Imagine the IT director of a large Polish company finalising the budget for a data centre upgrade. At the same time, on the other side of town, a freelance programmer is configuring his dream powerful laptop for work in an online shop.

Although their goals and the scale of their purchases are radically different, they have one thing in common: they both do not realise that the final amount on the invoice they will have to pay is largely shaped not in Warsaw or Wroclaw, but thousands of kilometres away – by the decisions of currency traders in New York, analysts in London and factory managers in Shenzhen.

Poland’s dynamic digitalisation and its deep integration into the global economy have made our country a significant consumer of modern technology. However, this appetite for innovation comes at a price.

Dependence on imported hardware – from servers and disk arrays to computers and components to smartphones – puts the entire Polish IT sector at the mercy of global currency markets. Any fluctuation in the US dollar or euro has a direct impact on companies’ operating costs, investment budgets and, most importantly, the prices we all pay for the technology that drives our economy.

The anatomy of Polish IT imports: Where is the technology stream coming from?

In order to understand the specifics of IT imports, it is first necessary to situate them in the overall landscape of Polish foreign trade. Data from the Central Statistical Office (CSO) paints a picture of an economy deeply integrated with international markets.

In recent years, we have seen dynamic changes in the value of both exports and imports, with the trade balance oscillating between positive and negative values, indicating a high sensitivity to the global economic situation.

A key piece of this puzzle is the geographical structure. Developed countries, and in particular the European Union, have the largest share of Polish trade, both on the export and import side.

In total imports, the share of developed countries is around 65%, with EU partners accounting for more than 52%. This dominance is the foundation on which many analyses are based, but in the case of the IT sector it can be misleading, masking the true origins of technology.

The analysis of IT equipment imports faces some methodological challenges. Publicly available CSO data does not distinguish a precise category covering only ‘computers, servers and components’.

However, we can use with a high degree of confidence a proxy category that largely captures the scale and trends of this phenomenon. This is SITC section 7: ‘machinery, plant and transport equipment’. The rationale is twofold.

Firstly, it is the largest single category in the structure of Polish imports, regularly accounting for more than 35% of their total value. Such a high share testifies to the fact that the Polish economy, in its development and modernisation, is strongly dependent on imports of capital goods and advanced technologies, in which IT equipment plays a key role.

Secondly, it is in this broad category that the vast majority of computer, telecommunications and server equipment imported into Poland is classified.

The CSO data clearly indicate Poland’s three main import partners. The podium is invariably occupied by Germany, China and the United States. Understanding the role of each of these countries is key to analysing the impact of exchange rates.

- Germany: Our western neighbour is number one, accounting for around 19.3% of all Polish imports. However, in the context of IT, Germany’s role is primarily that of a giant logistics and distribution centre for the whole of Europe. Much of the equipment we formally import from Germany was not manufactured there. These are goods originating from factories in Asia or designed in the USA, which come to Poland through German ports and warehouses.

- China: With a share of around 14.4%, China acts as the ‘factory of the world’. It is where the lion’s share of finished consumer products (laptops, smartphones, monitors) and key components come from.

- United States: The USA’s share of Polish imports is around 5.0%. However, the country’s role is much larger than this figure suggests. The US is a source of intellectual property, designs, advanced software and key high-margin components such as processors and specialised integrated circuits. Significantly, Poland records a significant deficit in trade with the USA, meaning that the value of imports from this direction significantly exceeds the value of exports.

It is also worth mentioning other important players from Asia, such as South Korea (around 2.9% of imports), which is a powerhouse in memory and display manufacturing, as well as Vietnam and Taiwan, key links in the global semiconductor supply chain.

Memories, displays, USD components

A fundamental conclusion emerges from this simple table: although IT equipment arrives in Poland from various geographical directions and transactions with European intermediaries take place in euros, at the very financial basis of this trade is the US dollar.

Germany’s role as a ‘gateway to Poland’ for technology goods obscures the picture. The base cost of the server that the Polish distributor buys from the German intermediary was calculated on the basis of the price that this intermediary paid to the Chinese factory – and this price was denominated in dollars. The euro transaction is therefore only the last step in a chain whose beginning was denominated in dollars.

The dollar king, the euro prince: A currency duopoly in the world of technology

To understand why the USD/PLN exchange rate is so important for IT equipment prices in Poland, it is necessary to grasp the global role of the US currency. The dollar is the default currency of global technology trade for historical and structural reasons.

The key components at the heart of any modern device – semiconductors, processors, memory bones – are priced and sold in dollars, whether the factory is in Taiwan, South Korea or Malaysia.

The dollar is the global language of trade in the IT industry. All major global IT spending forecasts, market value analyses and contract valuations are universally quoted in US dollars.

The euro plays a different, but also important role. It is first and foremost a transaction currency within the single market of the European Union. A Polish importer, buying equipment from a distributor in Germany, the Netherlands or France, will most likely receive an invoice and make payment in euros.

