The upheaval in global supply chains from 2020-2024 has forced the tech giants to redefine their strategies. In this new dispensation, Central and Eastern Europe (CEE) is no longer merely a ‘cheaper alternative’ to Germany. Thanks to a combination of advanced warehousing infrastructure, growing manufacturing competence and strategic location, the region is emerging as a key distribution hub for the IT and electronics sector. What does this mean for the Polish IT industry?

End of the “Just-in-Time” era, beginning of the “Just-in-Case” era

Until a decade ago, the model was simple: electronics produced in Asia sailed by container ship to the ports of Rotterdam or Hamburg, and from there they were sent to distribution centres in Western Europe. The CEE region played a peripheral role. Today, this model is becoming a thing of the past. The pandemic, the blockades of the Suez Canal and the war in Ukraine have exposed the fragility of long supply chains. The corporate response is nearshoring – moving production and logistics closer to markets.

The data is clear: around half of the companies operating in Europe have started to decentralise their supply chain, and CEE is the main beneficiary of this trend. It is no longer just about cheap labour. It is about resilience. For an IT distributor, not having goods on the shelf during the ‘peak season’ (Q4) means measurable losses. Warehousing goods in Poland or the Czech Republic, from where it takes a few hours to get to Berlin, has become a safety net for Western European business.

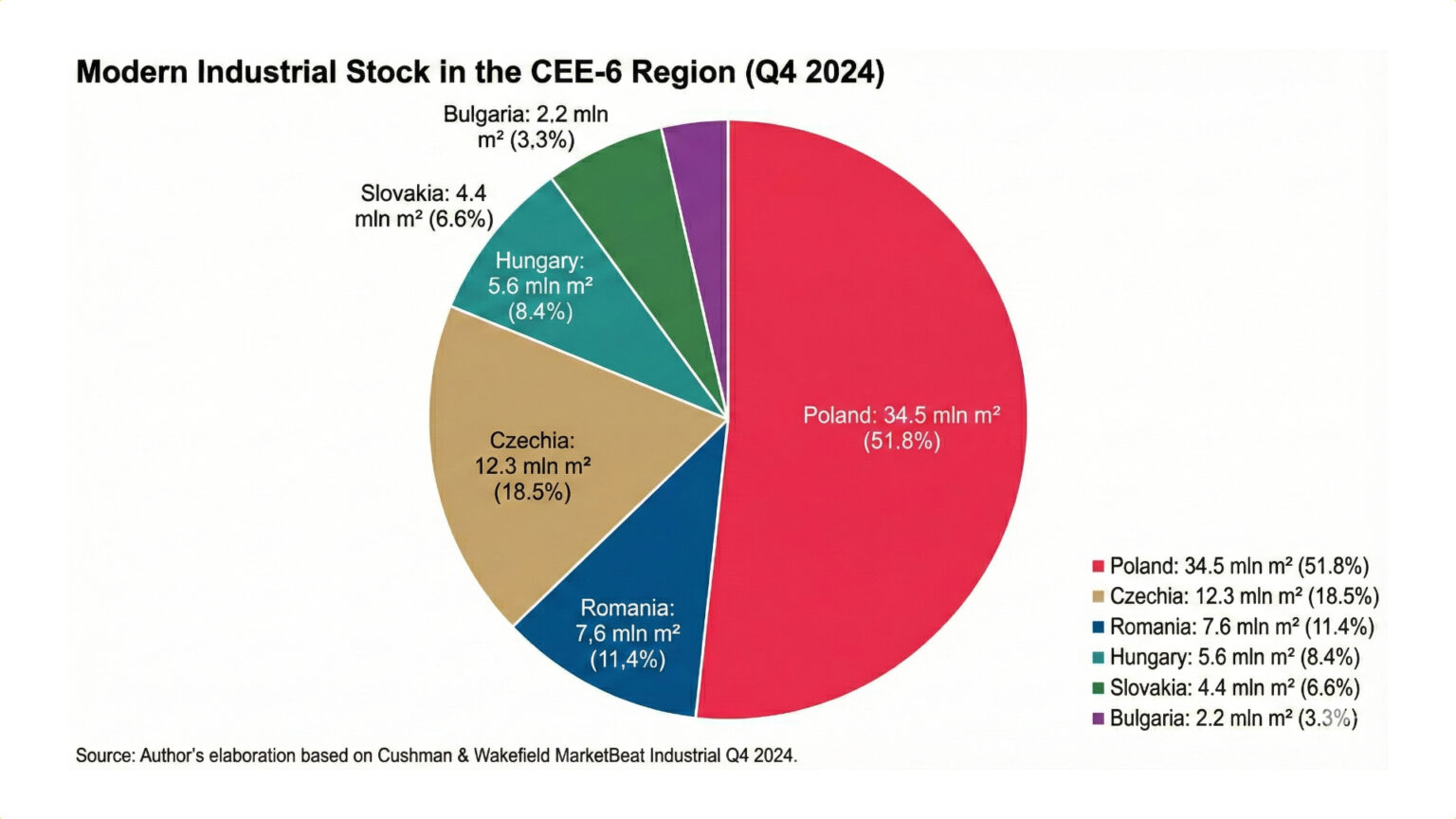

Hard data: Poland the warehouse of Europe

Poland has grown into the undisputed logistics leader in the region, with 2024 figures confirming its dominance over many Western markets. In the first half of 2024, Poland recorded the highest warehouse rental volume in Europe, even overtaking the German market.

