When Hangzhou-based startup DeepSeek unveiled a model to match the world’s best for a fraction of the cost of training in early 2025, global technology markets reacted with panic. Today, a year after that event, China’s artificial intelligence ecosystem is no longer just a backdrop for one player’s phenomenal growth. Ahead of the upcoming Chinese New Year, giants such as Alibaba and ByteDance are preparing a series of launches to prove that they have learnt lessons from their smaller competitor’s success.

The AI landscape in China has undergone a fundamental shift: the low-cost open-source model has become the prevailing standard rather than an anomaly. According to data from research group RAND, Chinese systems now operate at between one-sixth and one-quarter the cost of their US counterparts. This undermines the previous Silicon Valley paradigm of assuming that only multi-billion dollar infrastructure investments guarantee the highest quality.

Strategic divergence: Research versus product

Although rivals have adopted DeepSeek’s open-source model, their business strategies are clearly beginning to diverge. DeepSeek, backed by hedge fund High-Flyer Quant, remains in a unique structural position. It can prioritise pure research over immediate commercialisation, avoiding pressure from external investors.

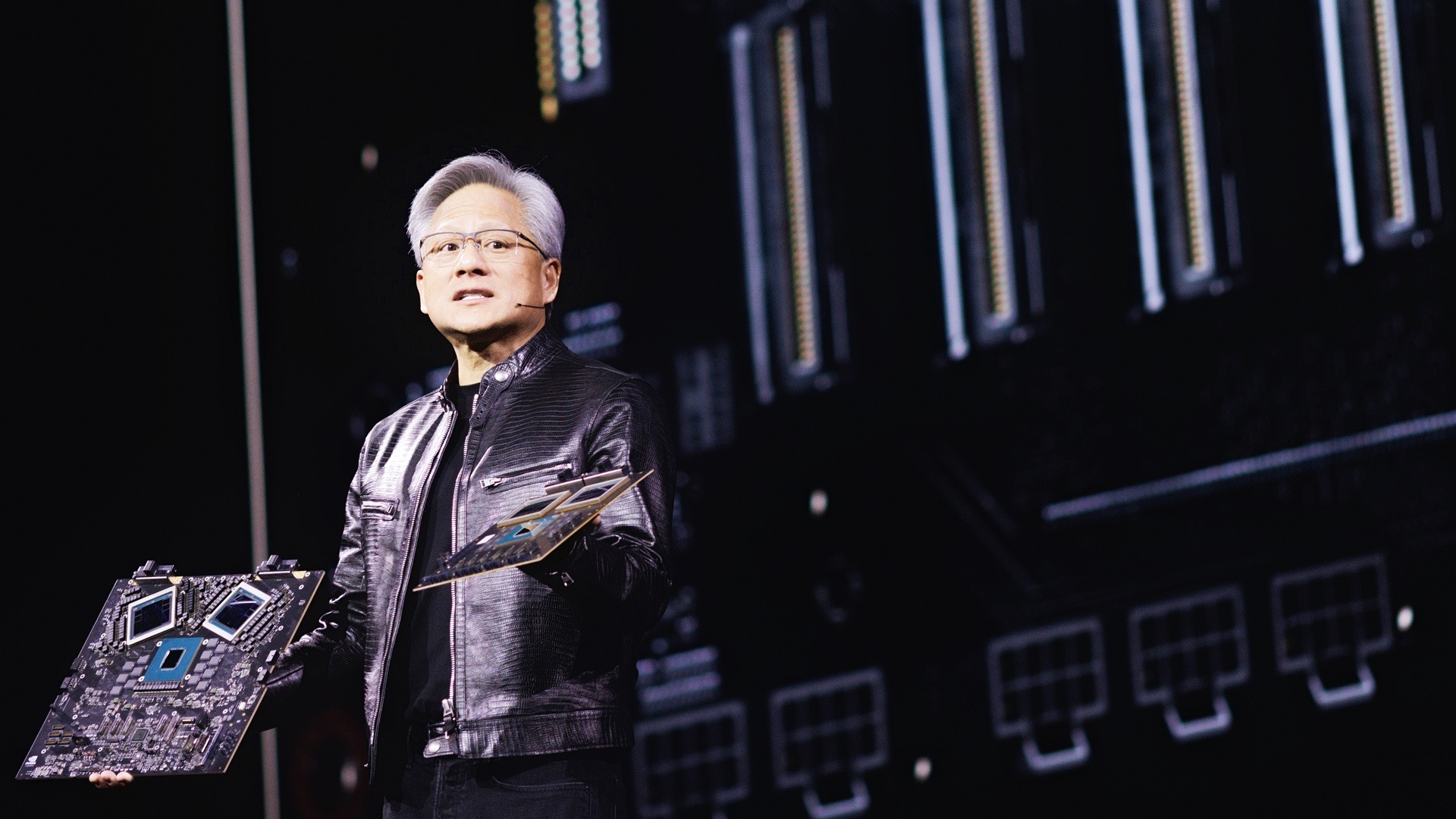

The situation is quite different for Alibaba or ByteDance. These companies need to prove to shareholders that AI translates into real revenues. Alibaba is experimenting with integrating the Qwen chatbot into its e-commerce systems, enabling purchases directly via voice commands. ByteDance, on the other hand, is setting its sights on dominating the video and consumer app segment – their Seedance 2.0 model is expected to generate cinema-quality content in seconds, and chatbot Doubao, with 155 million weekly users, remains the most popular AI gateway in China.

The upcoming wave of premieres

February 2026 promises to be a moment of truth for China’s technology industry. DeepSeek is preparing the launch of the V4 model, while Alibaba is preparing the Qwen 3.5 series with improved mathematical reasoning. Zhipu AI has already managed to present a model capable of autonomously performing lengthy tasks without additional prompting.

This evolution shows that Chinese companies have stopped merely chasing US leaders. Instead, they are building their own path based on cost efficiency and deep integration with digital services. Market expectations are huge. If the new models deliver the promised quality, 2026 could be the moment when the centre of gravity of AI innovation finally shifts to the East.