Today’s digital economy is experiencing an unprecedented acceleration, referred to as the ‘digital infrastructure boom’. This phenomenon is characterised by the rapid growth and expansion of technological foundations that are supporting innovation and transforming the way businesses operate and consumers’ lifestyles. It is a direct response to rapid shifts in market preferences, the growing desire for sustainability and the need to adapt to a turbulent business environment characterised by a high degree of dynamism and discontinuous change.

A key element of this boom is the ubiquitous digital transformation of businesses. This includes the deployment of advanced solutions such as the robotisation of processes, the implementation of artificial intelligence and the end-to-end digitisation of operations, technologies, products and services. This process is not just about increasing the amount of infrastructure in place, but a qualitative change that requires technological systems to adapt to new, complex and interconnected requirements. The infrastructure must be highly flexible, secure and able to handle increasingly demanding workloads.

The main factors driving this development are multiple. The increase in interest in advanced online applications, both in the B2B and B2C sectors, the continuous growth of social media users and the increasing requirements for data security are generating a huge demand for computing resources. Developments in technologies such as artificial intelligence (AI), the Internet of Things (IoT), 5G networks, cloud computing and the rapid growth of e-commerce are the main drivers of this unprecedented growth. IoT devices, including sensors and cameras, generate gigantic amounts of data that must be stored and processed efficiently, which directly translates into the need to expand and upgrade data centres.

Data centres are the cornerstone of modern digital infrastructure, enabling the storage, processing and transmission of data with the highest requirements for security and technical efficiency. Their dynamic growth, driven by the aforementioned megatrends, has a cascading effect on the entire IT ecosystem. The growing demand for complex and high-performance digital environments inherently generates an increased demand for the specialised services of IT integrators. These integrators are the architects and implementers of these complex environments, responsible for connecting disparate components into coherent and efficient systems.

Data centre boom – what is driving investment?

