A quiet revolution has been playing out in the landscape of Poland’s technology economy for several years. Devoid of the global publicity that accompanies the biggest tech hubs, the transformation of the HealthTech sector is fundamentally changing the face of national healthcare, while attracting record streams of capital.

What was a niche for enthusiasts just a decade ago is now becoming one of the hottest and most stable segments of the investment market. Driven by the growing maturity of the ecosystem and digitalisation catalysed by the pandemic, Poland is establishing itself as a leading HealthTech hub in Central and Eastern Europe.

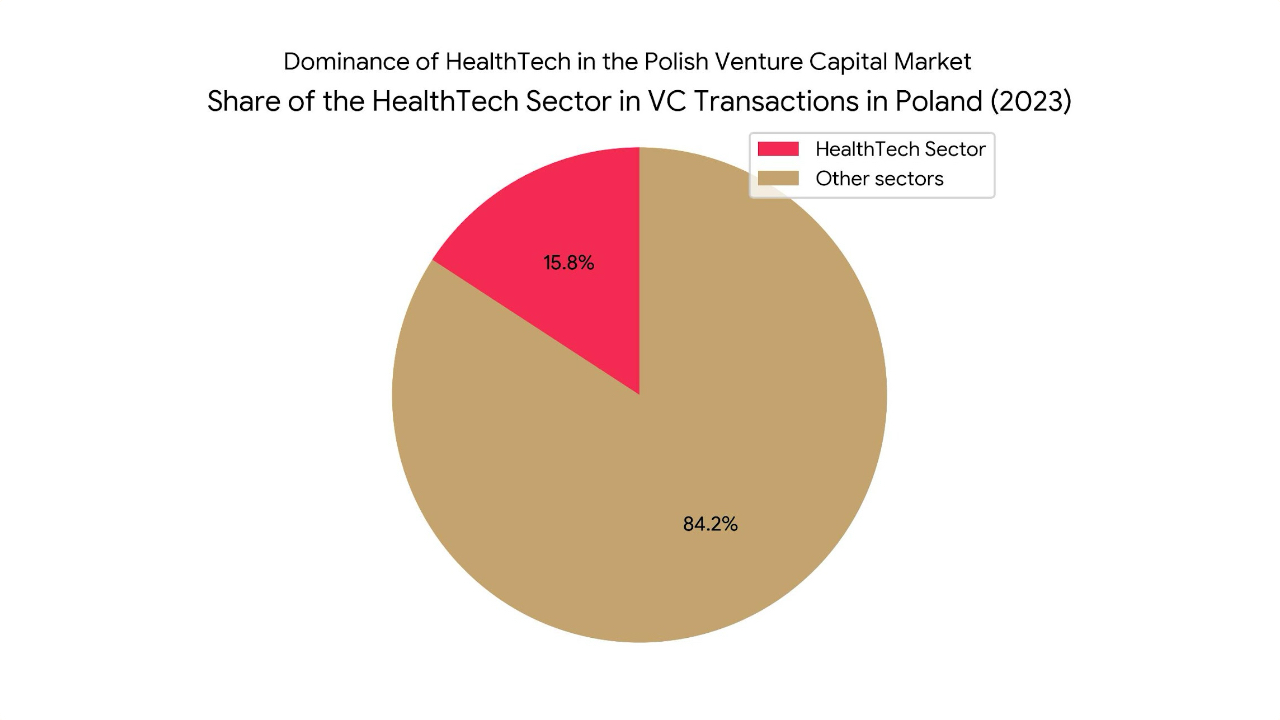

This thesis is strongly supported by the data. The health sector has consistently held the leading position in terms of the number of Venture Capital (VC) deals in Poland for the past four years, accounting for 15.8% of all funding rounds in 2023.

This is a sign that investors have not only recognised the potential, but are treating HealthTech as a strategic and volatility-proof area of capital investment. A symbol of the maturity of the market has been the global success of Docplanner (known in Poland as ZnanyLekarz), the first Polish unicorn in this sector, whose valuation has exceeded one billion euros.

This quiet revolution is gaining momentum, transforming Poland from a technology adopting country to a technology creating and exporting country.

Capital flows to health in a broad stream

Analysis of data from the Polish Venture Capital market leaves no illusions – the health sector has become its undisputed leader. Reports from the Polish Development Fund (PFR) and PFR Ventures consistently indicate that HealthTech, MedTech and BioTech startups have attracted the largest number of investment rounds since 2020.

In 2023 alone, they raked in as much as 15.8 per cent of all transactions in the market, outclassing other popular sectors.

The scale of this growth is impressive. As recently as 2019, VC funds had funded just 17 projects in the health area. By 2023, this number has risen to nearly 70. This more than fourfold increase in the number of deals has also translated into a huge increase in the value of capital.

