Today’s technological revolution has an epicentre, and that is undoubtedly artificial intelligence. It is not just another innovation; it is a fundamental force transforming the global economy, military strategy and social fabric.

In this new era, marked by an unprecedented pace of change, patents have become the equivalent of territorial claims during the gold rush era. They are a hard, measurable indicator of national strategy, innovative capacity and, most importantly, future economic power. Leadership in AI is seen as a prerequisite for competitiveness, security and prosperity in the 21st century, with the technology revolutionising every sector from healthcare to defence.

The global scene is dominated by two hegemons: The United States, with its capital power and dominance in the creation of fundamental models, and China, which is pursuing a monumental state-led strategy to achieve quantitative superiority. In this bipolar balance of power, a key question arises about Europe’s position. Is the Old Continent merely a distant third player, condemned to watch the giants compete from the sidelines? Or is it, contrary to common narratives, building its own unique path to technological sovereignty and competitiveness? Is Europe realistically catching up?

Drawing on hard data from the world’s leading intellectual property organisations – the European Patent Office (EPO) and the World Intellectual Property Organisation (WIPO) – and in-depth reports from leading research institutions such as the Stanford Institute for Human-Centered AI (HAI) and the OECD, this analysis aims to separate the facts from the media hype. We will trace the dynamics of patent applications, examine the quality and strategic focus of innovation, and place this data in a broader geopolitical context to provide a nuanced answer to the question of Europe’s future in the global AI race.

