After years of structural problems and strategic missteps, Intel seems to finally be catching the wind in its sails. Investors, who have watched the tech giant’s melting lead anxiously for the past quarters, are beginning to believe in CEO Lip-Bu Tan’s turnaround plan. The numbers speak for themselves: the company’s shares are up an impressive 84 per cent in 2025, outclassing the benchmark semiconductor index, which has gained 42 per cent in that time.

The foundation for this optimism, however, is not just market speculation, but real changes to the capital and operating structure. Strategic cash injections – $5 billion from Nvidia and $2 billion from SoftBank, backed by US government commitment – proved crucial. This gave Tan the necessary financial flexibility to combat the ‘bloated management structure’ and accelerate the transformation of the manufacturing model. The market responded enthusiastically, with at least ten brokerages raising their recommendations on the company in the past two months.

Data centres remain the driving force behind the results. According to LSEG data, Intel will report a more than 30 per cent jump in revenue in this segment, reaching $4.43 billion. Paradoxically, the AI boom, which initially pushed Intel onto the defensive, is now stimulating demand for its traditional server processors, which are needed to work with competitors’ GPUs. Analysts are even predicting double-digit price increases for server processors in 2026, heralding improved margins in the long term.

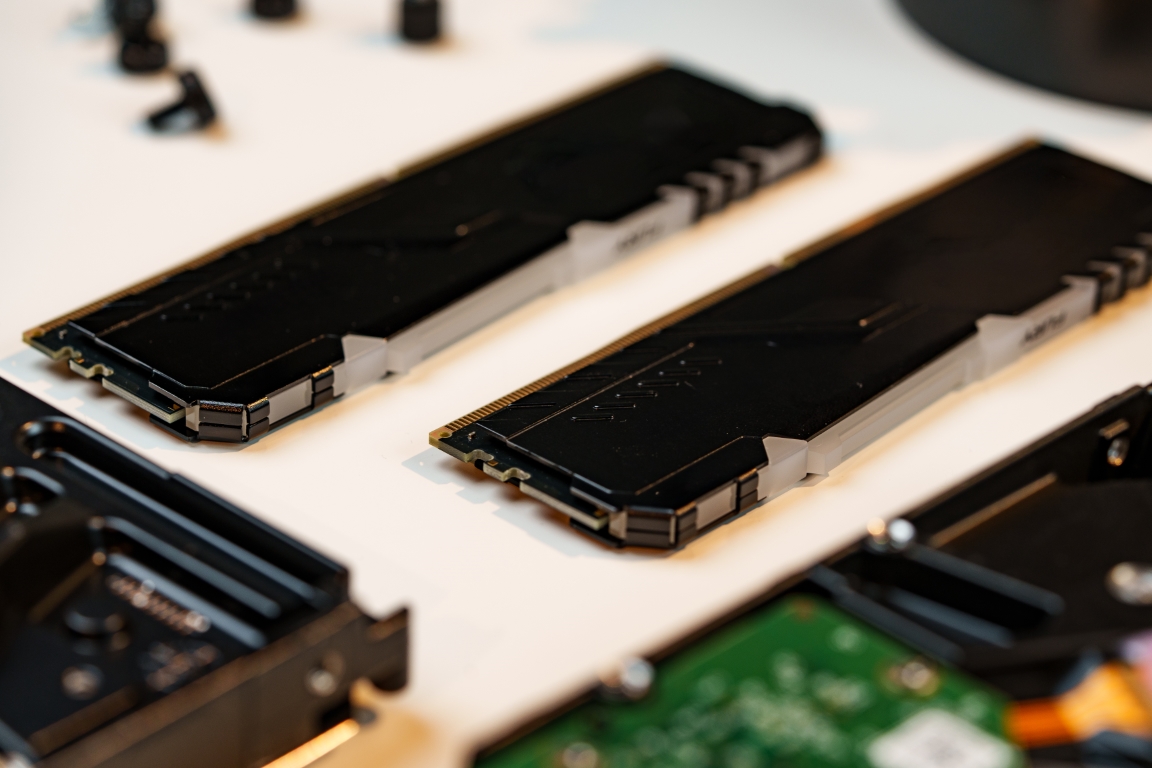

The picture is not without its cracks, however. Rebuilding PC market position is still a challenge. Intel is losing share to AMD and the Arm architecture, and the global rise in memory prices – which account for up to 30 per cent of the material cost of a PC – could chill demand for new laptops. UBS analysts even forecast a 4 per cent decline in PC shipments in 2026.

However, the biggest test for Tan’s strategy remains production in 18A lithography. Although the company has started shipping ‘Panther Lake’ chips made in its own factories, yield rates are still at levels that limit wide availability to external customers such as Broadcom and Nvidia. The pressure on profitability is evident – adjusted gross margin is expected to fall to 36.5 per cent. Intel therefore faces a clear choice: it must prove that it can produce cutting-edge chips not only for itself, but also for the market, before investor confidence runs out.