Nominal revenue growth in the IT industry is no longer the only determinant of success. Between 2023 and 2025, we are seeing a fundamental change in Poland and Europe: money in the distribution and partner channel is changing its nature. Instead of one-off cash shots (transactions), the market is shifting towards streams (subscriptions). For distributors this is an accounting challenge, for resellers a painful foray through the ‘valley of death’ in cash flow, but for those who survive, the reward is company valuations that are up to three times higher.

The transformation from CapEx (capital expenditure) to OpEx (operating costs) is no longer just the domain of SaaS start-ups, but a hard reality for the traditional sales channel – from distribution giants to local MSP integrators (Managed Service Providers).

Invisible turnover: lessons from the global giants

To understand what is happening in Poland, you need to look at the performance of global leaders who are setting trends. The traditional ‘Revenue’ line in financial statements has become confusing in the cloud era. Why? Because subscription sales (e.g. Microsoft 365, AWS, Cyber-as-a-Service) are often accounted for on a ‘net’ agency model – the distributor only shows its margin, not the full invoice value.

This is perfectly illustrated by TD SYNNEX’s Q3 results for fiscal 2025. Reported revenues amounted to USD 15.7 billion (+6.6% year-on-year), but so-called Gross Billings (the real value of technology sold) reached a staggering USD 22.7 billion, increasing by 12.1%.

This difference – amounting to $7 billion in a single quarter – is the ‘invisible’ mass of turnover coming from cloud services and subscriptions in a standard P&L account. For the Polish market, the lesson here is clear: if your revenues are stagnant, but the number of supported licences and service contracts is growing, then your business is actually growing faster than the simple P&L calculation shows.

Poland specific: Infrastructure ready, people not

The growth dynamics of the as-a-Service model in Poland has a unique, local drive. It is the gap between infrastructure and competence. On the one hand, Poland has a fibre optic infrastructure above the EU average, which is a technological highway for cloud services. On the other hand, Poland’s basic digital skills rate is only 44.3% (compared to the EU average of 55.6%).

For the partner channel (Resellers/MSPs), this is an ideal situation. Polish SMEs have the connectivity to use the cloud, but do not have the people to manage it. This forces outsourcing. According to PMR forecasts, the cloud market in Poland was expected to grow by 24% in 2024, reaching a value of PLN 4.8 billion. Importantly, Polish companies are still at the ‘Cloud 1.0’ stage (mail, storage), while the adoption of advanced services (AI, analytics) is only 3.7% compared to 8% in the EU. This shows a gigantic potential for upselling in the coming years.

AB S.A. and the run to the front

In Poland’s backyard, this transformation is perfectly illustrated by the AB S.A. Group. In the 2023/2024 financial year, the group’s revenues amounted to PLN 14.7 billion (a slight decrease reported by exchange rate differences), but profitability is key. The profit margin on sales reached a record level of 4.1%.

This is evidence of a shift in product mix. AB S.A. is shifting the weight of the business from simple ‘box shifting’ to VAD (Value Added Distribution) – advanced server solutions, cyber security and cloud. The company has reduced its net financial debt by three quarters, building a powerful financial cushion. In a subscription model, where payments are staggered, it is the strong balance sheet and low-cost financing that become the distributor’s main competitive advantage over smaller players.

| Year | Non-recurring revenues (Hardware/perpetual licences) | Recurring revenues (Subscriptions/MSP/Cloud) | Trend commentary |

| 2021 | 80% | 20% | Dominance of the transactional model (traditional reseller). |

| 2023 | 65% | 35% | Post-pandemic acceleration, cloud growth (PMR data). |

| 2024 | 55% | 45% | ‘Gross Billings’ effect – growth in managed services and security. |

| 2025 (Forecast) | 45% | 55% | Point of intersection (AI, DaaS, NIS2). |

The holy grail: own IP and repeatability

At the other end of the market are companies that have already completed the transformation. Asseco Poland reported in 2024 that as much as 79% of revenue (approximately PLN 13.5 billion) comes from its own software and services.1 Such a revenue structure, based on licences, maintenance and subscriptions, is the goal pursued by the modern IT channel. It ensures predictability and resilience to economic fluctuations, as can be seen from the steady growth of Asseco’s net profit (+8% year-on-year).

MSP and the ‘Valley of Death’: why suffer?

For smaller IT companies (integrators, resellers), moving to a subscription model involves the risk of the so-called ‘Valley of Death’ in cash flow (Cash Flow J-Curve). Instead of a one-off invoice for PLN 50,000 for the implementation, the company receives, for example, PLN 2,000 per month. This means a drastic drop in cash inflow in the first year, even though the customer value (LTV) is higher in a three-year perspective.

So why do companies decide to take this step? The answer lies in the valuation of the business.

- A traditional IT company (break-fix/non-recurring sales model) is valued in the market at 2.6x – 4.8x EBITDA.

- A mature MSP with a high proportion of recurring revenue (Recurring Revenue) achieves multipliers of 8x – 10x EBITDA, and even more for large-scale platforms.

