The global IT market is undergoing a transformation that is shaking its foundations. The model where technology was bought like a product in a one-off investment (CapEx) is being systematically displaced by the Everything as a Service (XaaS) paradigm.

From software (SaaS) to infrastructure (IaaS) to hardware(DaaS), almost every technology feature today is available as a subscription, billed as an operating expense (OpEx).

This is not a fad, but a strategic shift driven by fundamentally different customer expectations, who instead of asset ownership, are looking for flexibility, scalability and real business results.

The scale of the phenomenon is impressive. Global forecasts indicate a compound annual growth rate (CAGR) for the XaaS market in excess of 20%, and it is expected to grow from around US$610 billion in 2025 to nearly US$3.7 trillion by 2034.

However, the key to understanding this trend is to set it in the wider context of the subscription economy. Research shows that there are already 3.9 subscriptions per statistical Pole, and this model is popular even among older generations.

Everyday experiences with services such as Netflix and Spotify normalise the idea of paying for access rather than ownership. This habit is seeping into the B2B world, where decision-makers, who are privately owned consumers, are becoming much more open to paying for ongoing value rather than a one-off purchase.

In this new landscape, the Polish IT partner channel faces its biggest challenge in a decade.

Mature market, new rules of the game

The Polish IT market is no longer just a follower of global trends – it has become an active participant in them, reaching a significant level of maturity. According to analyses by PMR Market Experts, the value of the Polish cloud computing market reached PLN 4.7 billion in 2024 and is expected to exceed PLN 13 billion by 2030.

IDC Poland data confirms this dynamic, valuing the public cloud segment alone at USD 2 billion in 2023 and forecasting annual growth of 25%.

These figures are reflected in adoption rates. In 2023, already 55.7% of Polish enterprises were using cloud services, which for the first time ever puts Poland above the EU average.

In the large enterprise segment, adoption is almost universal, reaching 95%. A key catalyst for this shift has been the strategic investment by global hyperscalers – Google, AWS and Microsoft – in local data centres.

They neutralised the main barriers to adoption, such as concerns about data sovereignty or regulatory compliance, giving Polish companies the ‘green light’ to accelerate migration.

However, an analysis of the structure of this growth reveals a deeper trend. Although Software-as-a-Service (SaaS) still dominates, accounting for nearly 70% of the market, Platform-as-a-Service (PaaS) is growing much faster than Infrastructure-as-a-Service (IaaS).

This signals that the market is moving from simple lift-and-shift migrations (moving existing machines to the cloud) towards developing and upgrading applications directly in the cloud environment. Companies are no longer asking ‘if’ but ‘how’ to use the cloud to build competitive advantage, especially in the context of the rapid development of AI.

It is in services centred around PaaS – such as DevOps, data analytics or the implementation of AI/ML solutions – that the future and greatest value for the partner channel lies.

Device-as-a-Service: a barometer of change

A prime example of the expansion of the ‘as a service’ model beyond the software world is the growing popularity of Device-as-a-Service (DaaS). For years seen as a niche curiosity, DaaS is finally gaining real momentum.

Research shows strong interest in Poland: as many as 56% of large companies and 44% of medium-sized ones are considering renting hardware as an alternative to buying. The global market is expected to grow fivefold by 2030, demonstrating the strength of this trend.

The real value of DaaS, however, lies not in the leasing itself, but in the comprehensive service model, covering the full lifecycle of the device: from implementation, management and support to safe decommissioning and recycling.

In the era of hybrid working, this is becoming a key operational solution. Importantly, the narrative around DaaS has evolved. Initially, the model was promoted mainly through the lens of financial benefits (replacing CapEx with OpEx).

Today, strategic arguments are coming to the fore. Manufacturers such as Lenovo, Dell and HP emphasise aspects of sustainability, the circular economy and improving the employee experience (Employee Experience). This positions DaaS as the answer to the key challenges of boards of directors, not just finance departments.

Partner parallax: the painful truth about transformation

The transition to the XaaS model is a revolution for the Polish partner channel that exposes fundamental problems. The research organisation TSIA has accurately diagnosed the key phenomena.

The first is ‘Partner Parallax’ – a situation in which the supplier perceives the transformation as smooth and logical, while for the partner it appears as a scenario fraught with reduced revenues, higher costs and huge business risks.

This discrepancy is reflected in hard data. “The Partner Performance Gap”, also identified by TSIA, shows that revenue from XaaS solution sales made through the channel is on average 40 percentage points lower than for direct sales.

