Taiwan’s Foxconn – the world’s largest contract electronics manufacturer – reported record revenues in the second quarter of 2025. The boom in artificial intelligence solutions proved to be the main driver of growth. At the same time, the company is signalling that exchange rate volatility and geopolitical tensions could threaten further growth.

According to figures announced by the company, Foxconn’s revenue increased year-on-year by 15.8 per cent to reach 1.797 trillion Taiwan dollars (approximately US$55.5 billion). This was above analysts’ expectations from LSEG SmartEstimate and the best second quarter in the company’s history. In June alone, sales rose 10% year-on-year, also breaking the monthly record.

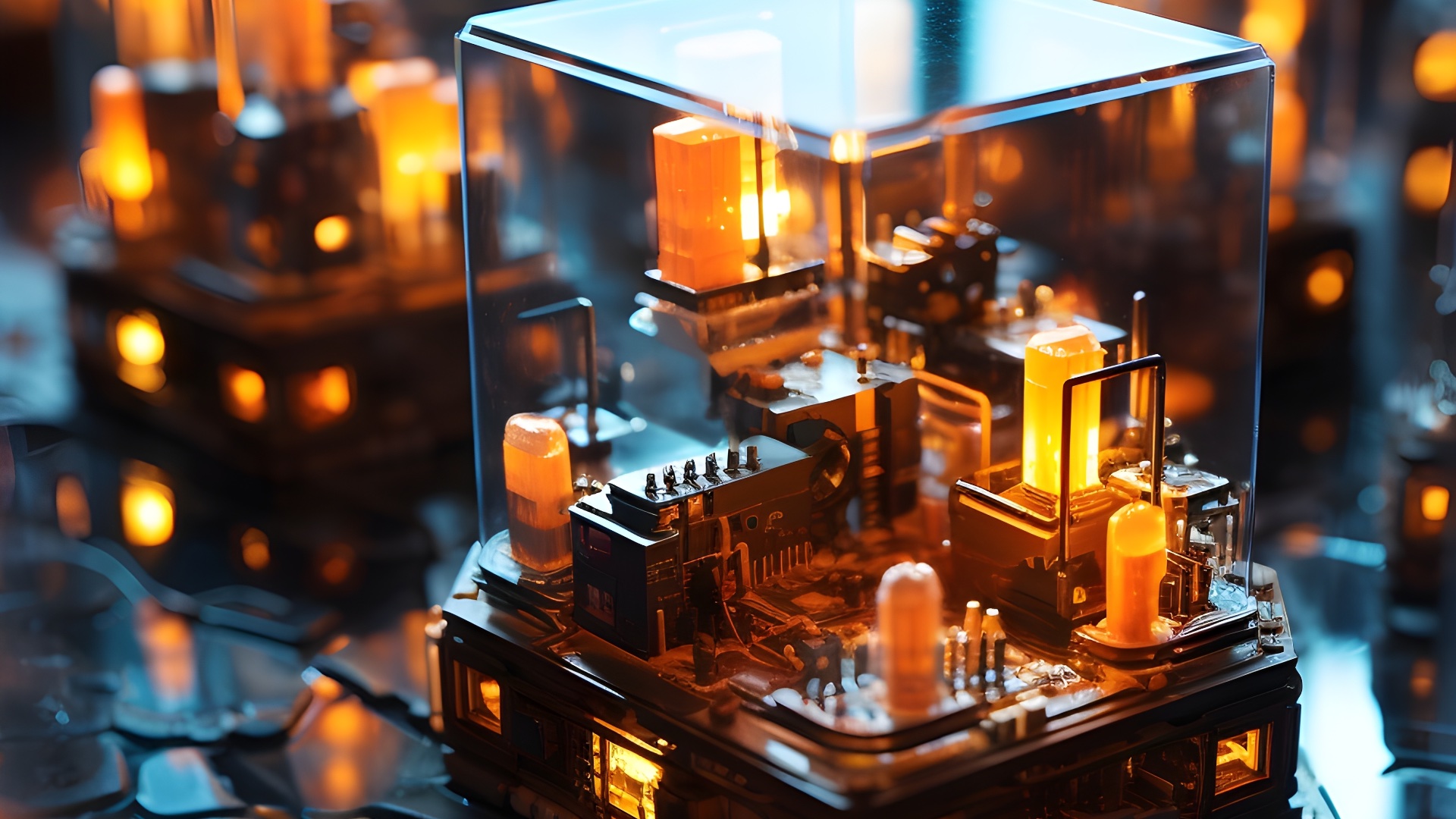

Behind the growth is strong demand for hardware supporting AI and cloud infrastructure – a segment that includes servers and networking equipment supplied to Nvidia, among others. This shows how AI is transforming the global supply chain: not long ago, the iPhone was Foxconn’s main source of revenue, today the burden of profit is shifting towards data centres.

The consumer electronics segment – including iPhones – remained stable, although without major increases. Foxconn indicates that the unfavourable currency situation had an impact here. Meanwhile, the Zhengzhou factory – a key link in Apple’s global production – is running smoothly, but there are political risks in the background.

Investors are concerned about increasing pressure from the US administration, which has signalled the possibility of imposing further tariffs on Asian imports. In this context, Foxconn announces that it is “closely monitoring the risks” and does not give specific numerical forecasts for the next quarters.

Despite the excellent performance, the company’s shares have fallen by more than 12% this year, in line with the broader downward trend for the technology sector in Asia. In the longer term, however, Foxconn seems well positioned for further growth – as long as geopolitics does not shatter the new AI-driven order.