Over the past five years, local and international VC funds have invested approximately PLN 1.3 billion in Polish medical innovations.

What is particularly telling is that the HealthTech boom is taking place against the backdrop of a global and local VC market downturn. In 2023, the overall value of the Polish VC market shrank by as much as 42% compared to the record year of 2022. In these uncertain times, HealthTech has proven to be an investment ‘safe haven’.

Its resilience stems from the fact that healthcare is based on fundamental, non-cyclical needs and that structural problems in the system, such as rising costs and staff shortages, create huge potential for technological solutions.

The development of the market is also supported by institutional initiatives such as the Healthcare Investment Hub created by PFR, which builds bridges between Polish companies and specialised European VC funds .

An ecosystem built on a foundation of unicorns

The Polish HealthTech ecosystem has reached a critical mass, counting, according to various estimates, between 100 and over 300 operating medical startups. Geographically, the scene is strongly concentrated in two centres: Warsaw (Masovian Voivodeship) and Wrocław (Lower Silesian Voivodeship), where 50% and 46% of the companies in the sector operate respectively.

However, the maturity of the market cannot be fully understood without analysing the Docplanner phenomenon. This company, founded in Poland, became the unofficial first VC-backed unicorn in the country’s history.

Its success, based on a model combining a patient-free appointment booking platform (B2C) with SaaS software for doctors and clinics (B2B), has been a powerful catalyst for the entire ecosystem.

Docplanner’s global success has proven to international investors that a Polish startup is capable of building a profitable global business. What’s more, the company has trained hundreds of managers and specialists who, having gained unique experience, have gone on to found their own startups or feed the ranks of others, creating a new wave of innovators and business angels.

As a result, the market has matured, moving from solving ‘first order’ problems (how to make an appointment) to challenges that are much more complex. Today, the ecosystem is diverse, led by companies such as Infermedica, a pioneer in the use of AI for initial symptom assessment, Tomorrow Medical, linking telemedicine to a network of physical PCPs, and StethoMe, developer of a smart stethoscope for home use that uses AI to analyse lung and heart auscultation.

HealthTech – 3 waves of the technological revolution

The evolution of the Polish HealthTech market is taking place in three distinct technological phases that build on each other.

Phase I – Normalising Telemedicine: the COVID-19 pandemic acted as a powerful accelerator. In 2020 alone, as many as 56.8 million teleconsultations were provided in primary care in Poland, accounting for 36.4% of all consultations. At the peak of the pandemic, the proportion of teleconsultations in Poland reached 62%, one of the highest rates in Europe. Remote consultation has ceased to be a curiosity and has become a standard, laying the digital foundation for a further revolution.

Phase II – The Era of Artificial Intelligence in Diagnostics: As remote communication became the norm, the market began to move from simple video consultations to sophisticated decision support systems. Artificial intelligence (AI) found its way into medical data analysis and the initial assessment of a patient’s condition. An example is the aforementioned Infermedica, whose platform conducts an initial interview with the patient and recommends the most appropriate form of assistance based on an analysis of symptoms.

Phase III (Future) – Internet of Things (IoT) and Proactive Medicine: the next phase is the Internet of Things (IoT) in medicine, which enables a shift from reactive to proactive and predictive medicine. Wearables and smart sensors can collect data on vital signs in real time, allowing early detection of health problems. Global forecasts indicate a compound annual growth rate (CAGR) for this market of around 21%. For Poland, a stable growth rate of 10.79% per year is forecast, making this segment a very promising growth area.

Challenges on the horizon: from lab to market

Despite its dynamic growth, the Polish HealthTech ecosystem faces serious challenges. The most important of these is the so-called “commercialisation gap” – the barrier between the huge scientific potential and its market exploitation.

Polish universities and research institutes conduct advanced research, but there is still a lack of effective mechanisms to turn scientific discoveries into scalable products, especially in the capital-intensive MedTech and BioTech segments.

Awareness of these barriers is growing, and with it come initiatives to build bridges between the worlds of science and business.

Examples include the POLMED Health Hub, a platform that facilitates collaboration between start-ups and mature medical companies, or the MedTech Forum created by the AstraZeneca Group, where scientists can meet entrepreneurs and gain practical business knowledge.

What does the future hold for Polish healthtech?

The Polish HealthTech sector has undoubtedly completed the ‘digital spurt’ phase and is entering a period of maturity. “Silent revolution” is getting louder and louder, and its further fate will depend on the ability of the ecosystem to overcome key challenges.

Future growth will be determined by further capital inflows, success in commercialising advanced technologies (deep-tech) and the effective integration of innovative solutions into the public healthcare system.

Poland has a unique opportunity to grow from a regional leader in technology adoption to become a significant European centre for the creation and export of medical innovations. If existing barriers can be overcome, the ‘silent revolution’ has every predisposition to become a resounding global success for the Polish economy.