Just a decade ago, Poland’s advantage in the IT sector was mainly lower labour costs. Today, this narrative is no longer valid. More and more global companies are choosing Poland not because of the prices, but because of the quality – the technological maturity of the teams, specialised competences and an operational culture that successfully operates in international realities.

According to Grafton Recruitment’s latest report ‘Salaries and trends in IT 2025‘, the IT market in Poland has reached a stage where it is no longer the price that is decisive, but the added value that teams are able to bring to ongoing projects.

Trust instead of stake

Polish specialists are increasingly working in distributed structures – for clients from the USA, Scandinavia or Germany – performing not only executive, but also advisory and strategic functions. Operational maturity and the ability to work in a project culture are competences that today constitute the market value of Polish teams.

The way companies manage talent is also changing. Modern leadership – based on flexibility, trust and empathy – effectively supports teams operating across borders and time zones. Leaders are becoming knowledge integrators rather than time controllers.

Talent is growing faster than the market

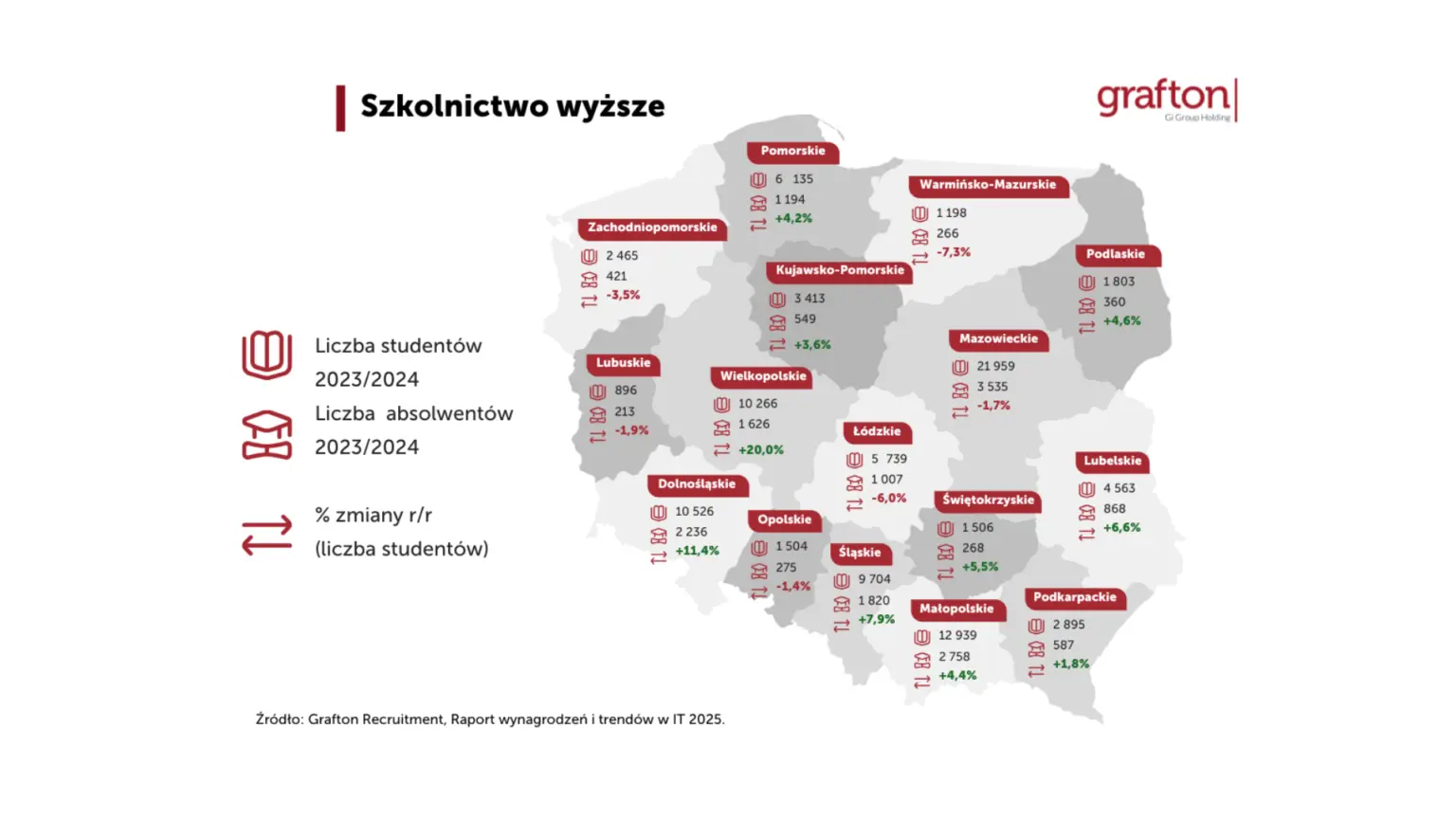

According to Grafton’s report, the IT talent base in Poland is growing steadily. CSO data shows that the number of IT students is growing faster than the total number of students. The share of this group in the education structure has increased by 4.2 percentage points, with provinces such as Wielkopolskie and Dolnośląskie recording double-digit increases.

The Mazowieckie, Małopolskie and Dolnośląskie provinces remain in the lead in terms of the number of IT students – which is not surprising given the concentration of technology companies in Warsaw, Kraków and Wrocław. At the same time, the increases in the smaller regions suggest that the educational infrastructure is spreading beyond the main academic centres, which may be of strategic importance for the decentralisation of the industry in the coming years.

Evolution of competences

The increase in the number of students is not the only trend – the competence profile is also changing. Specialisations related to AI, data engineering, algorithm ethics or prompt engineering are playing an increasingly important role. At the same time, the number of offers for junior positions is declining – not because the market is shrinking, but because the automation of simple tasks (thanks in large part to AI) is changing the structure of the demand for talent.

New roles require deeper specialisation, business analysis skills and strategic thinking. This is a challenge for both universities and companies themselves, who need to invest in developing competencies more complex than coding or testing.

Poland as a partner, not a subcontractor

Data from the Polish Investment and Trade Agency (PAIH) shows that Poland attracts technology investment not only because of the cost, but also because of the quality of education, the wide availability of talent and a stable economic environment. Annually, more than 55,000 people graduate from IT and telecommunications studies, and Poland records one of the highest shares of women among graduates in STEM fields in the EU.

Additional advantages – such as its geographical location in a time zone convenient for Europe and the USA, or its developed logistics infrastructure – make Poland a strategic technology hub, rather than just a place to outsource simple tasks.

The future: less scale, more value

The Grafton Recruitment report shows unequivocally – it is not the number of employees or the hourly cost that proves the strength of the IT sector in Poland today. What is key is the ability to build long-term relationships, flexibility in adapting to change and combining technological competence with an understanding of business needs.

Today, Poland has the resources to not only support global projects, but also to co-create them – from the concept level, through solution architecture and implementation. This shift in role from ‘contractor’ to ‘partner’ may be the most important trend in domestic IT in the second half of the decade.