Warsaw rarely features in the global discussion of financial centres. London, Frankfurt or Zurich dominate. Yet it is in Poland, far from the traditional bastions of banking, that a quiet revolution is taking place. A country that is not a global financial capital has built one of the most dynamic and innovative FinTech ecosystems in Europe. This is not a journalistic thesis, but a reality that can be measured and counted.

Poland’s position as a leader in payment innovation rests on three solid pillars: an astonishingly mature and profitable sector of domestic technology and financial companies, the unprecedented success of the national payment standard BLIK, and the rapid adoption of ‘Buy Now, Pay Later’ (BNPL) services. Analysis of hard data shows how Poland is methodically setting the standard for the entire continent.

The foundation for success: a healthy and mature ecosystem

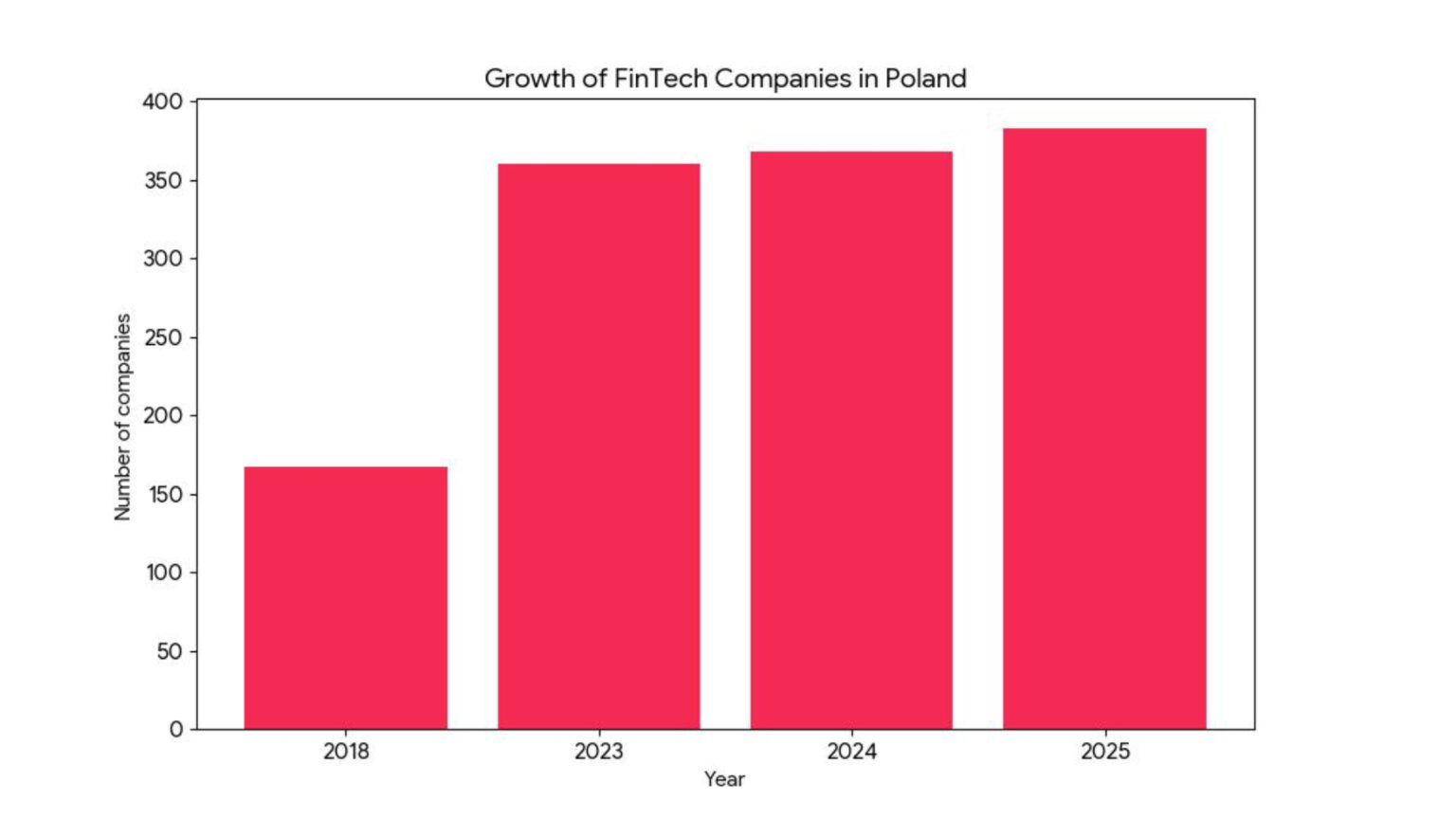

The strength of Poland’s FinTech sector is no accident. It is the result of years of building a deep and, most importantly, financially healthy ecosystem. The data unequivocally points to sustained and dynamic growth. According to the report ‘Map of Polish Fintech‘, the number of companies in the sector has grown from just 167 in 2018 to a record 383 in 2025. This is no longer a handful of promising start-ups, but a fully-formed branch of the digital economy, of which Warsaw is the centre with 45% of companies located in the capital.

