For decades, Europe’s technological landscape was based on a simple divide: innovative, capital-rich centres in the West and talented but mostly cheaper hinterlands in the East. Central and Eastern Europe (CEE) was mainly seen through the prism of cost arbitrage, ideal for nearshoring.

Today, this stereotype is not only outdated, but actually inhibits an understanding of the real dynamics of the continent. We are witnessing a fundamental change – the CEE region, led by Poland, the Czech Republic and Romania, is undergoing a transformation from a peripheral service provider to a self-sufficient ‘technology tiger’.

Its new competitive advantage is no longer based solely on lower costs, but on a unique combination of value, deep specialisation and unparalleled growth momentum.

To verify this thesis, let us look at the hard data, comparing the key pillars of the innovation ecosystems in CEE and Western Europe.

The talent equation: more than cost, unparalleled value

Traditional analysis of IT markets is often reduced to a comparison of nominal salaries. However, a full picture of the value of the CEE region only emerges when three dimensions are examined: the total cost of employment, the purchasing power of the employee and the objective quality of their skills.

The total cost of employing an experienced software engineer in Warsaw is still significantly lower than in western hubs. Taking into account the gross salary and contributions on the employer’s side, the annual cost of employing a Senior Developer in Warsaw is approximately EUR 88,568.

This compares to €101,035 in Berlin and €106,704 in Dublin. This means that it is 12-17% cheaper to acquire a world-class specialist in Poland.

However, the real advantage of CEE lies in purchasing power. The lower cost of living means that a salary here has a much higher real value. A key factor is the cost of renting a flat: a one-room flat in the centre of Warsaw costs between €740-990 per month, while in Berlin it is already €1,100-1250 and in Dublin an astronomical €1,950.

Similar disparities can be seen in the prices of public transport, catering or entertainment. As a result, the developer in Warsaw, while earning nominally less, enjoys a higher standard of living and greater financial freedom.

The most important argument overturning the old paradigm, however, is quality. Data from global programming rankings proves that the CEE region is a breeding ground for talent of the absolute highest order. The HackerRank platform ranks Poland 3rd in the world in terms of programmer skills, ahead of countries such as Switzerland, Germany and France.

Polish programmers are recognised as the best in the world in Java, and Czechs dominate in shell programming. Companies investing in CEE are therefore not making a trade-off between cost and quality – they are gaining access to world-class talent at a more sustainable price.