The global AI patent arena: a numbers game and exponential growth

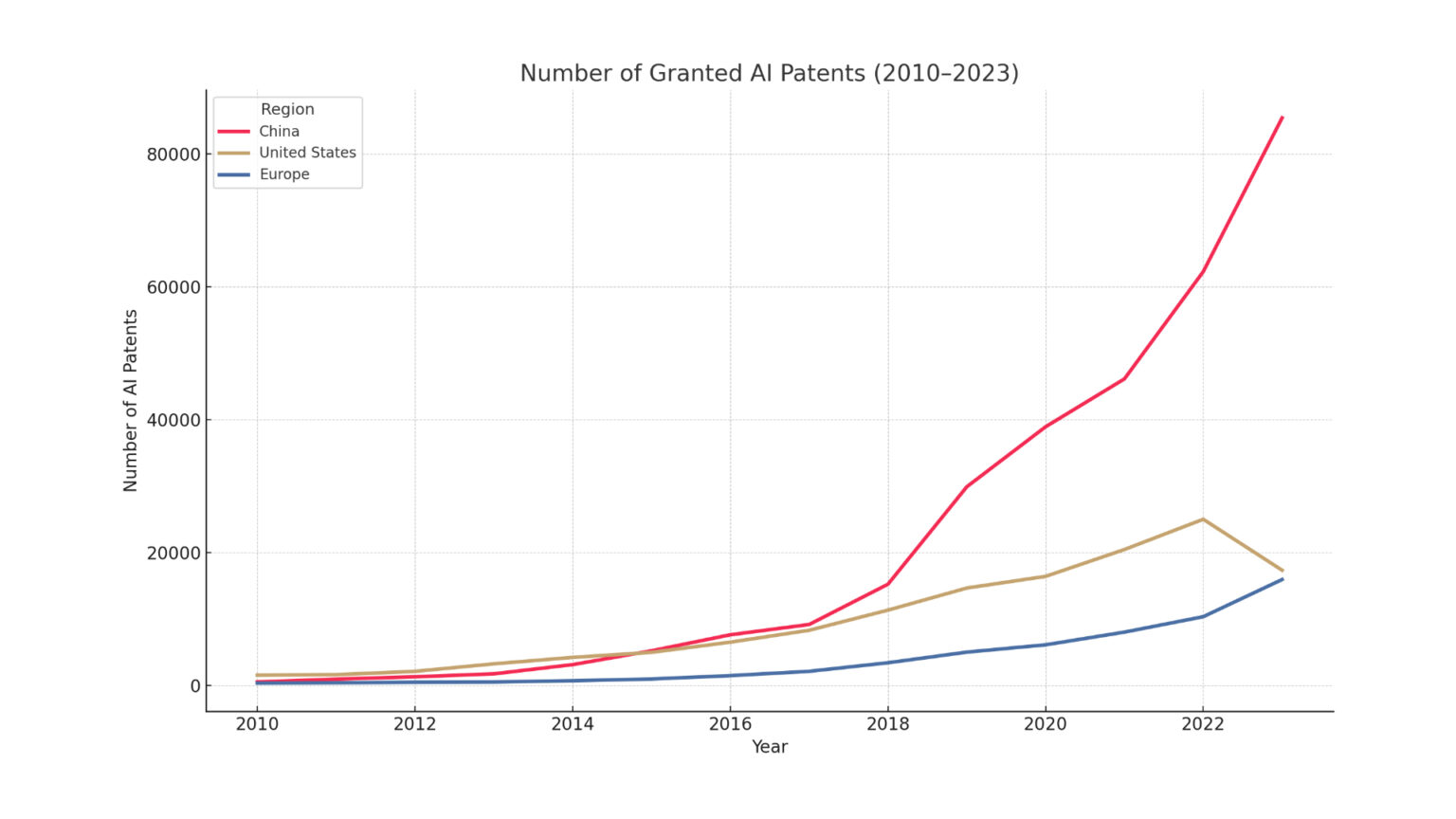

An analysis of global patent trends in the field of artificial intelligence reveals a picture of unprecedented dynamism. The scale and pace of growth in this field eclipses previous innovation cycles, signalling a fundamental technological shift. In just over a decade, the world has witnessed an explosion of patent activity that has redefined the map of global innovation.

An unprecedented wave of innovation

The data is clear: the number of AI-related patents granted globally has increased more than 31-fold since 2010. In 2010, only 3,833 patents were granted worldwide in this field. By 2023, this number has risen to a staggering 122,511, an increase of 29.6% on the previous year alone. This exponential growth is testament to the intense and ever-accelerating investment in AI research and development worldwide.

The tri-polar balance of power

When we look at the geographical distribution of these patents, a clear three-layered landscape emerges, with different players operating at very different scales.

- China’s quantitative supremacy: China is the undisputed leader in terms of volume, accounting for an overwhelming 69.7% of all AI patents granted worldwide in 2023. This share has increased dramatically over the past decade, cementing China’s position as the most prolific innovator in terms of number of applications. Already in 2022, China has been granted more AI patents (around 40,000) than the rest of the world combined, while the US, in second place, has been granted around 9,000….

- Position of the US and Europe: the US ranks a distant second with a share of 14.16% in 2023, and Europe is third with a share of 13.00%. These figures clearly indicate that in terms of pure patent numbers, Europe is not only failing to catch up with the US, but both regions are dominated by the scale of Chinese activity.

The scale of China’s quantitative dominance is so massive that it suggests more than just organic, market-driven innovation growth. Historically, in globally competitive technology fields, such a rapid and massive accumulation of intellectual property in one country is unusual. The data confirms that this is the result of a deliberate national strategy, supported by massive government funding and top-down directives. This means that China’s patent statistics cannot be interpreted solely as a measure of commercial innovation in the Western sense. They are also an indicator of the implementation of a state industrial policy aimed at declaring a technological presence and building a powerful national IP portfolio. This fundamentally changes the context of the comparison – it is no longer just a race for the best ideas, but for China, also a race for sheer volume as a strategic goal.

The European innovation frontline: analysis of data from the EPO

Global statistics, while impressive, only tell part of the story. To reliably assess Europe’s competitiveness, it is necessary to transfer the analysis to its ‘own backyard’ – the European Patent Office (EPO). This is because the EPO data reflects the real battle for the lucrative and technologically advanced European market, and these shed a whole new light on the continent’s position.

AI as the new engine of European innovation

The EPO Patent Index 2024 report brings breaking news: for the first time ever, Computer Technology, a category that includes Artificial Intelligence, has become the leading technology field in terms of the number of patent applications at the EPO, reaching 16,815 applications. This proves that AI is at the heart of the most advanced R&D aimed at the European market.

The main drivers of this growth over the past five years have been inventions directly related to AI – such as machine learning, pattern recognition and neural networks. Applications in these subcategories have grown at an average annual rate of 28% since 2019. In 2024 alone, the number of AI-related applications at the EPO increased by 10.6% compared to the previous year, confirming the unrelenting momentum in this area.

