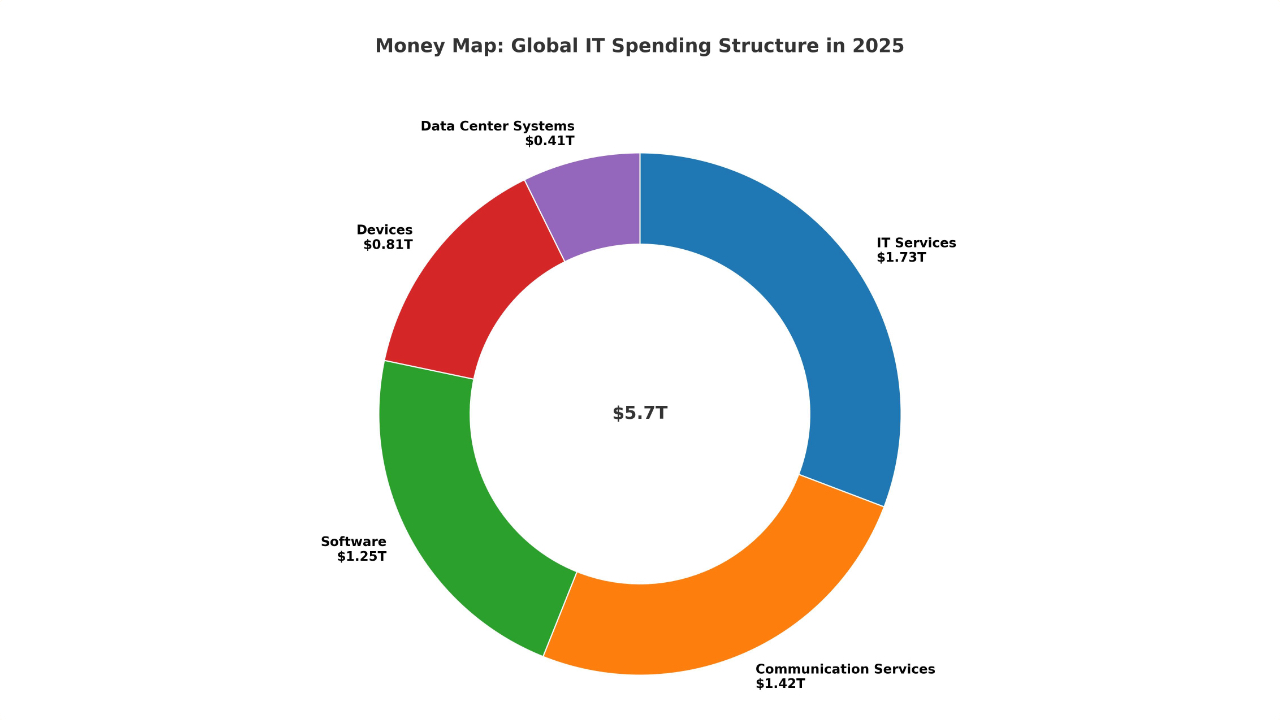

The global IT market is on the verge of an unprecedented boom. Leading analyst firms such as Gartner forecast that global IT spending will reach an astronomical $5.7 trillion in 2025, an impressive increase of more than 9% from 2024.

Other forecasts, although differing in detail, agree on one thing: we are witnessing a historic influx of capital into the technology sector. However, to stop at this headline figure would be a mistake. The amount itself, while impressive, is merely a facade for a much deeper and more fundamental transformation.

The story that this money tells is not about simple growth, but about a strategic and rapid reorientation of global business.

The real story lies in the asymmetry of this growth. While the overall market is growing by around 9%, some segments are exploding. Spending on data centre systems is set to grow by a staggering 23.2% and on software by 14.2%.

Communication services, on the other hand, will see a much more modest increase of just 3.8% . This disproportion is no accident. It is evidence of a conscious, strategic business decision that can be called the ‘Great Reallocation’ of capital.

Companies are not just spending more; they are actively shifting resources from one area to another, de-prioritising maintenance of the status quo in favour of aggressive investment in intelligence and services.

IT budgets in 2025 are not just bigger – they are smarter, more focused and ruthlessly geared towards a future where software and artificial intelligence are no longer support tools, but the very heart of value creation.

The AI gold rush: from grand experimentation to pragmatic integration

The undisputed driver of spending in 2025 is generative artificial intelligence (GenAI). It is the epicentre of the ‘Great Reallocation’, attracting capital at a scale that is redefining investment priorities around the world.

The physical manifestation of this gold rush is a monumental expansion of infrastructure. Spending on AI-optimised servers is forecast to reach $202 billion by 2025, doubling spending on traditional servers.

The entire data centre systems segment is expected to grow by the aforementioned 23.2 per cent as a direct result of the demand for computing power required to train and deploy advanced AI models .

