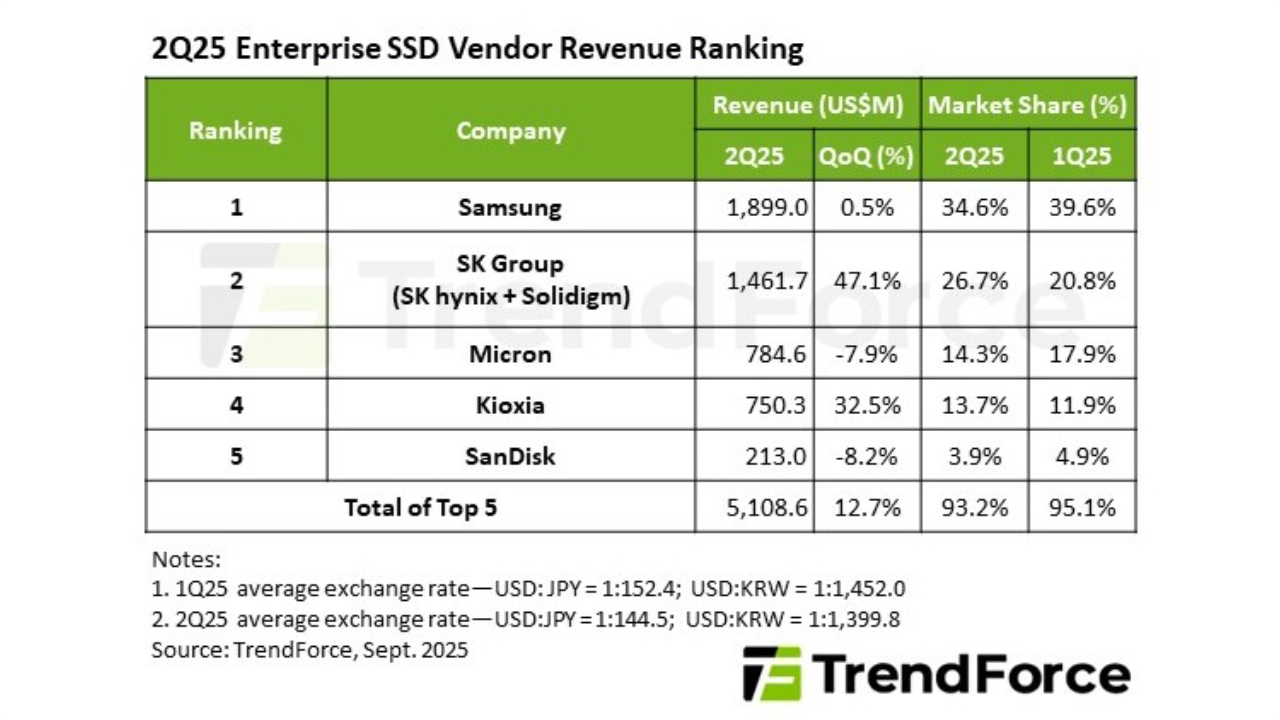

The enterprise SSD sector is experiencing strong growth, driven by investments in infrastructure for artificial intelligence. Revenues for the top five players exceeded $5.1bn, growing 12.7% quarter-on-quarter.

However, behind the optimistic data lie serious challenges in the supply chain that determine who wins and who gets left behind.

The main driver of the market is the growing appetite for computing power, stimulated by the upcoming release of the Blackwell platform from NVIDA and the continued expansion of server rooms by North American cloud service providers (CSPs).

New AI systems require ultra-fast and high-capacity storage media capable of handling gigantic language models without lag, which directly translates into a surge in enterprise SSD orders.

Nevertheless, the market has collided with a supply barrier. Manufacturers are facing shortages of legacy DDR4 memory, used in SSD controllers, and extended lead times for chip substrates.

These bottlenecks in production mean that not everyone is able to take full advantage of market prosperity. The ability to effectively manage inventory and plan production has become a key factor in determining financial performance.

The leader remains Samsung, whose revenues remained stable at $1.9 billion.

With a wide presence in the North American market and less susceptibility to DDR4 availability issues, the company has been able to capture a significant proportion of urgent orders, consolidating its dominance.

The biggest winner of the quarter, however, was the SK Group (SK hynix and Solidigm). Reporting revenue growth of an impressive 47.1 per cent to $1.46 billion, the company broke its historic record. This success was driven by growing demand for high-capacity drives from key US cloud customers.

In third place was Micron, with revenues of $784.6m, down 7.9%. The company is experiencing some delays in the validation process of its latest high-capacity media, which could limit its growth potential in the second half of the year.

An excellent result was achieved by Kioxia, increasing revenues by 32.5% to $750 million. The Japanese manufacturer’s competitive advantage turned out to be its so-called hybrid binding technology, which is key to accelerating AI applications.

Rounding out the pack is Western Digital, whose enterprise SSD division (included in the report as SanDisk) generated $213 million in revenue (down 8.2%).

Despite growing shipments, the company’s limited presence in the AI server segment has left it behind its competitors.

Analysts point out that the future of the market will be defined by three trends: the rapid pace of innovation forced by AI, increasing pressure from Chinese manufacturers and the need to balance new and older manufacturing technologies.

Supply-demand mismatches may become the new normal and profitability will depend on precision in planning and agility in the supply chain.