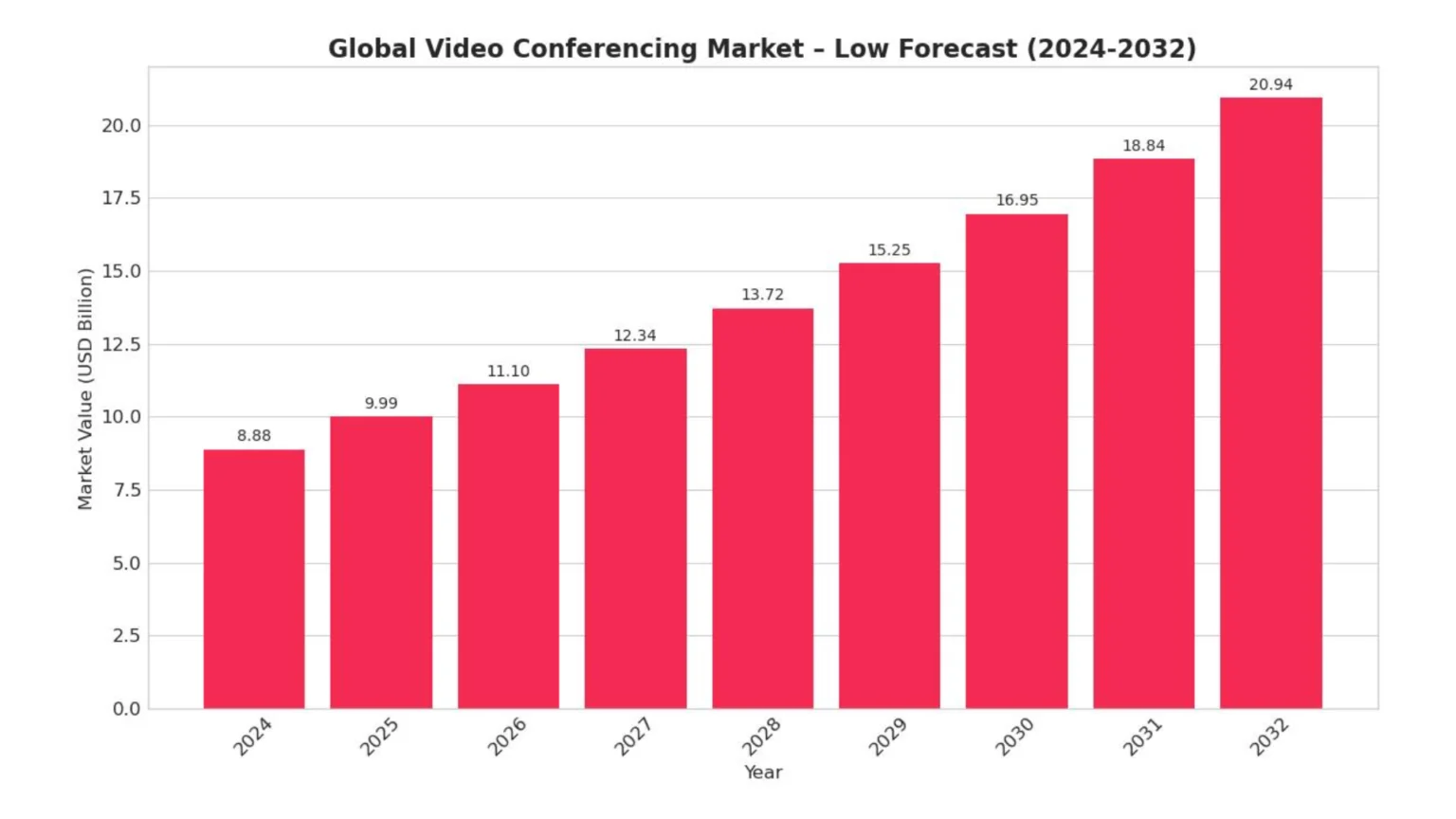

Video conferencing, once a niche tool for global corporations, has become a cornerstone of business communication over the past few years. The rapid transformation towards remote and hybrid working, accelerated by global events, has permanently changed the working landscape, making video platforms the lifeblood of modern organisations. Today, the video conferencing market, valued at tens of billions of dollars and forecast to grow steadily by double digits in the coming years, is entering a new phase of maturity. It is ceasing to be a battle arena for basic functions and is becoming a strategic battleground for the future of work, where integrated ecosystems, artificial intelligence, security and the psychology of human interaction are key.

The war on ecosystems: software as a command centre

At the heart of the videoconferencing revolution is software. This is where the fiercest battle is being fought and where innovation is redefining the rules of the game the fastest. The market is dominated by two titans: Zoom, which controls more than half the market, and Microsoft Teams, treading on its heels with a share of more than 30%. But their rivalry has long since ceased to be about single features such as screen sharing or recording, which have become standard . The real battle is over which platform will become the integrated ‘operating system’ for collaborative working.

