The public cloud was supposed to be a revolution in IT economics. The promise of flexibility, on-demand scalability and a pay-as-you-go model painted a vision of a world where companies only pay for what they need. However, the reality turned out to be much more complicated and, for many organisations, much more expensive.

Today, for an increasing number of IT and finance directors, the public cloud, rather than being a tool for optimisation, has become synonymous with an uncontrolled budget drain. The figures are alarming.

According to Flexera’s ‘State of the Cloud’ report, wasteful spending on the public cloud reaches an average of 32%. Globally, this translates into an astronomical amount of more than $225 billion lost in 2024 alone.

The problem is so acute that managing cloud spend is, for the second year running, the top challenge for companies worldwide, even overtaking security issues.

The ‘gold rush’ phase and the mass migration to the cloud is over.

Now the IT industry faces a much tougher challenge: achieving operational excellence and implementing financial governance in this new dynamic environment.

Anatomy of lost control: why are cloud bills rising?

In order to effectively manage costs, it is first necessary to understand the fundamental causes of their escalation. This is a confluence of technological, organisational and cultural factors, which together create the ideal conditions for the emergence of ‘cloud debt’.

- Lack of visibility (The Visibility Gap) is the most fundamental problem. Organisations cannot optimise what they cannot see. As much as 54% of waste in the cloud is directly attributable to a lack of insight into cost structure. Traditional finance departments are presented with a single, aggregate bill that, without specialised tools, is impossible to accurately allocate to specific teams or projects. This leads to companies employing ‘blind’ management strategies, with no idea who is generating the expenditure and why.

- Cloud Sprawl (Disorder and Resource Proliferation) is another scourge. The ease with which new resources can be deployed without proper oversight is becoming its biggest drawback. This phenomenon, compounded by ‘Shadow IT’ (deploying services without the knowledge of central IT), leads to a chaotic growth of instances and services. In a world where any developer can run a powerful infrastructure, purchasing power has been decentralised, but financial accountability rarely follows.

- The ‘Lift-and-Shift’ migration trap is often a financial Trojan horse. Moving existing applications from your own data centre to the cloud unchanged is quick, but proves costly in the long run. Applications designed for a static on-premise environment are unable to take advantage of the flexibility of the cloud. They run 24/7, generating costs even when they are idle, which is a simple way to overpay. Thus, companies are moving not only their applications but also old inefficiencies to the cloud.

A direct consequence of these problems is overprovisioning, i.e. allocating far more resources (computing power, memory) than is actually needed. For fear of performance problems, developers often choose instances ‘over-provisioning’, which is a major source of waste.

FinOps and the role of the partner: the answer to cost chaos

In response to the growing financial chaos, a new discipline has been born: FinOps. It is a holistic operational practice and cultural shift that aims to fundamentally change the way an organisation thinks about technology spend.

The main goal of FinOps is not to save money at all costs, but to maximise the business value from every penny spent in the cloud. It is about finding a smart balance between cost, speed of innovation and quality of service.

FinOps breaks down traditional silos, creating a bridge between engineering, finance and business teams. However, implementing a successful FinOps practice is a complex undertaking. It requires a unique combination of technical, financial and soft skills.

Few companies have this set-up within their own ranks, with as many as 64% of organisations reporting staff shortages in the cloud area.

In this context, the specialised IT partner becomes a strategic consultant and value architect. His or her role is to bridge this competence gap and accelerate the customer journey through the successive stages of FinOps maturity, which can be described in three phases:

- Inform: The partner implements tools and processes to ensure full cost transparency. Key here is the establishment of a consistent resource tagging policy that allows every dollar of expenditure to be accurately allocated to the appropriate team or project.

- Optimize: Armed with data, the partner moves into action. He or she brings ready-made strategies such as identifying and eliminating waste, ‘rightsizing’ (matching instance size to load) and intelligent commitment management (Reserved Instances/Savings Plans). Effective action in this phase can result in savings of 20-40%.

- Operate: This is the most important phase where the partner helps to embed FinOps practices into the day-to-day operations of the organisation, building the client’s internal capacity to manage costs sustainably on its own.