Pulse of capital: ecosystem dynamics and resilience

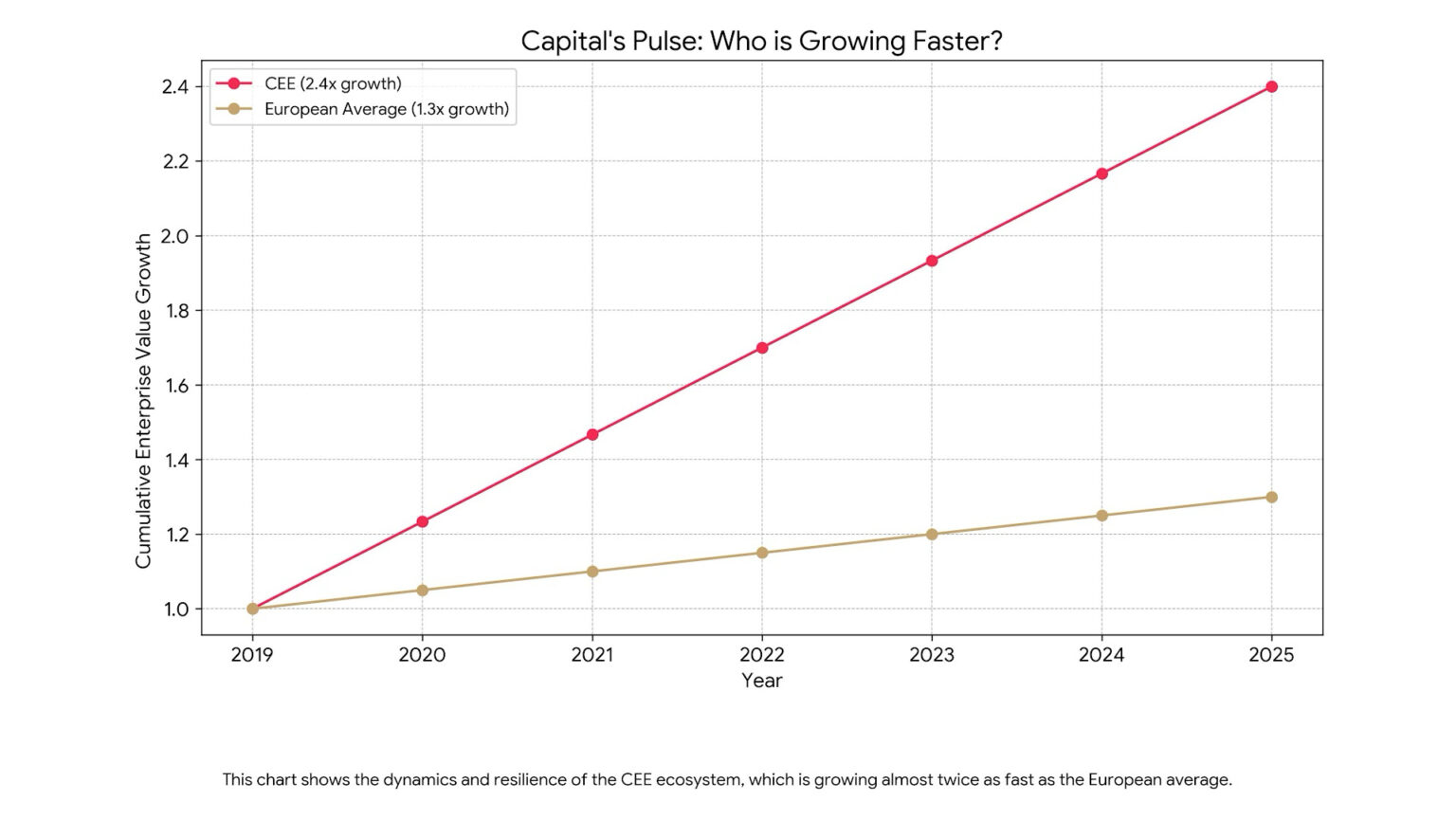

Venture capital (VC) flows are a seismograph for the innovation ecosystem. Analysis of the data shows that while Western Europe still dominates in terms of volume, it is CEE that shows greater dynamism and remarkable resilience to global slowdowns.

The total value of businesses in the CEE startup ecosystem has increased 2.4 times since 2019, reaching €243 billion in the first quarter of 2025 – a growth rate almost double the average for Europe as a whole.

What’s more, during the global slowdown in the VC market in 2023, when investments in Western Europe fell by 35%, the CEE region saw a decline of only 15%. Already in 2024, the market has rebounded, recording growth of 56%. This ability to recover quickly suggests that the foundations of the CEE ecosystem are healthier and better adapted to changing conditions.

The growing interest from global investors is due to a unique investment thesis for the region. CEE founders, in contrast to the ‘growth at all costs’ culture, are taking a more pragmatic approach, focusing on early revenue generation and capital efficiency.

This, combined with a strong engineering background, fostering the emergence of deep tech companies, and a ‘global from day one’ mentality, makes for an extremely attractive model for investors looking for not only high returns, but also lower risk.

Map of the giants: where global companies are locating their future

Investment decisions by global technology giants are the strongest signal of the region’s strategic importance. Over the past decade, CEE has become an arena for spectacular investments.

Google invested $2 billion to launch the Google Cloud region in Warsaw, followed by nearly $700 million in The Warsaw HUB office complex, which has become its largest cloud technology development centre in Europe.

Microsoft has announced a $1 billion plan to create a ‘Polish Digital Valley’, with a cloud computing centre near Warsaw. Intel, in turn, has been developing its largest R&D centre in the EU in Gdansk, employing more than 3,000 engineers working on future technologies such as AI and machine learning.

A key driver of this is access to world-class talent. Technology leaders know that in order to maintain an edge, they need to be present where engineers capable of delivering the most complex projects can be recruited.

The presence of these giants creates a powerful flywheel effect: it raises standards in the labour market, creates ‘start-up mafias’ (experienced workers setting up their own companies) and acts as a global quality certificate for the entire region.

Technological DNA: from monolith to specialisation

As the CEE ecosystem matures, we are seeing the emergence of deep specialisations. Poland has made a name for itself as a global leader in video game production (Gamedev) and financial technologies (FinTech). With revenues in excess of €1.28 billion and an almost total export orientation (96-97%), Polish gamedev is a powerhouse driven by the success of companies such as CD Projekt. In parallel, with more than 300 startups, Poland has become one of the liveliest FinTech hubs in Europe.

Romania, with a strong tradition in mathematics, has grown into a European cyber security powerhouse. It is where the globally recognised Bitdefender comes from, and the overall market is expected to grow at a rate of nearly 11% per year.

The Czech Republic, on the other hand, with its rich history in engineering, has naturally become a leader in artificial intelligence (AI) and its applications in Industry 4.0. The country has world-class research institutions and already more than 11% of Czech companies are using AI technology. This diversification is a source of strength for the entire region and evidence of its growing maturity.

Hunting unicorns: the ultimate measure of success

The ability of the ecosystem to regularly generate ‘unicorns’ – companies with a valuation of more than $1 billion – is the ultimate proof of its maturity. Although Western Europe still leads in terms of absolute number (UK – 104, France – 34, Germany – 30), the CEE region has already generated a total of 52-57 unicorns, with Poland as the leader (18).

However, the dynamics are key: more than half of all CEE unicorns were created in just the last two years (2022-2024), indicating a rapid acceleration. What’s more, the region’s unicorns often have their roots in deep technology (deep tech), such as Lithuania’s Nord Security or Poland’s ICEYE.

They are also developing a ‘global hybrid’ model, as exemplified by ElevenLabs – a company founded by Poles, with a key R&D centre in Poland, but with offices in London and New York, allowing them to draw on the best talent in the country while having access to the largest capital markets.

The verdict on the “technological tiger”

The data clearly shows that the narrative of Central and Eastern Europe as merely a ‘cheaper hinterland’ is outdated. The region offers unparalleled talent value, its VC ecosystem exhibits anti-fragility characteristics, it has become a strategic R&D centre for global giants, it is developing deep specialisations and is an increasingly efficient unicorn factory.

Although Western Europe still dominates in terms of scale and maturity, the heart of innovation – defined as the epicentre of dynamism, growth and resilience to crises – beats loudest and fastest today precisely in Central and Eastern Europe. “Europe’s technological tiger” is no longer just a promise – it is a reality that can no longer be ignored.