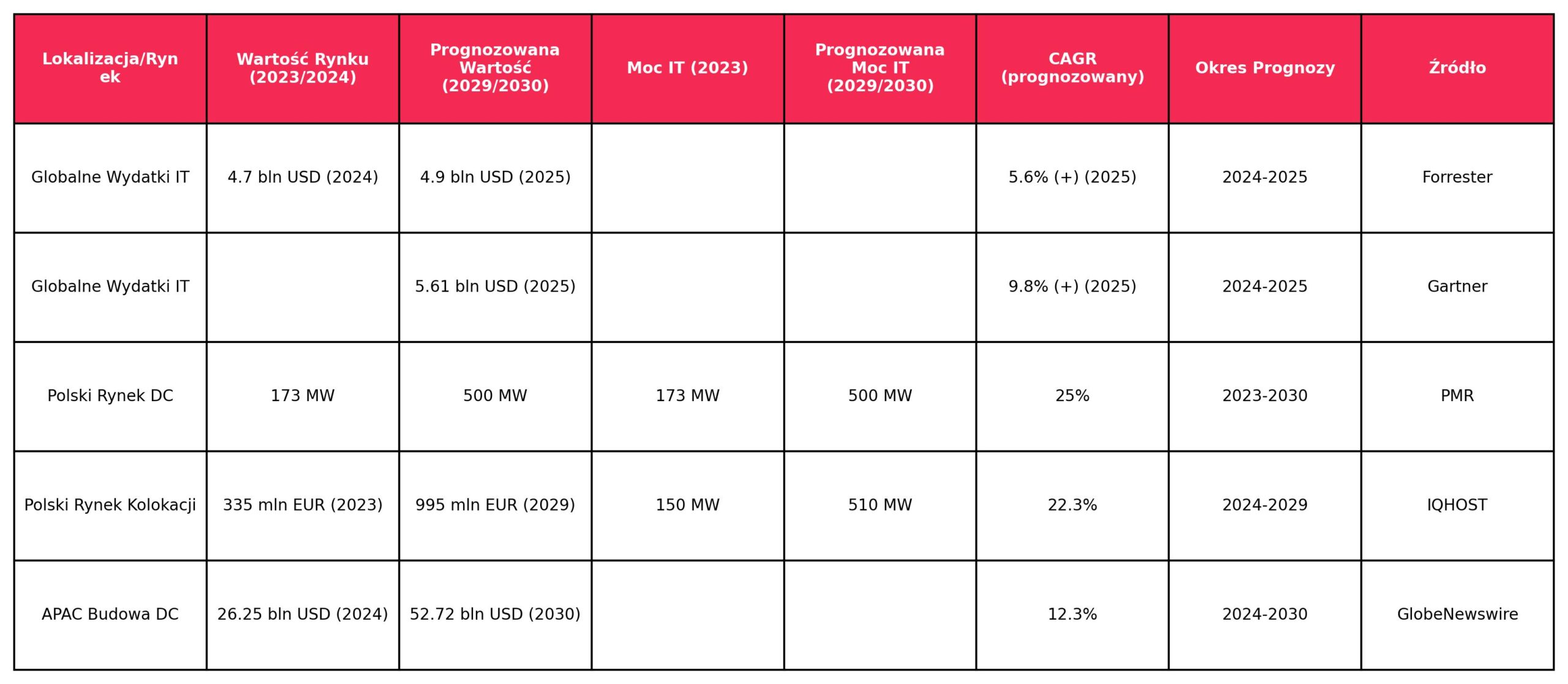

The digital infrastructure market, and in particular the data centre sector, is experiencing rapid growth both globally and locally. Forecasts point to a further acceleration in IT spending. Forrester predicts that global IT spending will grow by 5.6 per cent in 2025, reaching $4.9 trillion, while Gartner is even more optimistic, forecasting an increase of nearly 10 per cent to $5.61 trillion in 2025 .

Poland is playing an increasingly strong role in this global landscape. By the end of 2022, there were nearly 140 facilities designed as data centres in the country, with the largest concentration in Warsaw, where the total power supply was estimated at 130 MW. The Polish market is dominated by indigenous companies, although major global players are also present. Despite the significant difference in scale compared to the FLAPD markets (Frankfurt, London, Amsterdam, Paris, Dublin), Warsaw maintains a strong position, comparable to other European capitals, and is the leader in Central and Eastern Europe. This position is not only the result of current demand, but also the country’s strategic positioning as a regional digital hub, which attracts foreign cloud providers and drives further investment.