Microsoft Teams draws its strength from its deep, native integration with the ubiquitous Microsoft 365 suite. For companies already in the Microsoft ecosystem, Teams is a natural, often no-cost extension, combining communication, document collaboration and task management in a single, consistent environment . Zoom, on the other hand, has built its position on legendary ease of use, reliability and, crucially, platform agnosticity. It positions itself as a neutral communication hub that can be integrated into almost any tool, as evidenced by the huge market of nearly 2,800 apps in the Zoom App Marketplace . This flexibility makes it the preferred choice for communicating with external partners who do not necessarily work in a Microsoft environment. Google Meet, on the other hand, competes with the simplicity and seamless integration with the Google Workspace suite, running directly in the browser, which is a huge advantage in environments with limited IT privileges .

The decision to choose a platform thus becomes a strategic choice for the company’s entire technology stack. Vendors aim to ‘lock’ the customer into their ecosystem, because the more processes that are integrated into one platform, the more difficult and costly the eventual migration becomes.

AI: escaping commoditisation

With the standardisation of core functions, artificial intelligence has become a major battleground and a key differentiator of the offering. AI has ceased to be a marketing buzzword and has become the core of the value proposition, offering real productivity improvements. All market leaders are investing heavily in the development of their ‘intelligent assistants’: AI Companion in Zoom, Copilot in Microsoft Teams and Gemini in Google Meet . Their capabilities are revolutionising meetings by offering automatic summaries with to-do lists, transcription and real-time translation that break down language barriers in international teams. Tools such as Read.ai go a step further, analysing not only the content but also the context of the meeting, identifying moments of highest engagement or the sentiment of the speech . For suppliers, AI is a way to create unique added value and justify higher prices in premium plans.

Equipment and meaning of certification

Software is the brains of the operation, but it is the hardware that is the physical foundation of the professional videoconferencing experience. This market, although revenue-dominated by expensive systems, is inextricably linked to the software world. Manufacturers such as Logitech, Poly (HP) and Cisco are no longer competing in a vacuum – they are designing their products and strategies around the Microsoft and Zoom ecosystems, offering dedicated ‘kits for Teams’ or ‘solutions for Zoom Rooms’.

In this context, certification programmes such as ‘Certified for Microsoft Teams’ and ‘Zoom Certified’ have become crucial . Certification is a guarantee to the customer that the device has passed rigorous quality tests, ensuring seamless integration, the highest audio and video quality and full support for the platform’s advanced features . It simplifies the selection and implementation process, giving IT departments confidence that the equipment they purchase will work reliably. It is certification that has become the de facto industry standard and a key selection criterion for businesses.

Main challenges: security, interoperability and the human factor

Despite rapid growth, the market faces serious challenges. Cyber security has come to the fore. Incidents such as ‘Zoombing’ (unauthorised access to meetings) or data leaks, such as that of the Royal Mail Group, have shown how attractive a target video platforms have become . In response, end-to-end encryption (E2EE), strong authentication mechanisms and regular software updates to protect against phishing and malware have become standard .

Another fundamental problem is interoperability, or rather the lack of it. Leading vendors deliberately create ‘walled gardens’ in which their software and certified hardware work perfectly, but communication with other ecosystems is hampered. An organisation with meeting rooms based on Cisco hardware may encounter problems when trying to join a meeting in Microsoft Teams. The solution is intermediary services, known as Cloud Video Interop (CVI), offered by specialised companies like Pexip that ‘translate’ protocols between platforms . However, this is an additional cost that companies have to bear in the name of flexibility.

The human factor cannot be ignored either. The intensive use of video conferencing leads to a phenomenon known as ‘Zoom Fatigue’ – mental and physical exhaustion. Stanford University research has identified its causes: excessive and unnatural eye contact, increased cognitive load from interpreting limited non-verbal cues, stress from constantly seeing one’s own reflection, and reduced physical mobility. The problem has real business implications, leading to lost productivity and burnout. Organisations and platform providers alike are beginning to respond by making changes to work culture (e.g. days without meetings) and software interfaces (e.g. the option to hide the view of one’s own camera).

The future is immersive

The evolution of the video conferencing market is accelerating and the technologies that will define the next generation of communication are already on the horizon. Artificial intelligence will evolve from an assistant to a proactive partner that will not only summarise the meeting, but also analyse its dynamics and the sentiment of the participants. The ultimate goal, however, is to break down the screen barrier. Virtual (VR) and augmented (AR) reality technologies will enable the creation of fully immersive, 3D collaborative spaces. A breakthrough could come from Project Starline, being developed by Google and HP, which uses advanced technologies to create realistic, 3D holograms of the speaker in real time. Early tests have shown that the technology dramatically increases non-verbal communication and improves recall of conversational content.

The video conferencing market has matured. The winners in this new era will not be those who offer the most features, but those who best understand that technology is just a tool. The ultimate goal is to enable more productive, secure and satisfying human interaction, regardless of the physical distance that separates callers.