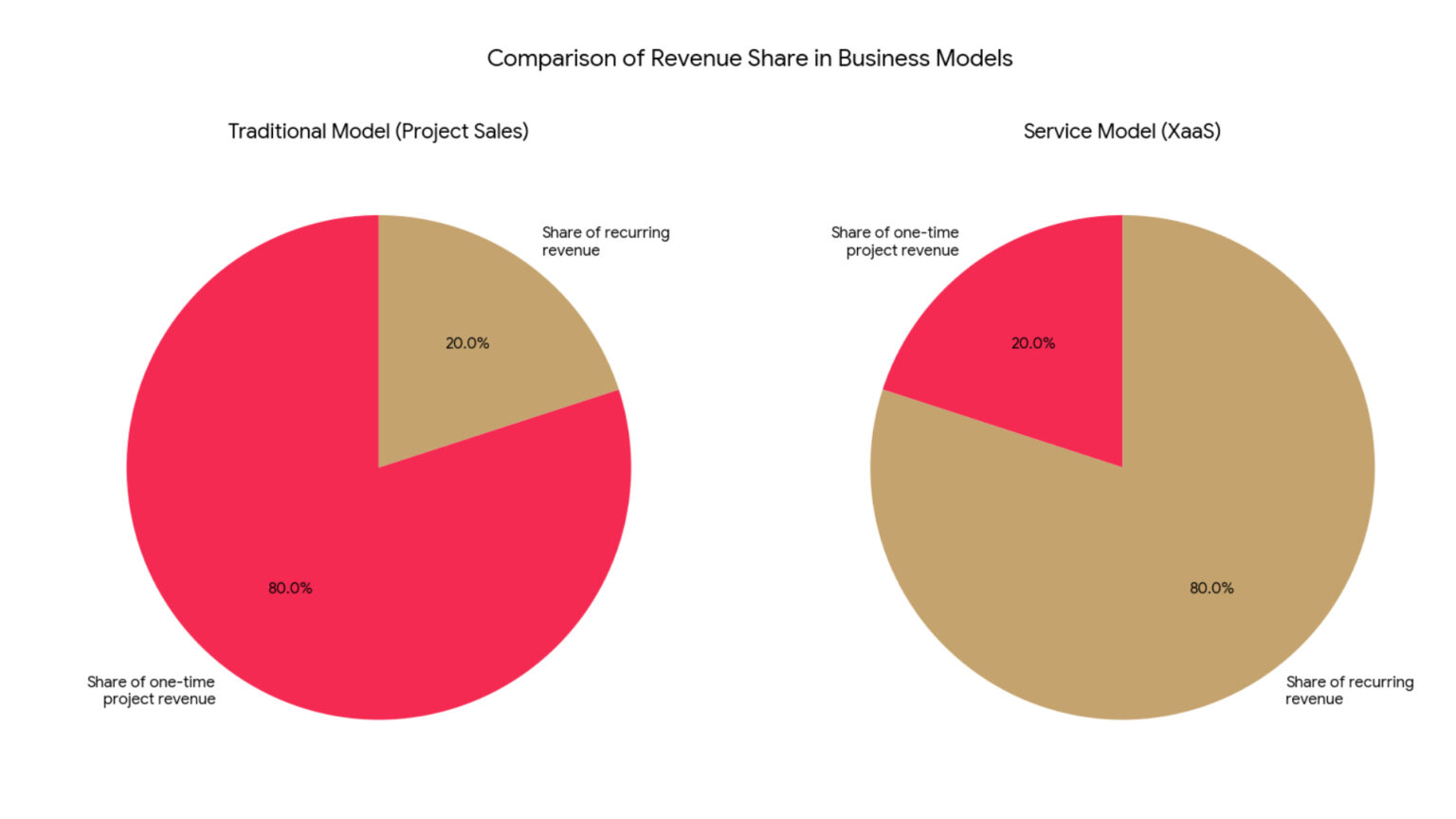

This figure brutally quantifies the financial pain of transformation. The traditional integrator business model, based on large, one-off deals, simply does not work in a subscription world. The value of the initial transaction is many times lower and the profit is realised gradually.

This creates the phenomenon of the ‘valley of cash flow death’, which, for many companies operating on already tight margins (median EBITDA in IT services is around 13%), can be critical.

In this new reality, the traditional role of ‘reseller’ is losing its raison d’être. To survive, the partner must evolve into a ‘solution aggregator’ and ‘managed service provider’. True profitability lies not in reselling subscriptions, but in building your own unique and high-margin cyclical services around them.

The profit does not come from the Microsoft 365 licence, but from the fee for its advanced management, configuration of security policies or user support. Partners who do not understand this will struggle to survive.

A strategic compass for times of transition

The analysis of the XaaS market leads to clear conclusions: transformation is inevitable, and ignoring it is a straight path to marginalisation. For Polish IT partners who want not only to survive, but come out of this revolution strengthened, four strategic directions will be key:

- Specialise or perish. The era of generalists is coming to an end. The future belongs to partners with deep, specialised knowledge – whether in the area of fast-growing PaaS or in specific industry verticals such as finance or manufacturing.

- Build your own high-margin services. This is the most important recommendation. Long-term profitability lies in building your own portfolio of managed services that create real value for the client and secure your partner’s margin.

- Solve the business model problem. Before a company invests in new technology, it has to grapple with its financial model. This means renegotiating incentive systems with suppliers and securing financing to survive the transition period.

- Adopt a ‘Customer Success’ mentality. The aim is no longer to ‘close the deal’, but to ‘manage customer success throughout the customer lifecycle’. This requires the development of new competencies, proactive guidance and constant monitoring of whether the customer is realising the full potential of the service purchased.

The transformation towards ‘Everything as a Service’ is undoubtedly the toughest test facing the Polish partner channel. It will be a period of increased competition and inevitable consolidation.

However, for those who manage to redesign their business models around repeatable value and customer success, the reward will be a business that is much more predictable, resilient to economic fluctuations and, most importantly, ultimately much more valuable.