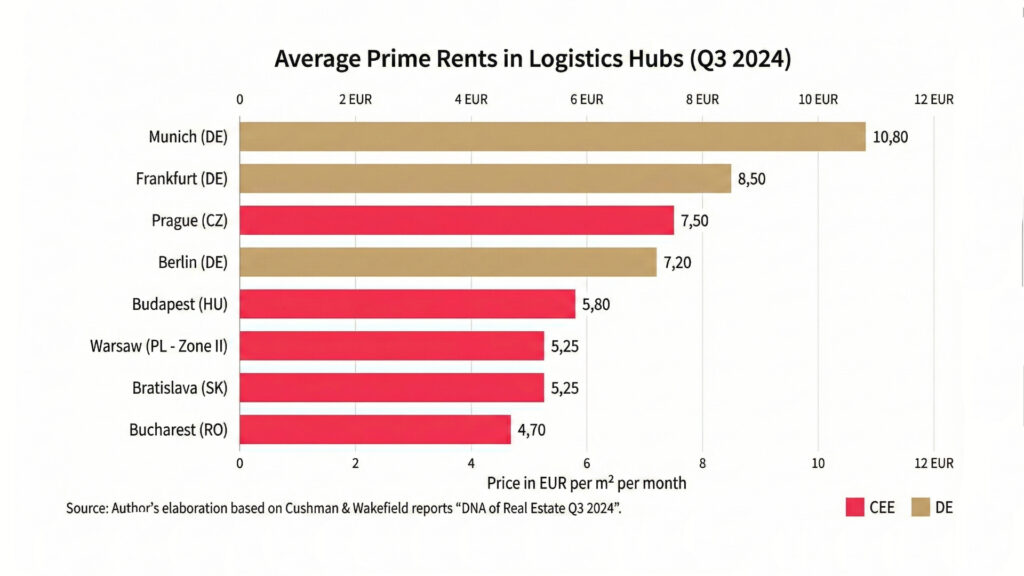

Cost arbitrage remains a key factor for the IT industry, operating on low distribution margins. An analysis of prime rents in Q3 2024 shows a gap between CEE and the West:

- Munich: approx. EUR 10.80/m²

- Warsaw (surroundings): approx. EUR 5.25/m².

- Bucharest: approx. EUR 4.70/m².

For a company from the SME sector or a large electronics distributor (such as TD Synnex or Ingram Micro), maintaining a distribution centre near Wrocław or Poznań is nearly half as expensive as in Germany, while maintaining the A-class standard. Moreover, modern warehouses in CEE are often younger and better adapted to automation and ESG requirements (BREEAM/LEED certificates) than older facilities in the West.

Not just a warehouse, but a factory

The myth of CEE as exclusively an ‘assembler’ collides with the data on high-tech exports. Hungary, the Czech Republic and Poland have transformed themselves from technology importers to net exporters.

- Hungary has become a regional powerhouse in electronics manufacturing, with exports of electrical and electronic equipment accounting for more than 23% of total exports there.

- Lenovo in Hungary: The Üllő plant is an example of what nearshoring looks like in practice. This plant has already produced more than 1.5 million servers and workstations, serving the EMEA markets (Europe, Middle East, Africa). Reducing delivery times to customers in Europe from several weeks (shipping from China) to a few days is a competitive advantage that cannot be ignored.

In the case of Poland, exports of high-tech products have approached USD 30 billion. Poland plays a key role in so-called fulfilment for e-commerce. Giants such as Amazon and Zalando have located their centres in Poland not only because of costs, but because of the possibility of servicing the entire German and Scandinavian market from here. More than 34% of the demand for warehouses in Poland in 2024 will be generated by the e-commerce and retail sector, which is directly correlated to the sale of electronics.

Risks: Lessons from Intel and labour market challenges

However, the image of the region as the ‘Promised Land’ has its cracks. The loudest echo in the industry was the suspension (and de facto cancellation in its current form) of Intel’s investment near Wrocław in the Semiconductor Integration and Testing Facility. This decision, resulting from the corporation’s global financial problems, shows that basing a development strategy on a single giant investor can sometimes be risky. Nonetheless, the logistics sector has ‘absorbed’ the news without breaking down. The land prepared for Intel’s investment remains an attractive asset and demand from other players is not waning.

For Polish IT SMEs, the labour market is becoming a challenge. Although labour costs in Poland are still 2-3 times lower than in Germany , the availability of skilled workers is decreasing. The answer is automation. Implementing systems such as AutoStore or AMR robots in warehouses (as Zalando or Ingram Micro are doing, for example) is becoming a necessity rather than a gadget. This is an opportunity for Polish IT system integrators who can offer these solutions to logistics.

Polish IT SMEs do not need to build their own warehouses. The CEE region offers the most modern fulfilment infrastructure in Europe. The use of logistics operators (3PLs) in Poland makes it possible to compete with Western companies on delivery times, with a lower cost base.

- Supplier diversification: Proximity to factories in Hungary (Lenovo, Samsung) or the Czech Republic (Foxconn) means that Polish distributors and resellers can rely on shorter supply chains. It is worth reviewing contracts and looking for manufacturing partners within the CEE region, rather than relying solely on imports from Asia.

- Investment in technology: As logistics in CEE is moving towards automation, IT companies should focus on providing solutions to support this trend: from WMS (Warehouse Management Systems), to IoT for shipment monitoring, to cyber security for industrial infrastructure.

Is CEE the new IT logistics hub for Europe? The answer is yes, but in a new formula. We will not replace Rotterdam as a port of entry, but we have become a ‘buffer warehouse and last mile factory’ for Europe. Poland (distribution), Hungary (manufacturing) and the Czech Republic (high-tech) form a complementary ecosystem. For the IT industry, this means more stable supply and lower operating costs. The winners will be those who understand that logistics in 2025 is not just about pallet transport, but about data and time management – and in this, the CEE region is starting to win over Western competitors.