A paradox has become entrenched in the Polish business landscape. On the one hand, the media report a normalisation and cooling in the IT labour market, which could suggest an end to salary pressures. On the other hand, finance and HR leaders budgeting for digital transformation see a different reality: the cost of acquiring and retaining technology talent has stabilised at a level that is becoming an insurmountable barrier for many companies.

The thesis is unequivocal – high IT personnel costs have become a hidden tax on innovation, which is measurably inhibiting key digitisation projects in Polish companies.

A new, expensive balance

Analysis of hard market data debunks the myth that the era of expensive professionals is over. Although wage growth has clearly slowed down, this does not mean a return to pre-boom levels. Instead, a new high equilibrium has taken shape.

According to the Hays Poland salary report for 2025, only 16% of technology companies are planning raises of more than 10%, a drastic change compared to 2021-2022. However, the slowdown does not mean a reduction in costs, only their stabilisation at a very high level.

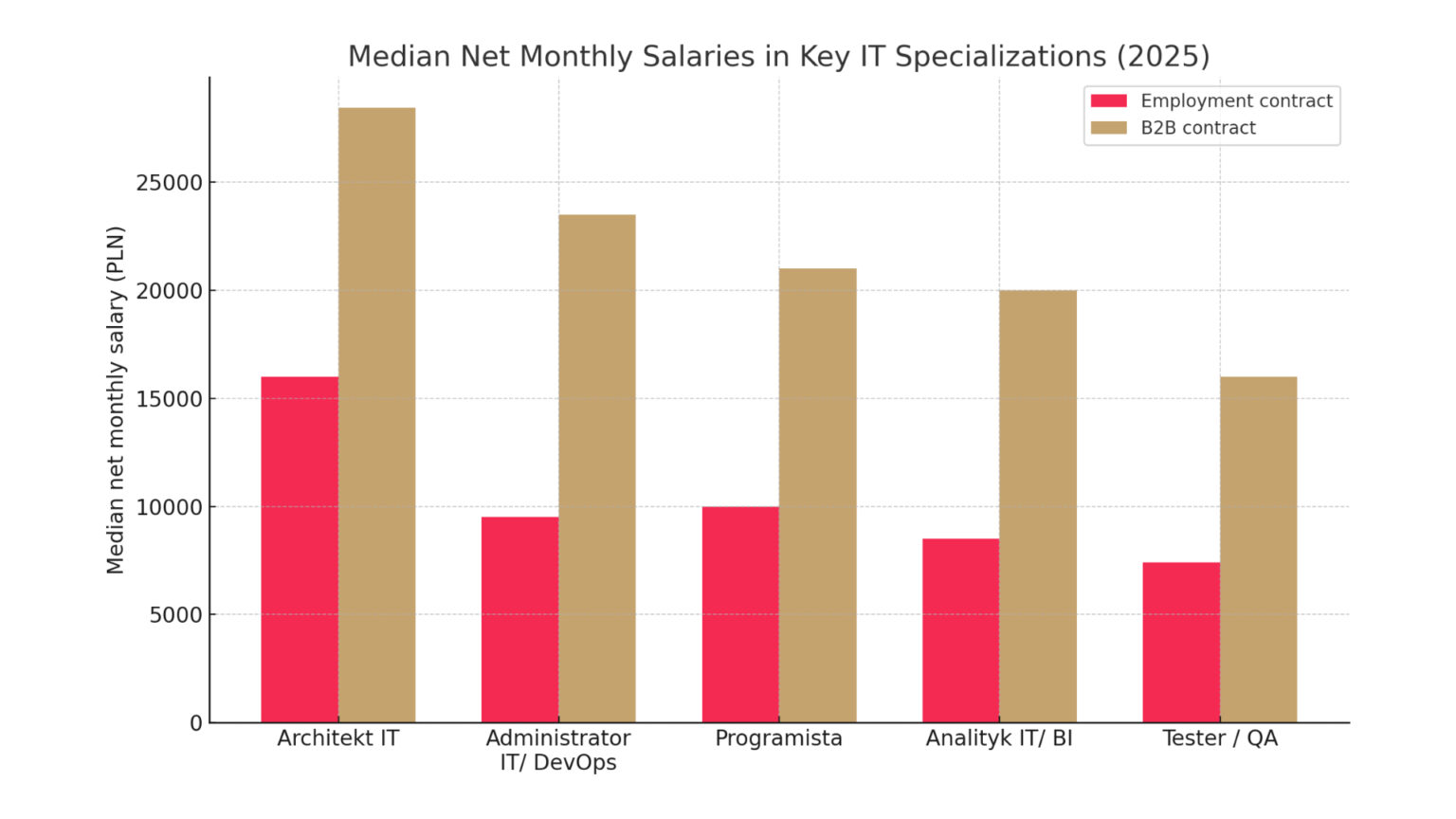

The scale of the challenge is best illustrated by comparing salaries in IT with the rest of the economy. Data from the Central Statistical Office shows that in July 2025, the average salary in the ‘Information and Communication’ sector reached PLN 14,307 gross.

At the same time, the average salary in the business sector was PLN 8,266. This means that IT specialists earn on average more than 70% more than the average employee. This gigantic salary premium, perpetuated by years of boom, is not diminishing, making digitalisation projects disproportionately expensive compared to other business initiatives.