The structure of the market is indicative of its maturity. In addition to agile, small entities employing up to 10 people (31% of companies), there are large, well-established companies with more than 100 employees (30% of companies). The distribution of revenues is similar – as many as 34% of entities are market leaders generating more than PLN 100 million per year.

However, the most telling indicator that differentiates Poland from many global technology hubs is profitability. In an environment where start-ups often prioritise growth at the expense of profit, Polish FinTech stands on solid foundations. As many as 86% of companies in the sector can boast a profit, while only 14% ended last year in the red. This is evidence of healthy business models that generate real value from the outset. This strong, profitable domestic market has served as an ideal incubator for world-class solutions ready for international expansion.

BLIK – how Poland has redefined mobile payments

If the Polish FinTech ecosystem is the foundation, then BLIK is the jewel in its crown. Its success is the result of a globally unique collaboration between competing banks, which created a single, common national standard within the Polish Payments Standard (PSP) company. This strategic decision avoided market fragmentation and gave BLIK access to millions of customers from day one.

The figures speak for themselves. In the first half of 2025, users completed 1.39 billion transactions with a total value of PLN 207.3 billion . This represents an increase in value of almost a third year-on-year. The active user base reached 19.4 million, growing by 2.5 million in just one year . The scale of operations is huge – on average, Poles make 7.4 million BLIK transactions every day.

BLIK’s initial strength was e-commerce, where it remains the undisputed leader to this day, accounting for nearly half of all operations. However, the system has evolved into a truly versatile tool. Phone-to-phone (P2P) transfers have become a daily habit for more than 18.7 million registered users. The real revolution, however, has been contactless payments at point-of-sale (POS) terminals, which are recording an astronomical growth rate of 86% year-on-year. This move is transforming BLIK into a direct competitor to the global card giants in the world of physical commerce.

On a European scale, BLIK is the absolute leader. In 2023, it processed more than 1.7 billion transactions, making it the largest mobile payment system on the continent in terms of volume . Its success is an exemplary example of synergy between the banking and technology sectors, which has become an inspiration for other markets.

“Buy now, pay later” (BNPL) – the second wave of innovation

The dynamic development of the ‘Buy Now, Pay Later’ (BNPL) sector is testament to the continued innovation of the Polish market. Poland has not only adapted this global trend, but has become one of the leaders in its implementation. The value of the deferred payment market in Poland is expected to reach USD 1.74 billion in 2025, with forecasts predicting further growth to USD 2.80 billion by 2030.

Significantly, Polish consumers show exceptional enthusiasm for this form of payment. Already in 2021, the percentage of Poles who used BNPL services (62%) was higher than in Sweden (58%) – a country considered to be the cradle of this type of service . Widespread adoption is progressing – the percentage of users increased from 15% at the end of 2023 to 21% in July 2024 . For e-commerce sellers, BNPL has become a powerful tool that can increase conversions by up to 20%.

A strategic move that further drives the market is the entry of BLIK with the BLIK Pay Later service. It leverages the huge user base and brand trust to accelerate BNPL adoption on a mass scale. Data shows that the average transaction value of this service (PLN 321) is more than double that of standard BLIK payments (PLN 155), proving that Poles are keen to finance larger purchases in this way .

Outlook: from local leader to global player

The success of Polish FinTech is based on the unique synergy of banks and technology companies, a demanding internal market and a strong technology base. In contrast to the confrontational model of Silicon Valley, cooperation dominates in Poland. Banks such as PKO BP, Alior Bank and Santander run their own accelerator programmes, actively implementing solutions created by start-ups .

Having established itself domestically, international expansion is a natural step. BLIK is already pursuing its strategy, implementing the system in Slovakia and preparing to enter the market in Romania . This is not an isolated case. Polish companies such as Verestro (operating on five continents), Authologic (integrated with sources in nearly 200 countries) or PayU (a global player with Polish roots) have already achieved significant success on the international stage.

The future of Polish FinTech will be shaped by global trends such as artificial intelligence and embedded finance, but also by new EU regulations and growing competition from global technology giants .

However, an analysis of the numbers leaves no doubt. A mature, profitable ecosystem, the BLIK phenomenon and the boom in the BNPL market unequivocally confirm that Poland is today one of the most important centres of payment innovation in Europe. It is a leader that not only keeps up with trends, but increasingly sets them.