The EUR/PLN exchange rate therefore has a direct impact on the final cost of such a transaction. However, it must constantly be borne in mind that the price in euros set by the European intermediary is already derived from the price he himself paid for the goods – and this, as we have established, was almost certainly expressed in dollars.

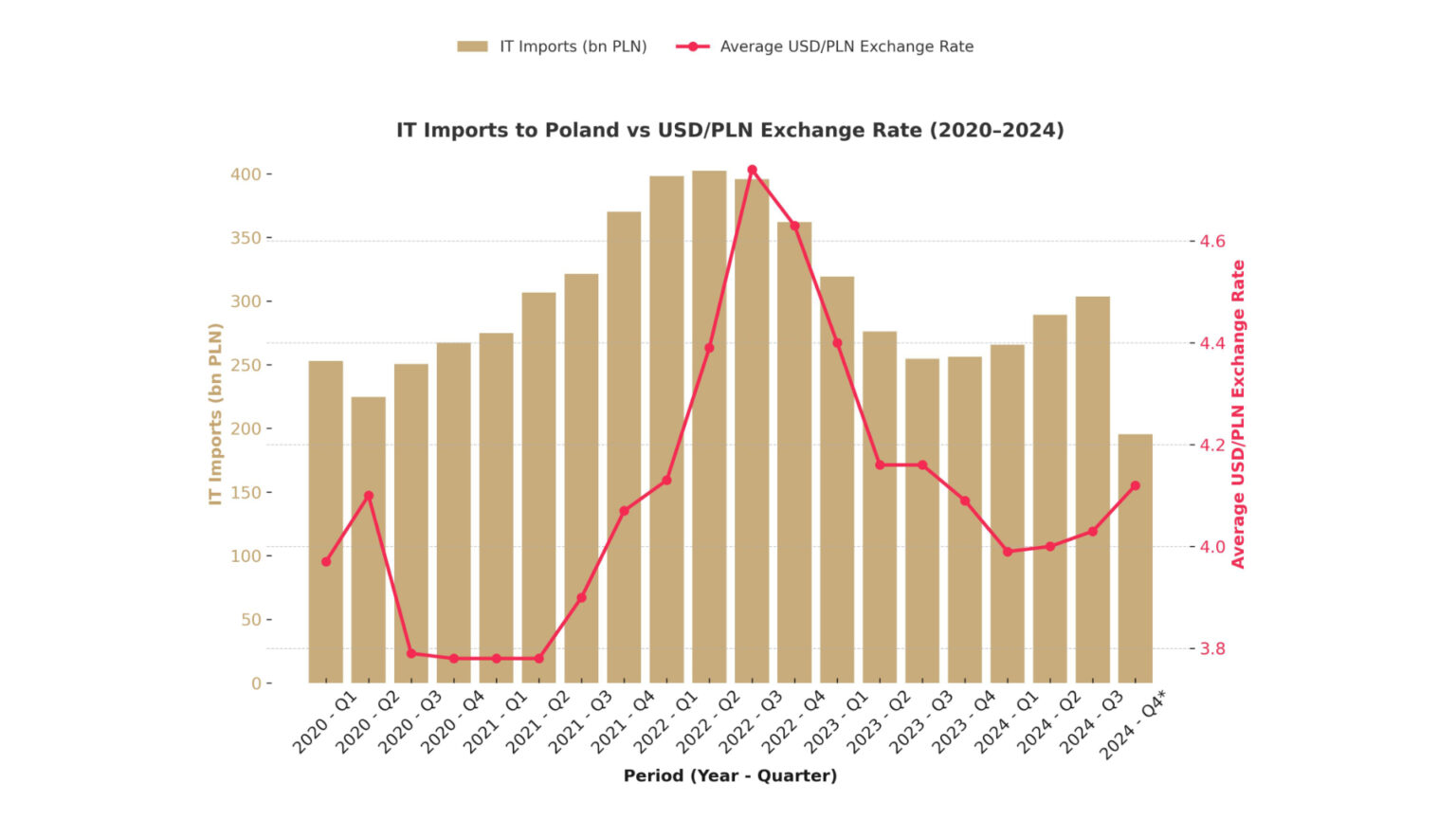

Understanding the scale of the problem requires a look at historical currency quotations. The National Bank of Poland’s data, publicly available in accessible formats, makes it possible to track these changes.

The USD/PLN and EUR/PLN exchange rate charts of recent years show periods of rapid volatility, often correlated with global events such as pandemics, geopolitical crises or changes in the monetary policies of major central banks. Each peak on the USD/PLN chart is a direct blow to the profitability of importers and a potential price increase for end users.

This dominance of the dollar creates a direct and often underestimated link between US monetary policy and the budgets of Polish companies. Decisions taken by the US Federal Reserve (Fed) in Washington on interest rates often have a greater and faster impact on equipment prices in Poland than decisions by the European Central Bank or even the National Bank of Poland.