European innovators leading their own market

Most importantly, the EPO data shows that in the key area of AI-related inventions, it is “applicants from EPO member states that have maintained a leading position throughout this period [of the last five years]”. Although in the broader category of ‘computer technology’, US entities lead the way (with a 34.4% share compared to 29.5% for EPO countries), in the narrower but strategically key area of AI, Europe is in the lead.

The growth in filings from EPO countries in computer technology was very solid at +5.9% in 2024, driven by significant innovation jumps from Germany (+12.7%), Switzerland (+37.4%) and the UK (+12.4%). This indicates the existence of a thriving and dynamic innovation ecosystem in Europe.

Analysis of the EPO data leads to an important conclusion. Filing a patent application, especially at an office as rigorous and expensive as the EPO, is a significant strategic investment. Companies do not take such steps without a firm belief in the commercial potential of their inventions. The high level of EPO filings from all regions – the US, Asia and Europe – is indicative of the widespread perception that the European market is a key and highly profitable one. The fact that it is European entities that lead the way in AI-specific filings at their own patent office suggests that they are not only conducting advanced research, but are strategically focused on protecting and commercialising these innovations in their home economic zone. Global statistics may reflect broad research activity and national strategies, but EPO data is a much better indicator of the real-world, commercial race for Europe. And in this race, Europe is not just a participant – it is a leader. This completely changes the ‘catching up’ narrative.

Quality vs. quantity: a deeper look at patent strategies

The number of patents alone is an imperfect measure of innovative power. To fully understand the global dynamics, it is necessary to introduce the dimensions of quality, impact and strategic purpose behind patent portfolios. An analysis of these factors reveals that the US, China and Europe are not in one, but in three separate races, each with different rules and objectives.

US strategy: fundamental models and high-impact intellectual property

The US has a clear focus on the quality and fundamental importance of its innovations. The best evidence of this is the citation rate – US AI patents are cited almost seven times more often than Chinese patents, indicating that they form the basis for later inventions around the world.

What’s more, the US absolutely dominates the creation of ‘notable AI models’ – systems that represent key technological breakthroughs. In 2024, US institutions have created 40 such models, compared to 15 by China and just three by Europe.

This leadership is driven by corporate giants such as Google, Microsoft and IBM, who are investing billions in basic research.

China strategy: Volume, applications and academic innovation

The Chinese strategy is based on massive scale. However, the quality of this portfolio is subject to debate; the grant ratio for AI patents in China is estimated at only 32%. Furthermore, the vast majority of these patents are filed only in the domestic market, suggesting a focus on the domestic market and the building of a defensive IP wall.

A key differentiator is the source of innovation. In China, as many as 65 of the top 100 patenting organisations in computer vision are universities. In the US, the number is only three. This shows a model driven by the state and the academic sector, in contrast to the US model, which is commercially oriented and dominated by the private sector.

The European model: Industrial integration and applied AI

Europe’s leading patent applicants reflect the continent’s industrial strength. Companies such as Siemens and Bosch from Germany are key players, focusing on the application of AI in industrial automation, manufacturing and transportation.

This suggests a strategy of integrating cutting-edge artificial intelligence into already established, highly developed sectors of the economy, rather than competing directly in the creation of foundational models.

The patent data shows not one race, but three parallel, strategically distinct endeavours. The US ecosystem, driven by massive private capital, seeks to create and own the foundational platforms – the ‘shovels and picks’ of the AI era – on which others will build their solutions. Its patent strategy is selective and geared towards maximum impact. China’s state-controlled ecosystem is focused on rapid and widespread adoption, technological self-sufficiency and achieving dominance in specific application areas such as computer vision. Its patent strategy is a game of volume and control of the domestic market. Finally, the European ecosystem is a mature industrial economy that is adapting AI to strengthen its existing competitive advantages. Its patent strategy focuses on protecting highly specialised, high-value applications in key sectors. The question of whether Europe is ‘catching up’ with the US is therefore like asking whether a Formula One team is ‘catching up’ with an aerospace company. Both are competing in engineering, but in completely different disciplines and with different objectives.

Behind the numbers: strategic and geopolitical context

Patent trends do not exist in a vacuum. They are a direct reflection of deeper national strategies, investment realities and structural conditions. Analysis of this context is crucial to understanding Europe’s true position in the global AI race.