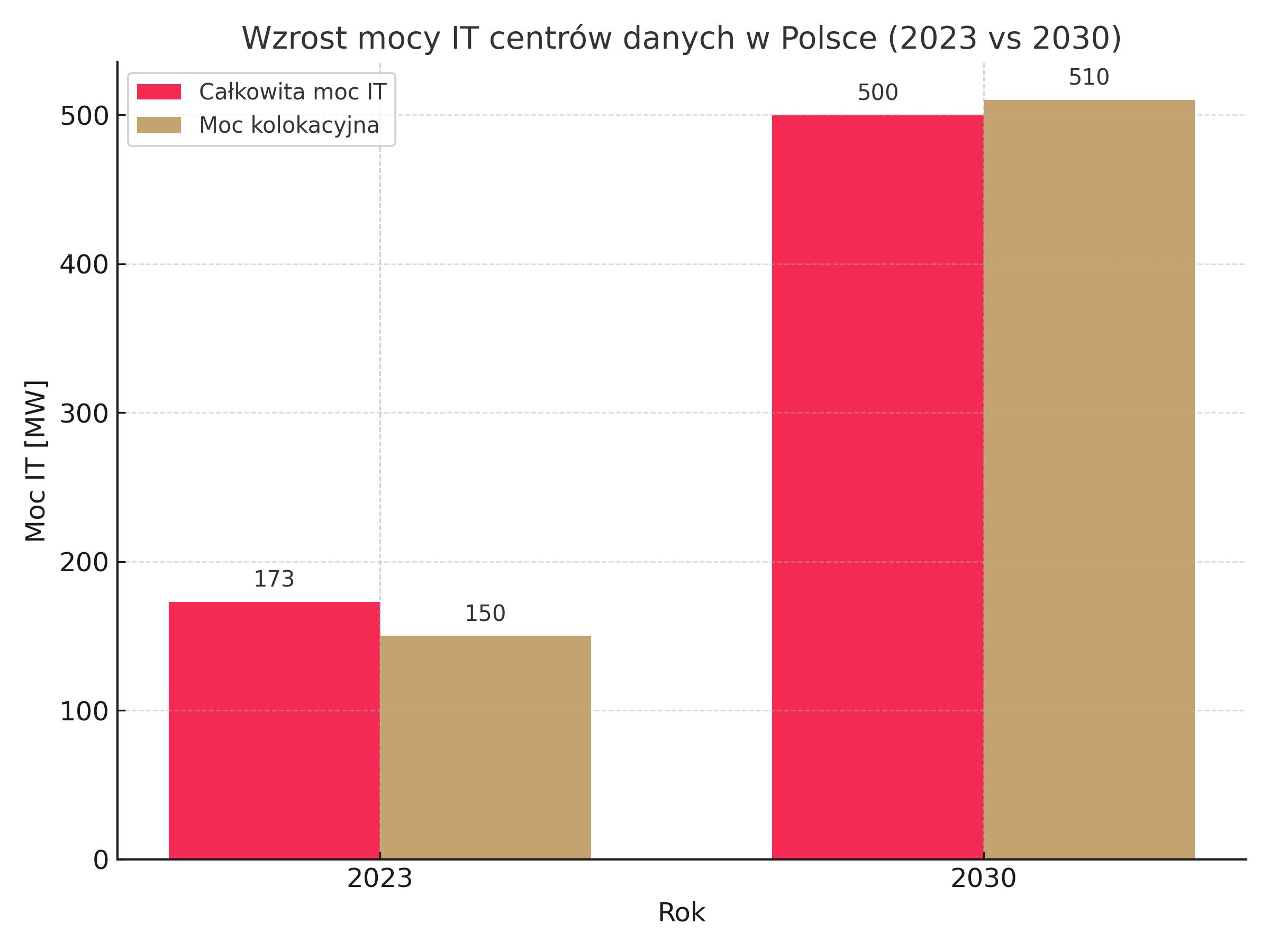

Forecasts for the Polish data centre market are extremely optimistic. PMR indicates that the size of the market could exceed 500 MW by 2030, implying a compound annual growth rate (CAGR) of 25%. The year 2023 was a record year, with 173 MW of capacity allocated to data centres in Poland, an increase of almost 43% compared to 2022. In just three years (2021-2023), the Polish data centre market doubled its power resources. The colocation market in Poland, valued at €335 million in 2023, represents around 1.8% of the European market, but is forecast to grow fastest in Central and Eastern Europe, with a CAGR of 22.3% between 2024 and 2029, reaching a value of €995 million and IT capacity of 510 MW in 2029. It is estimated that the volume of data centres in Poland will grow by several per cent per year over the next few years. On a global scale, the APAC data centre construction market is expected to grow from USD 26.25 billion in 2024 to USD 52.72 billion in 2030, with an average annual growth rate of 12.3 per cent.

The table below shows the key growth projections for the data centre market, illustrating the scale and dynamics of the sector.

The main drivers of these investments are complex and interrelated:

- Artificial intelligence (AI) and high-performance computing (HPC): Artificial intelligence (AI) is currently a key driver of growth in computing power demand. As many as 70% of market research respondents indicate that AI is increasing their demand for resources, with 37% forecasting an increase of 10-25% and 6% even 100%. Goldman Sachs forecasts that energy demand from AI will increase by around 200 TWh between 2024 and 2030, while experts at McKinsey predict that by 2030, the energy load in data centres will double to 35 GW per year. This trend is so strong that AI is expected to drive data centre market growth by more than half by 2029. It is estimated that around 40% of all data centre resources will be used for generative AI operation. AI installations require a much higher power density, in the order of 15-30 kW per rack, compared to 5-10 kW for standard workloads, forcing data centres to adapt to efficient liquid cooling. The growing demand for AI-based system architectures (up 84% year-on-year) directly translates into the need for investment in specialised infrastructure.

- Cloud Computing adoption: The global cloud market is currently worth around USD 350 billion, with an annual growth rate of 20-30%. Analysts predict that this market will grow to approximately USD 850 billion within five years. The Polish B2B cloud market is expected to grow above 20% year-on-year until 2026, reaching a value of PLN 10bn in six to seven years. In 2023, the value of the cloud market in Poland was PLN 3.9bn (up 34% year-on-year), with a forecast of PLN 4.8bn in 2024 and close to PLN 13bn in 2029. This is a sustainable trend, with less than 1% of large companies in Poland declaring a reduction in cloud spending. The development of infrastructure in Poland, including data centres and networks (including 5G mobile access and fixed FTTx), creates a solid foundation for new cloud applications. PMR forecasts indicate that the share of the public cloud in the total value of the data centre market in Poland will triple between 2024 and 2030, reaching 50%. Multi-cloud and hybrid strategies are becoming a key trend, increasing the resilience and flexibility of systems, although they come at an additional cost, estimated at around a 10% increase in billings.

