In the race for dominance in the artificial intelligence sector, technology giants usually take one of two paths: building their own expensive language models (LLMs) or a close, almost exclusive symbiosis with a single supplier, as is the case with Microsoft or Apple. Lenovo, the world’s largest computer manufacturer, however, decided to write its own script. Instead of competing with model makers, the company intends to become their global distributor.

Lenovo CFO Winston Cheng calls this strategy an ‘orchestrated approach’. At the World Economic Forum in Davos, Cheng outlined the company’s vision of not building its own intelligence, but integrating the best available solutions into its proprietary Qira system. It’s a pragmatic move that allows Lenovo to avoid the mammoth investment in research and model development, while addressing the problem of regulatory fragmentation globally.

Unlike Apple, which relies on select partnerships with OpenAI and Google, Lenovo is opening the door to a wide range of players. The list of potential partners includes Europe’s Mistral AI, Saudi Humain and Chinese giants such as Alibaba and DeepSeek. This approach allows Lenovo to respond flexibly to local data protection and digital sovereignty regulations, which is crucial for a company operating in so many markets simultaneously.

Lenovo’s position is unique. As the only player alongside Apple with significant market share in both the PC and smartphone markets (through Motorola), the company controls the physical point of contact between the user and the technology. Cheng, a former investment banker, understands well that in the era of the ‘AI bubble’ and rising valuations, the real value lies in effective implementation, not just pure computing power.

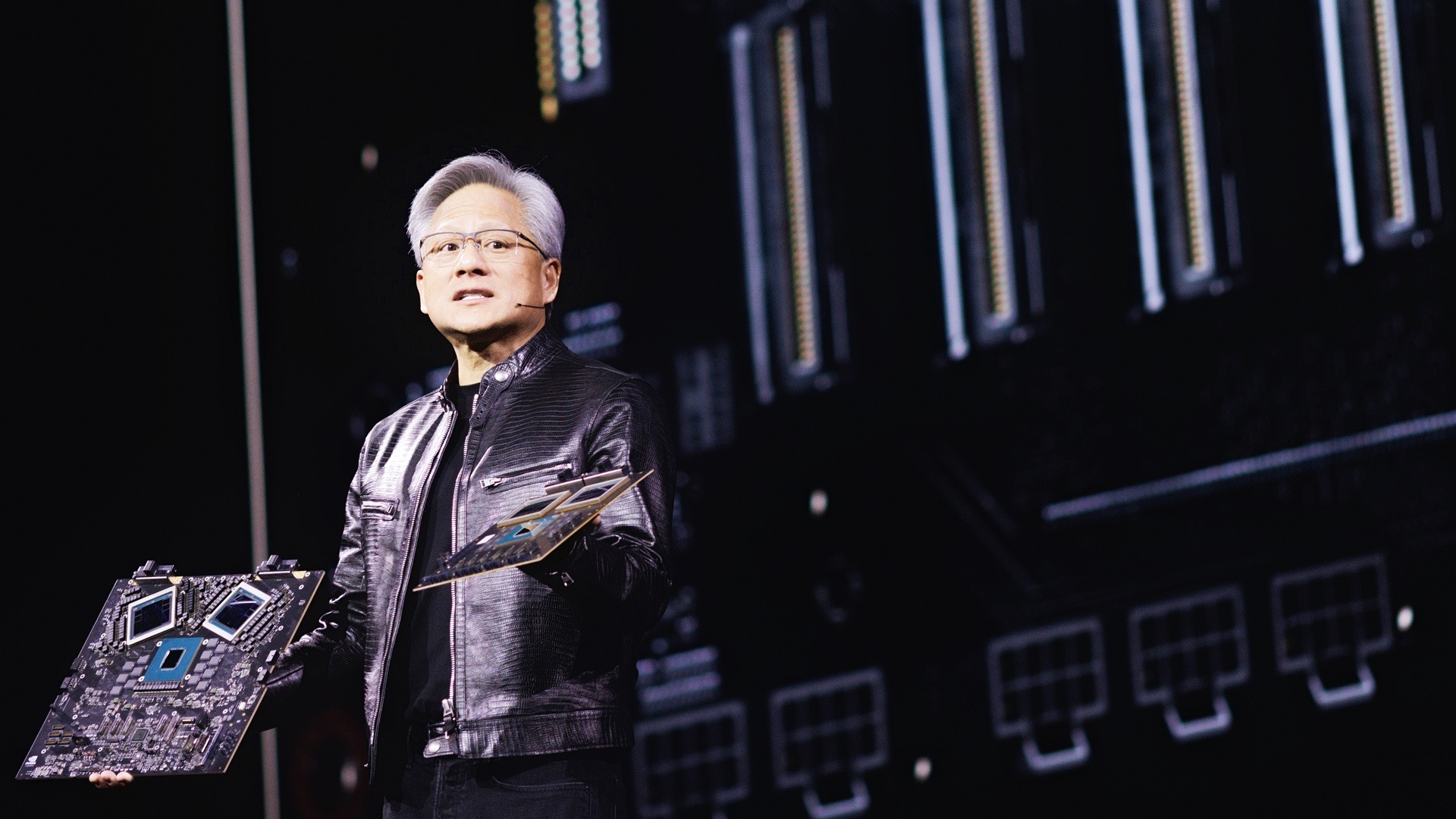

However, this strategy is not without its challenges. Rising component prices, especially for memory chips, are forcing Lenovo to pass on costs to customers. At the same time, the company is strengthening its cooperation with Nvidia in the area of liquid-cooled infrastructure, targeting the hybrid data centre market. For investors, the message is clear: Lenovo wants to be an indispensable intermediary in the world of AI – a platform without which the best language models will never reach the pockets and desks of the mass consumer.