Intel significantly beat analysts’ expectations for third-quarter profit as a direct result of the “drastic cost-cutting measures” implemented by its new CEO, Lip-Bu Tan. In response to the results and strategic investments, the company’s shares surged nearly 90% in 2025, recovering from a 60% decline last year.

It was the first earnings announcement since the company raised multi-billion dollar funding, described as a ‘lifeline’. Investors in Intel included Nvidia (US$5 billion), SoftBank (US$2 billion) and the US government, which took a 10% stake for US$8.9 billion. The funds are intended to support the company in its competitive battle with AMD in the PC and server market and in its so far unsuccessful attempts to enter the AI market, dominated by Nvidia.

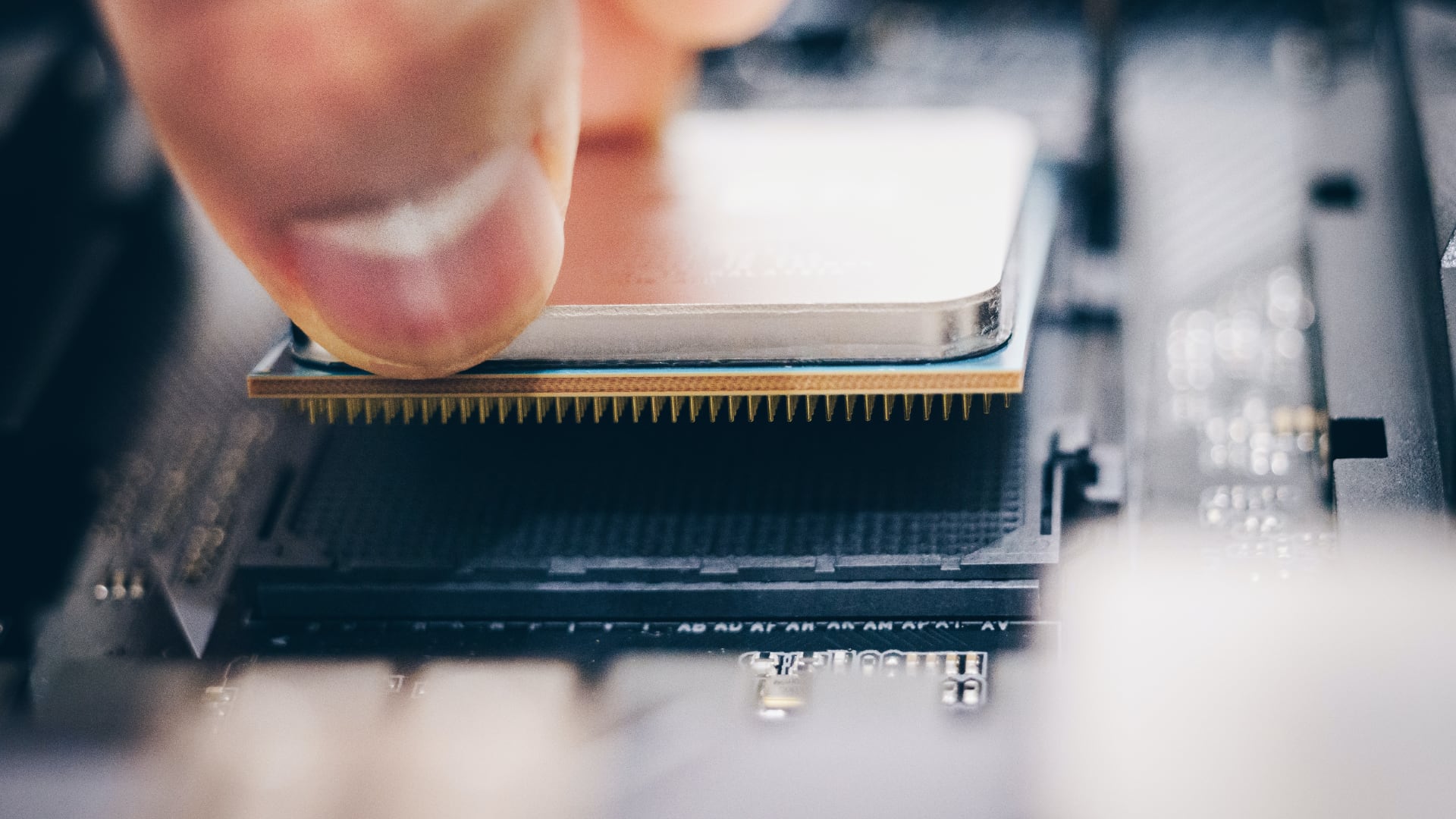

Tan’s new strategy departs from the costly ambitions of predecessor Pat Gelsinger to compete with TSMC. Cuts have included cutting staff by more than a fifth. Intel will now focus on creating custom chips for external customers, competing with Broadcom and Marvell.

Despite strong demand, which according to chief financial officer Dave Zinsner currently outstrips supply, the company faces significant challenges. Zinsner admitted that the capacity of the key 18A manufacturing process is insufficient and is unlikely to “reach industry acceptable levels” until 2027.