At the forefront of this boom are the hyperscalers – cloud giants such as Amazon Web Services, Microsoft Azure and Google Cloud. These companies, along with IT service providers, will account for more than 70% of all IT spending in 2025. Their role is evolving.

They are no longer just infrastructure-as-a-service (IaaS) providers; they are becoming the foundation of a new, oligopolistic market for AI models.

At the same time, the market is maturing at an extremely fast pace. The phase of unrestricted, often chaotic experiments with AI inside companies is coming to an end. Many companies have bumped into a wall: the capital and operational costs of creating their own models have turned out to be much higher than expected, the skills gaps in the teams have been too large, and the return on investment (ROI) from pilot programmes has been disappointing.

As a result, a key change in strategy is taking place: a shift from an expensive ‘build’ model to a pragmatic ‘buy’ model. IT directors are no longer creating GenAI tools from scratch; instead, they are buying off-the-shelf functionality that software providers build into existing platforms.

The market is entering a phase that Gartner refers to as the ‘bottom of disillusionment’ (trough of disillusionment) . Paradoxically, this does not mean a decline in spending, only a decline in unrealistic expectations.

Companies are moving away from chasing revolutionary breakthroughs to practical applications of AI that increase employee productivity, automate processes and give real competitive advantage.

Software-defined economics: how your car explains the future of business

The spectacular growth in spending on software (+14.2%) and IT services (+9%) is the strongest signal yet that we are witnessing the birth of a new economic paradigm . You don’t have to look far to understand its essence – just look at the transformation taking place in the automotive industry.

The Software-Defined Vehicle (SDV) model is an excellent, tangible case study that illustrates how physical products are transformed into platforms for delivering high-margin, cyclical digital services.

The SDV revolution is the fundamental separation of the hardware layer from the software layer in the vehicle. This allows carmakers to deploy new features and enhancements continuously, via Over-The-Air (OTA) wireless updates, without having to physically interfere with the car.

This completely changes the nature of the product. The car ceases to be an asset whose value diminishes over time and becomes a dynamic platform capable of generating revenue throughout its life cycle.

Manufacturers are already experimenting with new business models: BMW is testing subscriptions for heated seats and Volkswagen plans to offer autonomous driving features in a pay-as-you-go model.

However, this trend is not limited to automotive. It is a leading indicator of the universal transformation of business models. The entire software market is moving towards subscription and Software-as-a-Service (SaaS) models.

Software is the fastest growing technology sector and is predicted to account for 60% of global technology spending growth by 2029 . This confirms that the SDV model heralds a broader shift in which the boundaries between product and service are blurring.

In this new economy, the IT department, traditionally seen as a cost centre, is being promoted to the role of central value creator.

The chief information officer (CIO) and chief technology officer (CTO) become key figures in the product strategy, and their expertise is essential to the creation of the company’s core product.

Professional 2025: shaping a modern IT skill set

Technological and business transformation is having a profound impact on the labour market, reshaping the demand for skills. To succeed in this dynamic environment, IT professionals need to develop a hybrid skill set, combining deep technical knowledge with sustainable ‘soft’ skills.

The analysis of the labour market for 2025 leaves no doubt: the most sought-after professions are almost entirely technology-related. At the top of the lists are AI and machine learning specialists, data analysts and cyber security analysts.

Demand for cyber security professionals alone is forecast to increase by 33% between 2023 and 2033, with artificial intelligence, data analytics, cloud computing and programming, with a particular focus on the Python language, dominating among the key technical skills employers are looking for.

However, technical proficiency alone is no longer sufficient. As AI takes on more and more analytical tasks, the value of skills that machines cannot easily replicate increases.

Employers are increasingly prioritising abilities such as analytical and creative thinking, complex problem solving, emotional intelligence and adaptability.

Artificial intelligence will certainly lead to a displacement of the labour market. It is estimated that AI could automate up to a quarter of job tasks in the US and Europe, especially routine tasks such as basic programming or customer service.

However, the dominant expert narrative does not focus on mass unemployment, but on the transformation of work. AI is not so much eliminating occupations as redefining them, creating new, often more strategic roles. In this new occupational landscape, the ‘half-life of technological skills’ is now less than five years .

This means that continuous learning agility is becoming the most important meta-skill. The future of work is not about competition between humans and AI, but about their symbiosis.

The most effective professionals are those who master the art of using AI as a collaborative partner to enhance their own creativity and productivity.

Navigating the next wave of IT transformation

Analysis of global IT spending trends for 2025 clearly shows that we are witnessing profound, structural changes. We are seeing a shift from spending more to spending smarter, and the AI market is maturing, moving from building to integrating off-the-shelf solutions.

At the same time, business models are evolving from selling products to selling services, forcing a transformation in the labour market – from static roles to dynamic skills.