The year 2025 on the European technology scene is a time of apparent contradictions. On the one hand, data points to historically low levels of Venture Capital fundraising, with just €5.2 billion raised in the first half of the year, putting the current year on track for the weakest performance in a decade.

On the other hand, the same market is witnessing record multi-million dollar funding rounds for selected companies, with valuations of mature companies rising to previously unseen levels. This dichotomy is not a sign of weakness, but of a profound recalibration of the entire ecosystem.

In 2025, the European technology market is moving from a phase of broad, opportunistic growth to one of strategic depth. Capital, although more difficult to access, is being deployed in a more concentrated and deliberate manner.

Investors are targeting sectors critical to the continent’s future competitiveness and sovereignty: Artificial Intelligence (AI), Deep Tech, HealthTech and defence technologies. This is a turnaround driven by both the pragmatism of private investors and the conscious industrial policy of public funds.

The global AI arena: a European gambit in a race dominated by the US

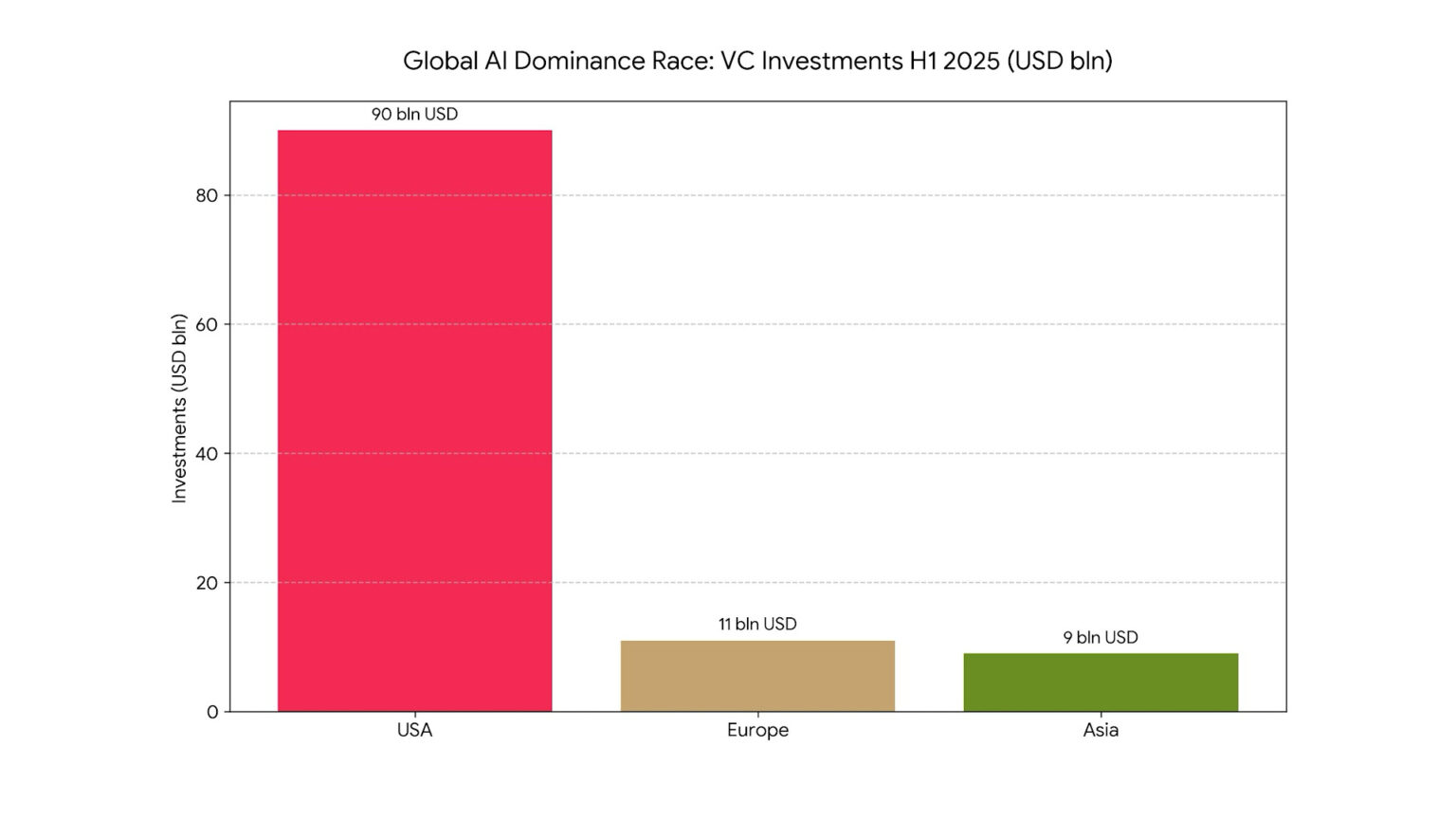

Data from the first half of 2025 clearly shows that the global AI landscape is dominated by the US. The scale of US dominance is overwhelming.

In H1 2025, VC investment in the US reached US$91.5bn, compared to US$18bn in Europe and just US$12.9bn in Asia-Pacific. In the area of generative AI, which is attracting the most attention, the gap is even deeper, with US companies accounting for 97% of global deal value in H1 2025.

There is also a reshuffle in the European backyard. Traditionally, the UK has been the undisputed leader. However, in the second quarter of 2025, Germany, for the first time in more than a decade, overtook the UK in terms of the value of VC funding raised.

Backed by powerful public investment pledges – President Emmanuel Macron announced a €109 billion plan to develop AI – France is dynamically consolidating its position.

The inability to compete with the US giants in the extremely capital-intensive foundational ‘model war’ has forced Europe to adopt a more pragmatic strategy. Instead of trying to build their own competitive language models (LLMs) from scratch, European investors and founders are focusing on the so-called ‘application layer’ of AI.