Investors pay a ‘peace of mind premium’ – a predictable revenue stream is worth far more than a one-off sales shot, even a high one.

Forecast: What will drive the market in 2025?

The data points to three catalysts for service share growth in 2025:

- AI PCs and the end of Windows 10: PC fleet replacement (predicted by AB S.A. and IDC) is an opportunity to sell hardware in a DaaS (Device-as-a-Service) model with AI management services.

- Cyber Security (NIS2): EU directive will force thousands of companies in Poland to professionalise security. SMEs cannot afford their own SOC (Security Operations Centre), so they will buy security as a subscription service from MSPs.

- Platformisation of distribution: Tools such as Ingram Micro Xvantage or AB S.A.’s cloud platforms automate the subscription renewal process, making revenue more ‘sticky’ and cheaper to handle.

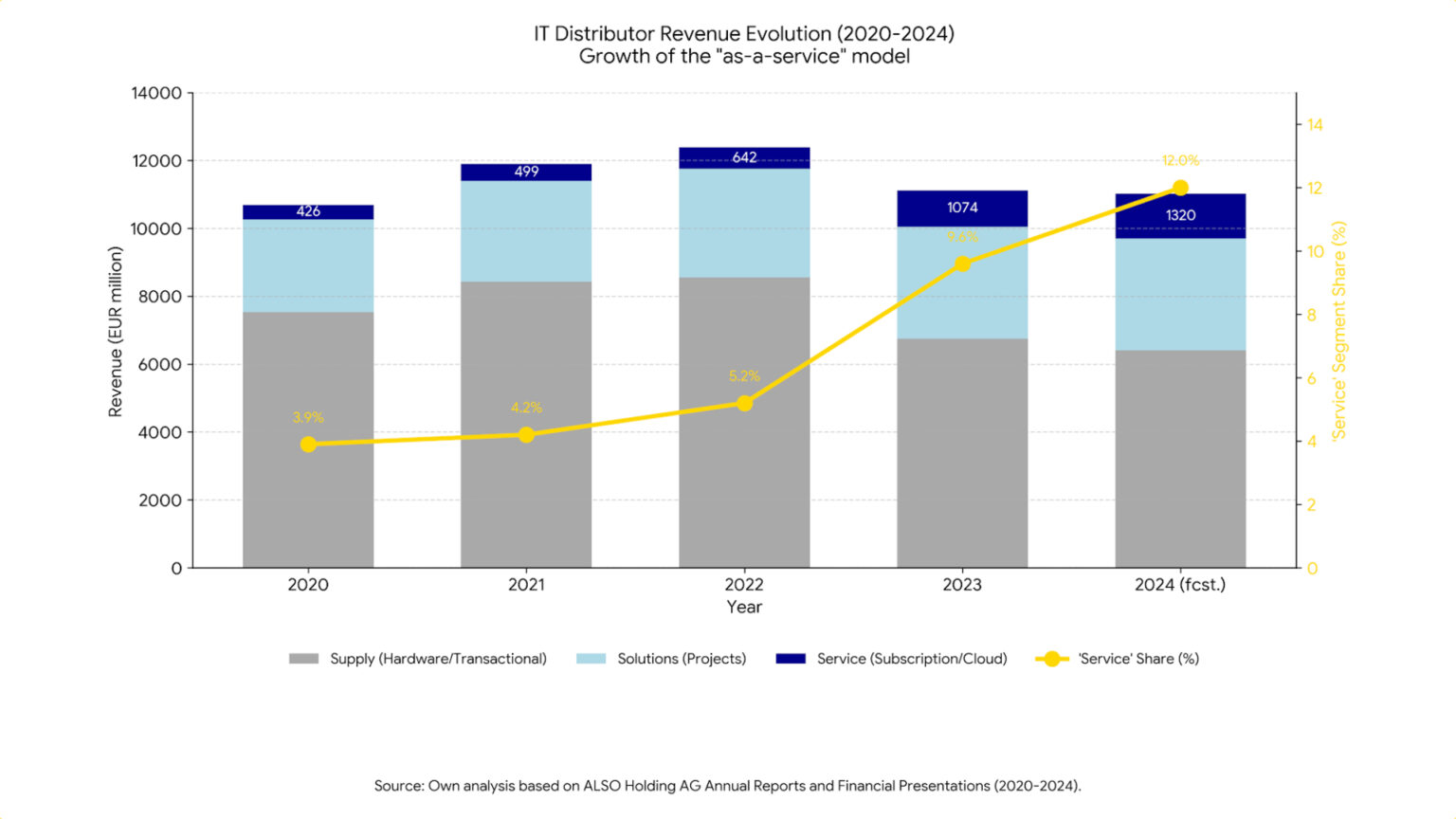

The Polish IT industry is at a turning point. Although, by volume, hardware sales still account for a large proportion of turnover (as can be seen from distributors’ results), margins and enterprise value are migrating towards recurring services. Analysis of the data shows unequivocally: whoever does not have a significant share of recurring revenues on their balance sheet in 2025 will lose relevance and market value, no matter how much nominal turnover they generate.