When the Fed raises interest rates, this usually leads to a strengthening of the dollar on global markets. As a result, the USD/PLN exchange rate rises, meaning that you have to pay more PLN for the same dollar. As a result, the underlying cost of importing all IT equipment rises almost immediately.

From factory to desk: How do fluctuations translate into shelf price?

Let’s examine how a change in the exchange rate translates into the price of a laptop that eventually reaches the desk of an employee in Poland.

- Invoice from the manufacturer (in USD): A Chinese laptop assembly plant invoices a Polish importer for, say, USD 1 million for a container of equipment.

- Purchase cost for the importer (in PLN): At the time of ordering, the USD/PLN exchange rate is 3.90. The theoretical purchase cost is PLN 3.9 million. However, payment is deferred for 60 days. During this time, as a result of market turbulence, the exchange rate rises to 4.20. The actual cost the importer has to incur to buy dollars and pay the invoice rises to 4.2 million PLN. The difference of PLN 300,000 is a pure cost resulting from the exchange rate change.

- Distributor margin: The importer adds transport, insurance, customs and its margin to its base purchase cost (PLN 4.2m).

- Retail price (in PLN including VAT): The equipment reaches the shop, which adds its margin and 23% VAT to the purchase price from the distributor. In this way, the original cost increase is not only passed on, but compounded at each subsequent distribution stage.

However, this mechanism does not work as a simple automaton. There are several factors that introduce delays. Distributors and retailers sell goods that are physically in their warehouses, purchased weeks or even months earlier, at a completely different rate.

This buffer acts as a shock absorber. In addition, the Polish electronics market is highly competitive. In the event of an unfavourable exchange rate change, companies may face a dilemma: raise prices and risk losing customers, or take some of the increase on themselves, accepting a temporary reduction in their own margins.

It would be a mistake to attribute all price movements solely to currency fluctuations. In recent years we have witnessed a ‘perfect storm’ of factors that have overlapped:

- Disruption in supply chains: Pandemic and geopolitical crises have caused chaos in global logistics, driving up freight costs.

- Component shortages: The global semiconductor crisis directly affected the cost of manufacturing devices.

- Inflation and manufacturing costs: Rising energy, raw material and labour costs in Asian production centres are pushing up the base dollar price of equipment.

- Technological progress: each new generation of equipment is initially more expensive to produce.

A close observation of the market reveals a regularity: retail prices tend to rise relatively quickly when the zloty weakens, but fall much more slowly when the zloty strengthens.

This phenomenon, known as ‘price stickiness’, has a business rationale. When the exchange rate is unfavourable, importers need to protect their margins. However, when the zloty strengthens, goods bought at a higher exchange rate are still sitting in warehouses and companies are tempted to maintain higher prices and enjoy higher profitability.

Behind the scenes of imports: The silent war on currency risk

No serious importer leaves the fate of their business at the mercy of daily currency quotations. Doing business in such a volatile environment requires active management of exchange rate risk. Importers have a whole arsenal of financial instruments at their disposal to hedge against adverse movements.

- Forward contracts: This is the most popular tool. The importer agrees with the bank to buy USD 1 million in three months’ time at a predetermined rate, regardless of what the market rate will be at that time. Such a transaction eliminates uncertainty and allows selling prices to be precisely calculated.

- Currency options: This is a more flexible but also more expensive solution that can be likened to ‘insurance’. The importer buys the right, but not the obligation, to buy the currency at a certain rate. This protects against loss, while allowing you to benefit from successful developments.

- Online currency exchange platforms: For smaller transactions, specialised platforms offer much more favourable rates and lower transaction costs than traditional banks.

These strategies, although invisible to the end customer, have a direct impact on them. Through hedging, importers introduce price stability. This is why the price of a laptop in the shop does not change daily with the NBP exchange rate table.

These actions smooth out market volatility. However, it is important to remember that this certainty comes at a price. Hedging is not free. Banks charge for their services and this ‘insurance cost’ is included in the final price of the product. Consumers, in an indirect way, therefore pay a small premium for price stability.

Event horizon: Forecasts and strategies for the world of Polish IT

The analysis clearly shows that the Polish IT market is structurally dependent on imports, with costs inextricably linked to global currency markets. Looking ahead, the trajectory of IT equipment prices in Poland will depend on several key variables.

Macroeconomic forecasts regarding the monetary policy of the US Federal Reserve, geopolitical stability and the general condition of the Polish economy and the strength of the zloty will play a primary role. Periods of appreciation of the zloty may bring relief to import costs, potentially stimulating investment and lowering prices for consumers.

In a world where economies are inextricably interconnected, understanding the flow of currency is becoming as crucial for the technology industry as understanding the flow of data. For Poland’s digital economy to grow sustainably, its leaders, professionals and informed consumers need to navigate both realities seamlessly.