The approach is to use existing, powerful models to solve specific vertical business problems. Examples of this strategy in action abound. Germany’s Helsing, which raised €600m, is applying AI to battlefield data analysis, becoming a key player in the defence sector.

UK-based Synthesia, with a US$180m round, dominates the market for generating video for corporate training and marketing.

Beyond AI hype: a map of the hottest investment sectors

Although artificial intelligence dominates the headlines, an analysis of capital flows in the first half of 2025 reveals a much more nuanced picture. Investors are diversifying their portfolios, directing significant funds to sectors of fundamental importance to the economy and society.

H1 2025 figures show a clear changing of the guard. HealthTech (medical technology) became the best-funded sector, raising an impressive €5.7 billion. Deep Tech (deep technology) and B2B SaaS (software as a service for business) followed closely behind, with €5.2bn each.

FinTech, once the undisputed leader, fell further down the list with €3.7 billion, recording a 20% year-on-year decline. In contrast, GreenTech (also referred to as Climate Tech), despite the global slowdown, remains a key pillar of European investment, attracting USD 5.3 billion (around EUR 4.9 billion) in the first half of the year.

HealthTech: a new leader driven by demographics and AI

The growth of the HealthTech sector is indisputable. Europe has seen a 1.65-fold year-on-year increase in funding in this sector, reaching USD 3.3 billion. This boom has solid foundations: Europe’s ageing population and the AI revolution in diagnostics and drug discovery. The mega-rounds for the UK’s Verdiva Bio (USD 410 million) or Sweden’s Neko Health (USD 260 million) are proof of this.

GreenTech: a resilient pillar in the consolidation phase

The GreenTech sector is experiencing a period of correction. Funding in H1 2025 fell by around 40-50% compared to the previous year. However, this decline signals a shift from broad market funding to investment in capital-intensive and strategically important Deep Tech.

Money is flowing to companies working on fusion energy (Proxima Fusion), sustainable aviation fuel (Skynrg) and large-scale battery systems (Green Flexibility).

FinTech: a mature sector in search of efficiency

FinTech is entering its maturity phase. The drop in total funding to €3.7bn in H1 2025 is a fact. However, the median round size has increased by 38% over the same period, meaning that capital is concentrated in fewer but more mature and proven companies.