- Edge computing and the dispersal of infrastructure: Edge computing, or data processing at the ‘edge’ of the network, moves computing and data storage closer to where it is generated, changing the traditional model of centralised data centres. The development of 5G networks is further driving the adoption of Edge Computing, providing the necessary connectivity infrastructure for low latency. Key is the growth in the number of smaller facilities, so-called micro data centres (200-500 kW),located closer to end users. This is essential for real-time, Internet of Things (IoT) and augmented/virtual reality (AR/VR) applications. This dispersal of infrastructure represents a fundamental architectural change, requiring different integration strategies than traditional hyperscale centres.

- Sustainability (ESG): Increasing sustainability (ESG) requirements are making the construction and operation of data centres increasingly complex. Energy efficiency is a key priority for 68% of respondents, with companies emphasising optimising energy consumption and reducing CO2 emissions. New green technologies and renewable energy sources are influencing the development of data centres, making them more environmentally friendly. The energy demand is so huge and growing so fast that in some regions (e.g. Ireland) the construction of new centres is already being blocked at national level. This raises the issues of energy efficiency and the use of renewables from ‘welcome’ to ‘necessary to keep the business going’.

- Security requirements and regulations: Data security is the most important criterion when choosing a data centre provider for 75% of respondents. Companies need to invest in advanced cyber security strategies and physical facility security. Local and pan-European security certifications (e.g. ENISA, national cyber security certificates) and compliance with regulations such as RODO, SOC 2, NIS2 or DORA are growing in importance. These requirements not only increase the complexity of projects, but also create demand for specialised security consulting and implementation services.

All these factors indicate that the data centre market is not only growing in volume, but is undergoing a profound qualitative transformation in which advanced technologies, energy efficiency and stringent security standards are becoming key.

IT integrators – architects and implementers of digital infrastructure

The role of IT integrators is becoming absolutely crucial. An IT integrator is an entity whose main task is to create an infrastructure that effectively supports the client’s business objectives. They act as architects and implementers, combining the various technological elements – hardware, software, networks, facilities and all the necessary components that support the management, processing and storage of information – into coherent and functional systems. The market for integration services is extremely heterogeneous, encompassing both independent consultants and large IT companies that offer both a broad spectrum of services and narrow specialisations, adapting to specific industry or technology needs.

The range of services of IT integrators in the context of data centres is wide and includes:

- Design and implementation of solutions: Integrators are responsible for designing and implementing comprehensive technology solutions. This process includes the selection of appropriate technologies, configuration of systems, installation of hardware and software, and rigorous testing of solutions prior to implementation to ensure full compatibility and performance.

- Data and application migration: As infrastructure grows and modernises, migrating data and applications to new data centre environments becomes a frequent need. Integrators ensure that data and applications are moved securely and optimised, ensuring that their integrity and availability are fully maintained. Every step of the migration is thoroughly tested to ensure a smooth transition and business continuity.

- Infrastructure optimisation and management (including hybrid and multi-cloud): IT integrators help organisations optimise their technology infrastructure. By analysing and optimising resources, they help to reduce unnecessary costs and ensure efficient use of infrastructure, enabling companies to be more competitive. This includes full management of servers, storage, networking and applications in the new data centre environment, as well as support for complex hybrid and multi-cloud environments. Their role goes beyond purely technical implementation; they become strategic partners to ensure business continuity and digital sovereignty. An example is the project for ProService Finteco, where the integrator implemented a hybrid IT architecture, providing Disaster Recovery as a Service (DRaaS) and meeting ISO standards and FSA regulations.

- Ensuring IT security and regulatory compliance: Security of data and technology infrastructure is a priority in an era of increasing cyber threats. IT integrators implement advanced security solutions such as firewalls, threat detection systems and incident response procedures to minimise the risk of data loss and cyber-attacks. They also manage compliance with regulations such as RODO and SOC 2 , which is crucial for companies operating in an increasingly regulated environment.

- Technical support and maintenance: once solutions have been implemented, IT integrators provide ongoing technical support and maintenance of the infrastructure. This means regular upgrades, repairs, performance monitoring (often 24/7) and rapid response to any technical issues. An example is the implementation of ManageEngine’s customer service and advanced reporting products, which enhances service delivery.

The diversity and specialisation of integrator services (from full-scale to narrow niches) is a direct response to the growing complexity and diverse requirements of the digital infrastructure boom. As the data centre landscape becomes more fragmented – into hyperscale, co-location and edge centres – and as technologies such as AI and IoT introduce new specific requirements (e.g. liquid cooling, high power density racks), no single integrator can be an expert in everything. This heterogeneity of the market allows specialised integrators to emerge to meet the needs of specific industries (e.g. fintech ) or technology niches (e.g. RPA/AI automation). This specialisation is key to effectively navigating the complex and rapidly evolving digital infrastructure environment.

