landscape of AI development in the region.

Conclusions

The dynamic development of artificial intelligence in Poland is undeniable, with tangible business benefits ranging from revenue and productivity growth to process optimisation. The Polish IT sector shows a strong readiness to further invest in AI, as evidenced by rapid growth in adoption and plans to expand infrastructure, including the creation of ‘AI Factories’.

However, this ambitious development faces significant challenges, of which rising electricity costs are one of the most pressing. Poland, despite some temporary fluctuations, is characterised by structurally high wholesale energy prices compared to other EU countries, as a result of the dominance of coal in the energy mix and the high cost of CO2 emission allowances. Forecasts indicate that after a period of price freezes for households, the business sector may experience significant cost increases if it fails to secure adequate contracts. This situation puts Polish companies, especially those with energy-intensive AI infrastructure, at a competitive disadvantage internationally.

The analysis indicates that the development of AI in Poland faces a ‘triple barrier’: high energy costs, a shortage of skilled personnel and regulatory uncertainty. These factors are closely interrelated and mutually reinforcing. High energy prices can discourage investment in infrastructure, which affects the demand for specialists and the overall attractiveness of the market. A lack of human resources can hinder the implementation and optimisation of energy-efficient solutions, while unclear regulation slows down innovation.

The rise in energy costs will not stop the development of AI in Poland, but will certainly shape it. Companies will be forced to take a strategic approach to energy management, investing in data centre energy efficiency (e.g. liquid cooling, PUE optimisation), and in renewable energy sources, often through long-term PPAs. The growing importance of cloud computing, which offers scalability and cost flexibility, will also influence investment decisions.

Government support and EU regulations, such as the EU AI Act with its energy transparency requirements, as well as investments in grid modernisation and RES development, are key to creating an enabling environment for AI. In order for Poland to maintain its competitiveness and become a leading AI hub in Europe, a holistic and coordinated action that simultaneously addresses energy, human resources and regulatory challenges is necessary. Only in this way will it be possible to ensure the long-term, sustainable and economically viable development of AI in the country.