Cyber security and defence tech: rising stars

The growth of these two sectors is directly driven by the geopolitical environment. The European cyber security market grew by 13% in H1 2025, stimulated by new regulations and AI threats.

At the same time, the Aerospace & Defence sector attracted a record €1.5 billion, following growing tensions and EU initiatives to strengthen European defence.

Public money: how Brussels is building technological sovereignty

In 2025, the investment landscape in Europe is shaped not only by private capital, but equally by the strategic interventions of public funds.

With a budget of €95.5bn for 2021-2027, Horizon Europe is the EU’s main vehicle for funding research and innovation, of which around 35% is earmarked for digital transformation.

The programme focuses on strategic areas such as quantum technologies, graphene, advanced computing and AI, supporting them, among others, through flagship initiatives with a budget of €1 billion each.

The National Recovery Plans (NRPs), in turn, are an unprecedented injection of money into member state economies. Each country was obliged to allocate at least 20% of the funds to digital and 37% to climate.

France, for example, is allocating around €8.5 billion to digital transformation, including €1.8 billion for technologies such as cyber security and the cloud. Germany has earmarked more than 52% of its plan for digital transformation (approximately €14.5 billion) , and Italy 25.6% (approximately €49.8 billion).

These actions show that public funds are not just a form of subsidy, but a tool for a conscious industrial policy. The aim is to build ‘technological sovereignty’ , i.e. making Europe independent of key technologies from the US and China.

The exit equation: a mature ecosystem seeks liquidity

In 2025, the European technology ecosystem faces a major challenge: how to deliver return on investment in an environment where traditional capital exit paths are limited.

The market for initial public offerings (IPOs) remains stagnant, with a dramatic 65% decline from H1 2024. In response, mergers and acquisitions (M&A) are growing rapidly, with H1 2025 in the UK alone seeing the highest number of takeover bids in 15 years.

Despite the general slowdown, the market is highly polarised. The median pre-money valuation in Europe reached a decade-long peak of €8.6m in June 2025.

This is indicative of the ‘flight to quality’ phenomenon, in which investors are concentrating capital on the most promising, proven companies. The best indicators of this trend are the largest funding rounds, which perfectly illustrate the key trends: the dominance of AI, the strategic importance of Defense Tech and HealthTech, and the capital intensity of GreenTech.

Polish growth: Dynamo from Central and Eastern Europe

In a European VC market landscape characterised by caution, Poland stands out as one of the most dynamically growing ecosystems. The Polish VC market recorded a spectacular 155% year-on-year increase in deal value in the first quarter of 2025, reaching PLN 444 million (approximately EUR 106 million).

This impressive growth is driven by several fundamental changes indicative of the maturation of the Polish ecosystem:

- Moving on to later rounds: Almost half (48%) of the deals in Q1 2025 were Series A or later rounds, showing that the Polish market is already capable of not only creating but also scaling innovative companies.

- Capital internationalisation: As much as 42% of the capital invested in Polish startups in Q1 2025 came from foreign funds, including from the US, Germany and the UK.

- Flagship successes: The funding round for ElevenLabs, exceeding PLN 700 million and attracting leading US funds such as Andreessen Horowitz (a16z) and Sequoia Capital, is an unprecedented event. As is the investment in Nomagic (approximately PLN 140 million). These transactions definitely put Poland on the global innovation map.

The analysis of the European technology market in 2025 leads to a clear conclusion: we are facing a more mature, selective and strategically focused market.

The time of easy money and financing growth at any cost is over. It has been replaced by an era of fewer deals, but bigger, smarter and concentrated in sectors that are fundamental to the continent’s future.

For investors, the greatest opportunities lie at the intersection of global technology trends (AI in particular) and Europe’s strategic priorities (sovereignty, energy transition, security).

For the founders, success in the current climate requires more than just innovative technology – investors expect a clear product-market fit and a credible path to profitability.

The year 2025 is a maturity test for the European technology ecosystem. It is a time when Europe, perhaps out of necessity, learns to invest not only broadly, but above all wisely, building the foundations for its long-term competitiveness on the global stage.