For the largest IT distributors in the Central European region, a moment of testing is coming. After a period of stabilising supply chains, the market is once again entering a phase of turbulence which, paradoxically, may prove extremely profitable for players such as AB Group. The company’s vice-president and COO, Zbigniew Mądry, paints a picture of a market where the confluence of three factors – component shortages, the AI boom and the unlocking of KPO funds – will create upward pressure on prices and sales volumes in the coming quarters.

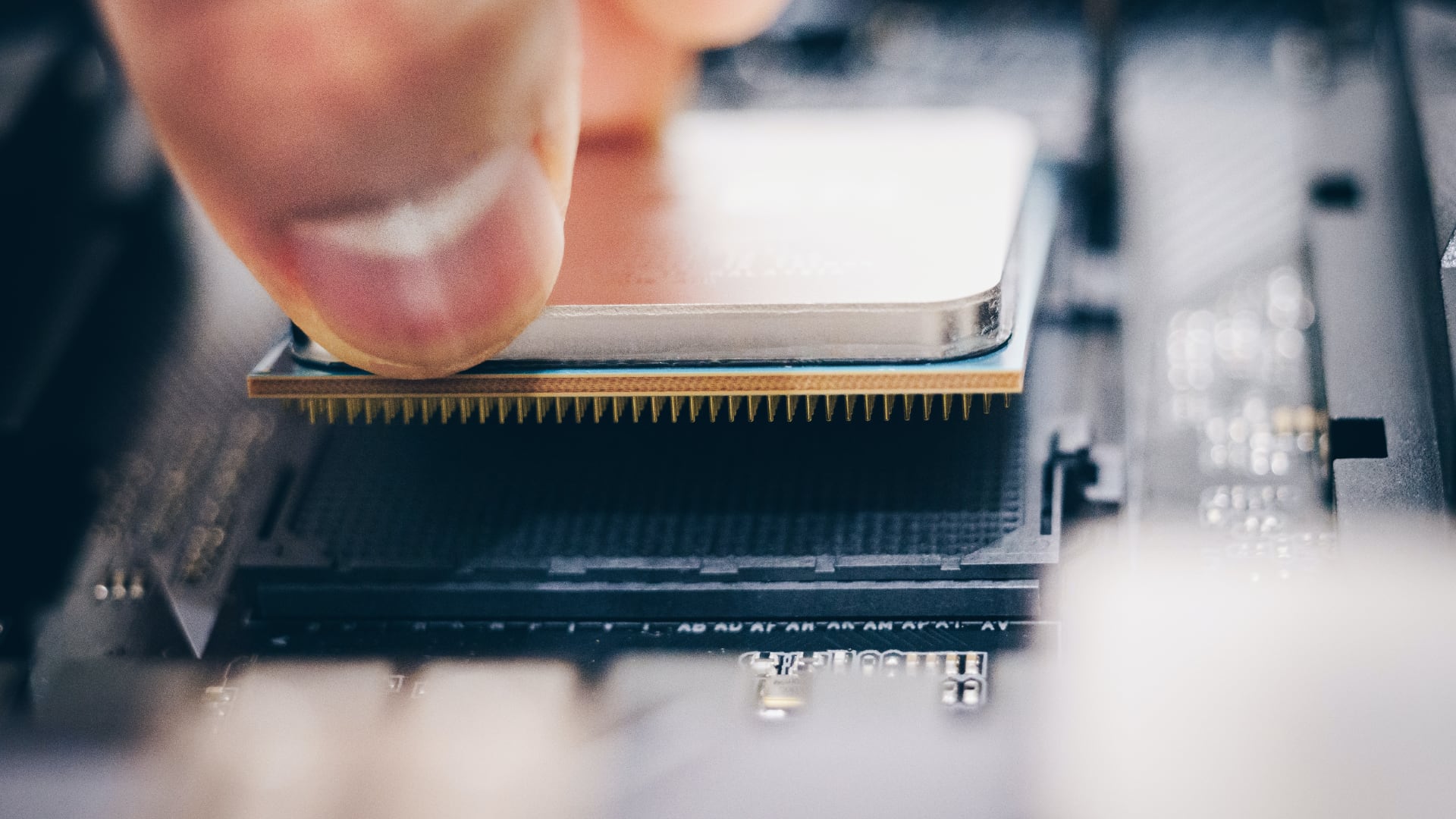

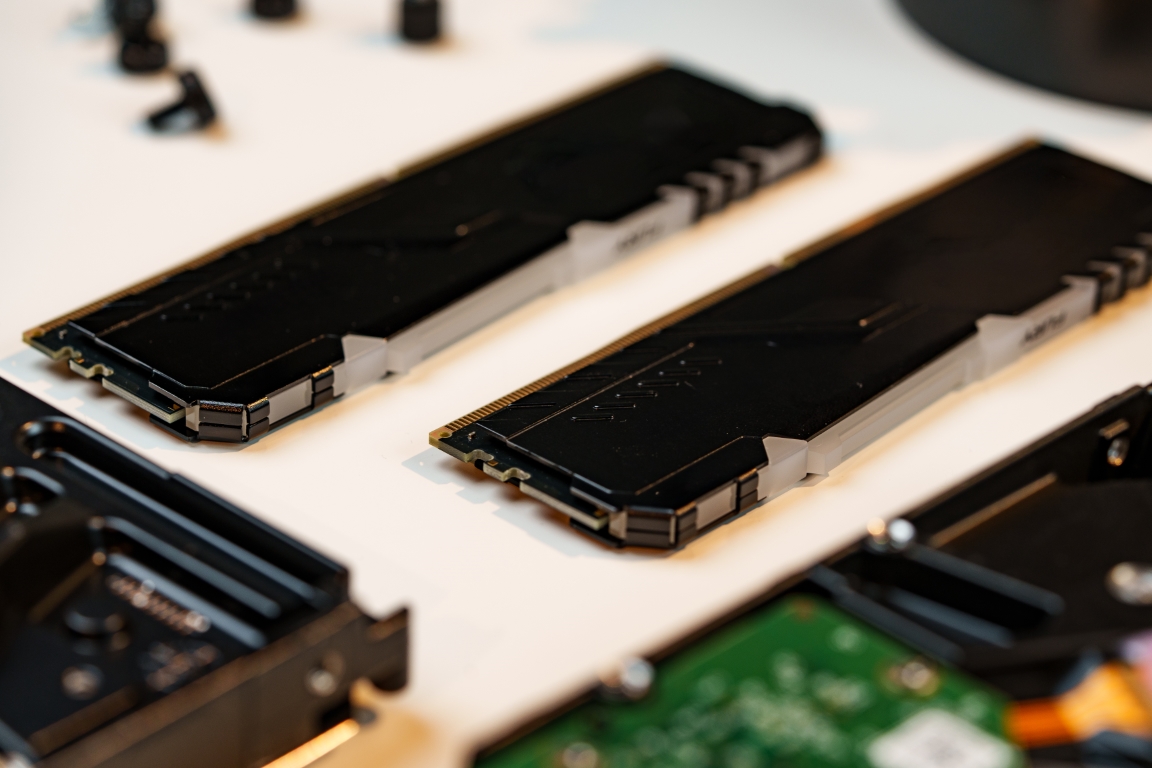

A key signal for the business is the return of RAM and SSD availability issues. Management estimates that current capacity covers only 70 per cent of global demand. In distribution logic, this means inevitable overnight price increases for IT equipment and a forced acceleration of purchases by corporate customers looking to escape increases. This phenomenon coincides with a rapid recovery in the public sector. Figures for the third quarter of 2025 show a leap of 61 per cent year-on-year increase in the number of tenders announced. The public procurement market is clearly waking up from its lethargy, stimulated by the need to spend NIP funds, the lion’s share of which must be settled in 2026.

The short-term outlook is supported by macroeconomic forecasts. Gartner predicts that IT spending in Europe will increase by more than 10 per cent in 2026, which is significantly higher than the global average. Importantly, the structure of the Polish economy is changing – the IT sector’s share of GDP is expected to increase from the current 4.5 per cent to nearly 9.5 per cent in 2029. The driving force remains spending on cyber-security (average annual growth of over 12 per cent) and AI technologies, where the cumulative annual growth rate by 2033 is expected to be as high as 30 per cent.

AB Group’s financial position seems prepared for this scenario. Although the last financial year ended with a flat net result of nearly PLN 174 million on revenues of PLN 14.9 billion, the company maintains a high level of cash (over PLN 135 million). CFO Grzegorz Ochędzan emphasises financial stability, which, with rising inventory financing costs, can be a key competitive advantage. CEO Andrzej Przybyło suggests outright that the current stock market valuation does not reflect this potential, pointing to the disparity between the share price and the fundamental value of the company in the face of upcoming