It is also crucial for budgeting to understand that the highest costs are generated by the most desirable, experienced professionals, often working on B2B contracts. In the first half of 2024, as many as 74% of senior offers included a proposal to work in this model.

When the cost of talent becomes a barrier

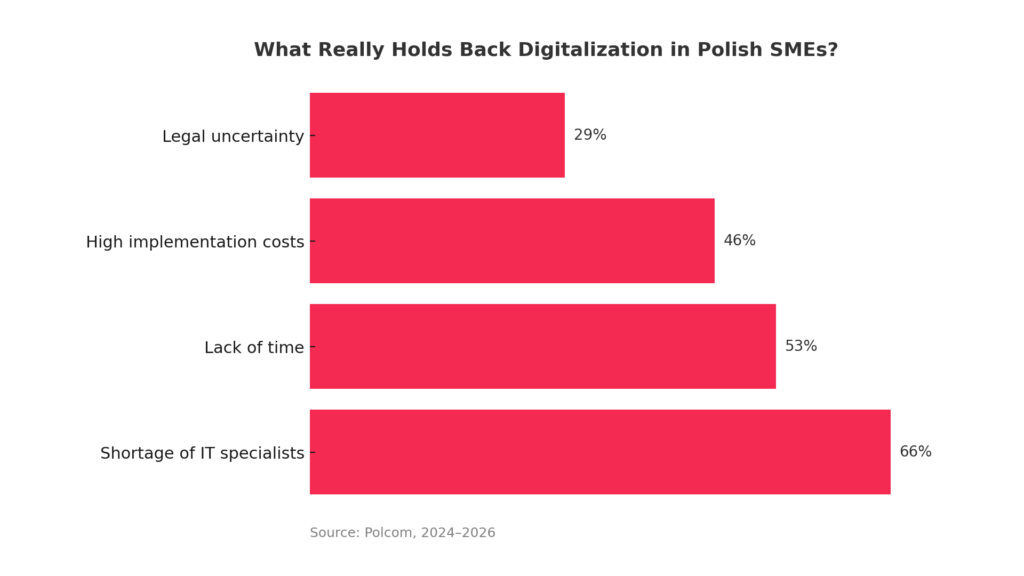

High staff costs have ceased to be a mere statistic and have become a major brake on transformation. Market research leaves no illusions. A report by Polcom indicates that for Polish companies in the SME sector, the two biggest barriers to digitalisation are the shortage of IT specialists (indicated by 66% of companies) and the high cost of implementations (46%). These two factors create a vicious circle: the limited supply of talent drives up their price, while high costs limit companies’ ability to compete for them.

This means that every IT project carries a huge amount of risk. In a typical technology implementation, 70% to as much as 90% of the budget is human costs – the time of developers, analysts and managers. This structure means that even a small overrun or delay in a project can negate the projected return on investment.

The most serious consequence, however, is strategic paralysis. The decision to postpone a project because personnel costs are too high is not neutral. In fact, it leads to an accumulation of technological debt.

Outdated systems, on which half of Polish companies still work, are becoming more and more expensive to maintain and are blocking innovation. Apparent savings today therefore become a high-interest loan taken out for the future.

Strategic responses to bottlenecks

Instead of engaging in a debilitating war for talent, business leaders can take a more sophisticated approach, based on three complementary pillars.

The first is smart sourcing, i.e. diversifying sources of competence. Instead of relying solely on recruiting full-time employees, companies can build a flexible talent ecosystem. This includes strategic outsourcing and nearshoring, but also effective relationship management with B2B contractors.

Data from the Central Statistical Office (CSO) and CEIDG show that as many as 70.3% of entities in the ‘Information and Communication’ sector are sole traders. This is a huge market of flexible experts that allows project teams to be dynamically scaled according to needs.

The second pillar is the democratisation of technology through Low-Code/No-Code (LCNC) platforms. These tools enable business applications to be built using visual interfaces, allowing solutions to be created by business analysts or managers, referred to as ‘citizen developers’.

This drastically reduces implementation time from months to weeks, reduces costs and relieves permanently overburdened IT departments. The growing popularity of this approach is a fact – according to the NoCode Poland report, as many as 77% of companies plan to implement LCNC technology in the next 12 months.

The third key element is the use of automation and artificial intelligence (AI) as an efficiency lever. The aim here is to free up financial and human resources, which can then be reinvested in strategic projects. AI implementations can deliver operational cost reductions of 25-40%, and technologies such as Robotic Process Automation (RPA) can increase the productivity of teams by up to 40%.

New game plan

The high cost of IT competence is not a passing trend, but a new, structural feature of the market. Attempts to ignore it lead directly to a loss of competitiveness. Instead of seeing IT as a cost centre, CFOs should treat it as an investment portfolio in digital capabilities, diversifying it between strategic staffing, a flexible network of external partners and technologies that increase productivity across the organisation.

The role of HR, in turn, is evolving from that of a recruiter to an architect of the talent ecosystem that builds and nurtures relationships with various competence providers. In the new market reality, the advantage will be built not by those companies that hire the most expensive developers, but by those that most cleverly reduce the need to hire them, achieving the same business goals faster, cheaper and with less risk. This is the essence of strategic leadership in the digital age.