The generative artificial intelligence (GenAI) revolution has created an insatiable demand for computing power, fundamentally changing data centre architectures. Traditional processors (CPUs), for decades the heart of computing, have become the bottleneck for language-based models (LLMs) and other GenAI systems. In response to this challenge, a new class of specialised hardware was born: AI accelerators.

The end of the CPU era and the birth of a new paradigm

The problem with CPUs in the context of AI lies not in their speed, but in a fundamental architectural mismatch. Optimised for sequential execution of complex tasks, they have only a few powerful cores. Meanwhile, deep learning algorithms require massive parallel processing – performing trillions of simple operations simultaneously. This is a task for which graphics processing units (GPUs), equipped with thousands of smaller cores, are ideally suited .

Alongside GPUs, which have become the standard for model training, even more specialised units have emerged. Neural processing units (NPUs) are a broad category of chips designed from the ground up with AI in mind, prioritising energy efficiency, making them crucial for edge AI applications. Tensor processing units (TPUs), on the other hand, are Google‘s proprietary ASICs, optimised for its software ecosystem and massive cloud computing .

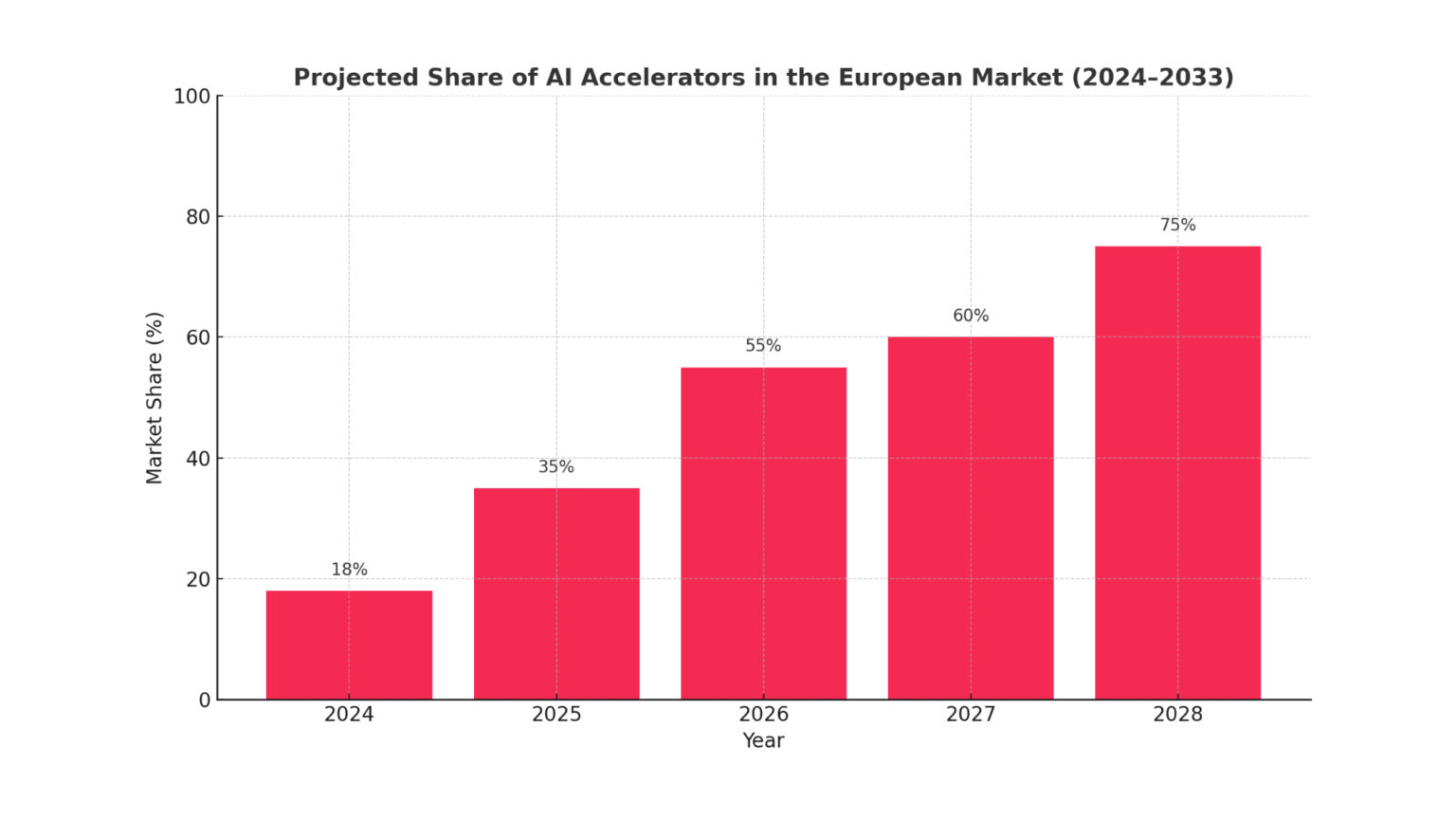

This paradigm shift is driving a market in Europe with huge potential. Valued at around €4.88 billion in 2024, the European AI accelerator market is expected to grow to nearly €43 billion by 2033, with an impressive compound annual growth rate (CAGR) of 27.4% .