Europe’s dilemma: A pioneer of regulation, a marauder of investment

The European Union has adopted a proactive, regulation-oriented approach, culminating in the AI Act. The aim is to establish a global standard for ‘trustworthy’ artificial intelligence as a showcase for the European model. However, this ambitious regulatory vision is accompanied by a massive investment gap. In 2024, private investment in AI in the US reached USD 109.1 billion. This is almost 12 times more than in China (USD 9.3 billion) and significantly more than in the European Union, where estimates suggest around USD 8 billion. European strategic initiatives such as the ‘AI Factories’ programme (with a budget of EUR 20 billion) or the ‘Apply AI Strategy’ (EUR 1 billion) attempt to respond to this challenge. However, their scale pales in comparison not only to total US private investment, but even to individual corporate projects such as OpenAI’s Stargate.

Infrastructure gap – Europe’s Achilles heel

Europe’s greatest structural weakness is its critical dependence on foreign technology infrastructure. It is estimated that around 70% of Europe’s digital services run on the clouds of three US giants (so-called hyperscalers). At the same time, the European semiconductor manufacturing sector accounts for less than 10% of global production, making the continent dependent on chips designed in the US and manufactured in Asia. This fundamental weakness poses a direct threat to the EU’s strategic goal of achieving ‘digital sovereignty’.p

The table below synthesises the key differences between the three ecosystems, providing a summary of the AI strategic landscape.

| Indicator | Europe | USA | China |

|---|---|---|---|

| Private Investment in AI (2024) | approx. USD 8 billion | USD 109.1 billion | USD 9.3 billion |

| Regulatory Philosophy | Proactive, risk-based, horizontal (AI Act) | Reactive, free market, voluntary framework | State-controlled, information control, sectoral regulation |

| Key Players | Industrial companies (Siemens, Bosch), start-ups (Mistral) | Technology giants (Google, Microsoft, OpenAI), VC funds | Technology giants (Baidu, Alibaba, Tencent), universities, the state |

| Patent Strategy | Qualitative, focused on industrial applications | Qualitative, focused on fundamental models and high impact | Quantitative, focused on the domestic market and a broad spectrum of applications |

| Main assets | Strong industrial base, leadership in applied AI, high regulatory standards | Dominance in capital, leadership in basic research, global platforms | Huge scale, rapid adoption, state support, dominance in data |

| Main Weaknesses | Investment gap, infrastructure dependency (cloud, chips), market fragmentation | Potential risk of lack of regulation, concentration of power in the hands of a few companies | Quality issues and international recognition of patents, political barriers |

What does the future hold for Europe in the AI race?

After an in-depth analysis of the patent data and the strategic context, the answer to the question of Europe’s position in the global AI race becomes clear, albeit multidimensional.

Firstly, in terms of pure patent numbers, Europe is not catching up and will probably never catch up with China. The scale of Beijing’s state strategy makes volume an inadequate and misleading measure of success for Europe.

Secondly, Europe is significantly behind the US in developing fundamental models and raising venture capital. The financial strength and risk appetite of the US ecosystem are currently out of reach.

However, the key conclusion of this analysis is that Europe’s success should not be measured by its ability to copy American or Chinese models. On the contrary, its future lies in the skilful exploitation of its unique strengths. Europe is not a marauder, but a leader in the race for high-value, industrial and applied artificial intelligence. Its strength lies in the deep integration of AI into the world-class manufacturing, automotive, medical and green technology sectors. Data from the European Patent Office clearly confirms that in its own core market, Europe is winning the innovation race.

The future competitiveness of the continent will depend on two critical factors:

- Bridging the infrastructure and investment gap: The success of initiatives such as AI Factories is absolutely crucial. Without sovereign computing power and a stronger venture capital ecosystem, Europe will always build its innovative applications on foundations owned by foreign powers.

- Strategic use of regulation: Europe must effectively present its AI Act not as a barrier to innovation, but as a global competitive advantage. The aim is to create a premium market for ‘trustworthy’, secure and human-centred AI systems, which will increasingly be demanded by corporate customers and citizens around the world.

Europe may not win the sprint for the number of patents, but it is perfectly placed to compete in the marathon for sustainable, valuable and trustworthy integration of AI into the real economy. The race is far from over, and Europe is running its own distinct and well-considered path in it.