Synergies of data centre investment and demand for IT integrator services

The growth in data centre investment and the increasing demand for IT integrator services are inextricably linked, creating a dynamic synergy. The direct correlation stems from the increasing complexity and scale of digital infrastructure. Galloping investment in hyperscale data centres, driven in large part by the development of generative artificial intelligence, is leading to a new data centre every 2-3 days. This pace and scale requires complex planning, design and implementation, which is the domain of integrators. Poland’s data centres are stepping up infrastructure investment in response to growing demand for computing power, changing regulations and ESG requirements. Each of these areas – from energy optimisation to regulatory compliance – requires integration expertise. A 5% increase in IT spending in Europe by 2025, in excess of $1.5 trillion, driven by investments in cloud, cyber-security and AI, means a direct increase in demand for IT services, including integration.

Demand for the services of IT integrators is particularly evident in several key areas as a direct result of the data centre boom:

- Integrating infrastructure for AI: The explosion of interest in artificial intelligence is forcing data centres to fundamentally change their infrastructure. Often, this means building facilities from scratch, rather than simply extending existing facilities. Integrators are needed to design and implement these new, high-density environments, which require advanced cooling systems, including liquid cooling, to effectively manage the huge energy demands. The growing demand for AI-based system architectures, with an increase of 84% year-on-year , directly translates into the need to engage integrators to create and optimise these complex environments.

- Implementing and managing hybrid and multi-cloud environments: The rise of hybrid and multi-cloud environments, as well as cloud consulting, implementation and integration services, is a key trend and presents significant opportunities for local service providers and data centres. Integrators are helping companies transition to cloud services and implement complex multi-cloud strategies that increase resilience and operational flexibility. An example is the deployment of a hybrid IT infrastructure for the fintech industry that provides Disaster Recovery as a Service (DRaaS), which is critical for business continuity.

- Developing and integrating Edge Computing solutions: Edge computing, driven by the growth of 5G and the Internet of Things, requires the creation of micro data centres and the dispersal of infrastructure closer to data sources. Integrators are key in the design and implementation of these distributed environments, which must operate at low latency to support real-time applications. There is also a noticeable skills gap in Edge Computing , increasing the need for external experts capable of designing and implementing these new architectures.

- Automating processes in data centres and for customers: The increase in data volumes and complexity of data centre operations is making automation a necessity. Artificial intelligence is being used to automate routine tasks such as system updates, backups or infrastructure monitoring, as well as to analyse information and respond to errors. Many activities in data centres are monotonous and repetitive, and automation tools increase productivity and adaptability. In logistics, IoT enables the automation of warehouse and supply chain processes, reducing workload and the risk of human error. Integrators are deploying RPA and AI solutions to automate business processes such as invoice accounting and accounts receivable management, delivering significant savings and efficiency gains.

- Cyber security and regulatory compliance: As data centres become central points for critical data, security becomes an absolute priority. IT integrators are responsible for implementing advanced security solutions, such as firewalls and threat detection systems, and managing compliance with regulations such as RODO or SOC 2. The growing importance of regulations such as NIS2 and DORA is a significant challenge for data centres , which in turn is driving demand for integrators specialising in cyber security and compliance.

- ESG and energy efficiency: Increasing energy demand, especially from AI, is pushing data centres to find innovative ways to power and minimise their carbon footprint. Energy efficiency is a key priority , and integrators are essential to implement solutions that optimise energy consumption, such as liquid cooling systems that are more reliable and energy efficient. Investment in sustainability is becoming a necessity and integrators are helping to adapt infrastructure to new climate standards and regulations.

The market for IT services, including integration, is showing significant growth. Gartner forecasts point to a 9.8 per cent increase in global spending on IT services by 2025. With more than 410,000 IT specialists and 60,000 technology companies, Poland is a leader in the Central and Eastern European region and a key player in the global IT market. Investments by technology giants such as Microsoft and Google in Polish data centres and AI infrastructure further cement this position.

The synergy between investment in data centres and demand for IT integrator services is therefore a feedback loop. The growth and complexity of data centres are generating demand for advanced integration services, and the solutions provided by integrators are in turn enabling further expansion, optimisation and innovation in the data centre sector. Integrators are key in navigating through challenges such as rising energy consumption, changing regulations and talent shortages. Demand for their services is evolving into expertise in the areas of AI, Edge Computing and sustainable solutions.