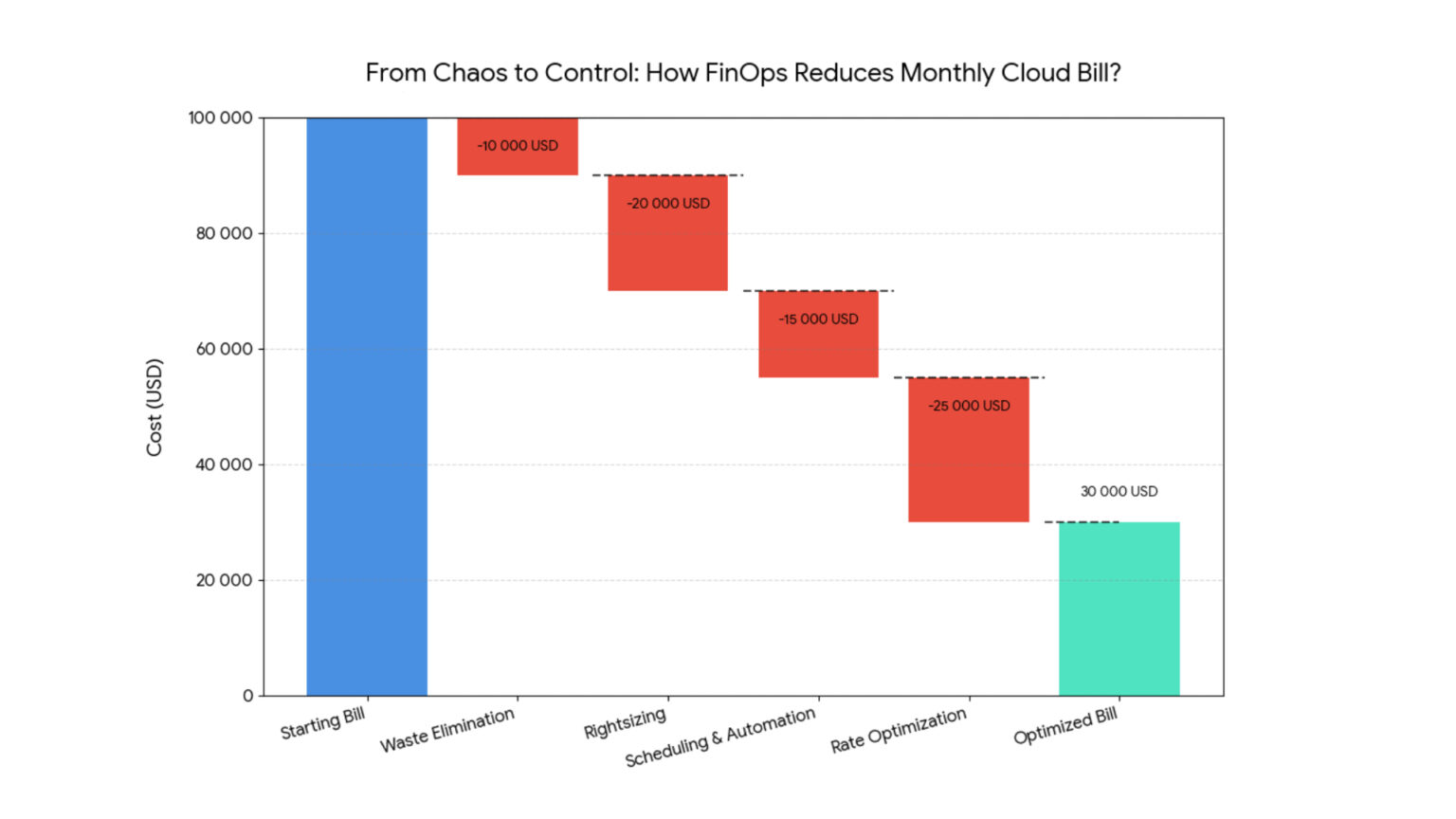

Optimisation plan in practice: from chaos to control

Working with a FinOps partner translates into a concrete, structured action plan that takes the organisation from chaos to predictability.

Step 1: Visibility and Waste Elimination (Quick Wins)

The process starts with cleaning up the environment. The partner implements consistent resource tagging and scans the environment for ‘zombie resources’ – unused disks, obsolete snapshots or idle load balancers that continue to generate costs. Their elimination results in immediate savings of 5-15% of the total bill.

Step 2: Optimising Efficiency Gains

The partner then focuses on efficiency. Rightsizing is key here. By analysing historical data, it identifies oversized resources and recommends reducing them, which can reduce costs by up to 40%. In parallel, automation is implemented that shuts down development and test environments out of hours, which can reduce their cost by up to 60-66%.

Step 3: Rate Optimisation

Once the resources are used efficiently, it is time to optimise the price. For workloads of a stable nature, the partner recommends purchasing discount instruments such as Reserved Instances (RI) or Savings Plans (SP). Committing to one or three years of computing power can give discounts of up to 75%. For interrupt-resistant tasks, spot instances are implemented, which offer discounts of up to 90%.

Step 4: Architectural Optimisation (Strategic Value)

This is the most advanced stage. The partner, in collaboration with the client’s architects, analyses the applications transferred by the lift-and-shift method. It identifies those whose refactoring towards modern, cloud-based architectures (e.g. serverless, microservices) will yield the greatest return on investment. Although refactoring requires an initial outlay, in the long term it leads to a drastic reduction in operating costs and unlocks the true economic potential of the cloud.

An investment in FinOps is an investment in the future

The journey to the cloud that began with the promise of savings has, for many companies, turned into a struggle to control costs. The problem of wastage of more than 30% is not an anomaly, but the new, painful norm.

Cloud cost management is no longer a one-off IT project. It has become an ongoing, strategic business function. The answer to this challenge is FinOps – a cultural shift that brings financial accountability to the heart of technology operations.

However, the road to FinOps maturity is long and requires unique, interdisciplinary competences. For most organisations, working with a specialised IT partner is becoming not a luxury, but a strategic accelerator.

An experienced partner brings knowledge, tools and proven methodologies that enable companies to achieve a measurable return on their cloud investments faster.

The ultimate goal is sustainable transformation – transforming the cloud from an unpredictable cost centre to an efficient engine that drives innovation and generates real business value.