Unique European Drivers: Politics meets market demand

The European accelerator market is shaped by a unique combination of bottom-up commercial demand and top-down strategic initiatives, which sets it apart from markets in the US or Asia.

On the one hand, AI adoption is growing in key sectors such as healthcare, automotive and finance. Already 13.5% of businesses in the EU are using AI technologies, and the entire European AI market (software, hardware and services) is growing at a rate of more than 33% per year.

On the other hand, the European Union is pursuing an ambitious programme to strengthen its digital and technological sovereignty. Geopolitical concerns and the desire for independence from non-EU suppliers have led to powerful investment mechanisms:

- EU Chips Act: This initiative aims to mobilise more than €43 billion in public and private investment to double Europe’s share of global semiconductor production from 10% to 20% by 2030 . Attracting investment to build advanced factories, such as Intel’s and TSMC’s plants in Germany, is crucial for future accelerator production in Europe.

- AI Continent Action Plan: this €200 billion plan aims to create a sovereign, pan-European AI ecosystem. Its key element is the InvestAI initiative, which is expected to mobilise €20 billion to build 4-5 ‘AI Gigafactories’ – each equipped with more than 100,000 advanced AI chips.

- EuroHPC and ‘AI Factories’: The Joint Undertaking for European Large Scale Computing (EuroHPC JU) is investing billions of euros to build a fleet of supercomputers. Around these, 13 ‘AI Factories’ are being built to democratise access to computing power for startups and SMEs, stimulating innovation and creating guaranteed demand for infrastructure .

The competitive landscape: Nvidia’s dominance and the strategies of the contenders

The data centre accelerator market is close to a monopoly. Nvidia controls around 98% of the global market in terms of units shipped, and its real advantage is its mature CUDA software ecosystem, used by 5 million developers . This creates a powerful lock-in effect, making it difficult for competitors to gain share.

Nevertheless, the contenders are pursuing well thought-out strategies:

- AMD: Positions itself as a major high-performance alternative. The Instinct MI300 series of accelerators is intended to compete with Nvidia’s offerings, with a key selling point being the open ROCm software platform, aimed at breaking the CUDA monopoly.

- Intel: It is betting on price competition with Gaudi accelerators (to be 50% cheaper than Nvidia’s H100) and an open oneAPI ecosystem.

- Google (TPU): It does not sell the chips directly, but uses them as a key differentiator for its cloud platform, offering an excellent performance-to-cost ratio for specific AI workloads.

Against this backdrop, European players such as the UK’s Graphcore and France’s Blaize are also emerging, focusing on niches such as novel architectures (IPUs) or energy-efficient chips for Edge AI

The growth trilemma: Cost, energy and talent

Despite the optimistic outlook, the European market faces three fundamental barriers that create a strategic trilemma for decision-makers.

Cost and availability: The price of a single high-end accelerator, such as the Nvidia H100, is up to US$40,000, making building your own AI infrastructure prohibitive for most companies . Additionally, global supply chains are vulnerable to disruption and export controls, which threatens project continuity .

Energy and ESG: Data centres dedicated to AI consume four to five times more energy than traditional ones. Data centre energy consumption in Europe is forecast to almost triple by 2030. This is in contrast to the EU’s ambitious sustainability goals, such as

Energy Efficiency Directive, which imposes an obligation to reduce energy consumption.

Talent: Europe is facing a critical shortage of AI and HPC professionals. The skills gap is slowing down innovation and preventing companies from effectively using even the infrastructure they already have, empowering global cloud providers.

Future trends: From possession to access, from monolith to module

Looking ahead to 2030, the market will be shaped by three key trends:

- The dominance of the ‘Compute-as-a-Service’ model: Due to the aforementioned trilemma, most companies will not buy accelerators, but rent access to them. This model, pursued by both public ‘AI Factories’ and commercial cloud providers, transforms huge capital expenditure (CAPEX) into predictable operating costs (OPEX).

- Software battle: The long-term structure of the market will depend on the success of open standards, such as ROCm and oneAPI, in breaking the dominance of CUDA. Avoiding dependence on a single vendor is a powerful motivator for the industry as a whole

New hardware architectures: To overcome physical limitations, the industry is moving towards chiplets – smaller, specialised silicon cubes combined into a single system. This allows for greater modularity and lower costs. In the long term, the revolution could be

photonic computing, using light instead of electrons, which promises orders of magnitude higher throughput and energy efficiency .

Strategic lessons for technology leaders

The European AI accelerator market is an arena where global technology competition meets unique political and regulatory ambitions. For technology and innovation directors, this means navigating a complex ecosystem.

The key strategic question is shifting from “which accelerator to buy?” to “how to strategically access computing power?”. The answer requires balancing performance, cost, sovereignty and sustainability. Success in the GenAI era will not depend on simply having the latest hardware, but on the ability to intelligently use both public initiatives and private innovation to build a sustainable competitive advantage in a unique European market.