In 2023, investment expenditures in the Polish economy exceeded PLN 461 billion. Although nominally a record, a deeper analysis of the CSO data reveals a worrying trend of polarisation. We are facing a two-speed economy: while the financial sector is aggressively deploying AI and the cloud, industry is approaching digitalisation with great reserve and SMEs are still struggling with the basics. Where does the money for the IT industry lie in this landscape?

Digital transformation in Poland is no longer a homogeneous process. Just three years ago, at the height of the pandemic, everyone and everything was digitalising. The figures for 2023 and the first half of 2024 show a paradigm shift: the time for simple hardware purchases is over and the stage of efficiency verification has begun. For technology providers and decision-makers in SME companies, the lessons from the hard data are clear – the market is maturing, but unevenly.

Spending map: Finances are fleeing, industry is stabilising

When analysing the flow of money into the market, it is important to distinguish between two key categories: growth rate (who is accelerating?) and investment volume (who is spending the most?).

The financial and insurance sector is the clear leader of the transformation. According to the Central Statistical Office (CSO), the dynamics of investment expenditures in this section amounted to 137.1 (real growth of more than 37% year-on-year). Banks and insurers, with the highest digital maturity index (6.2 points on a 10-point scale according to KPMG ), are running ahead. Their investments are no longer just in infrastructure, but increasingly in ‘soft’ technologies: cyber security, hyper-personalisation of the offering and advanced data analytics.

At the other extreme in terms of dynamics, but at the first in terms of volume, is Industrial Processing. It is here that more than PLN 98.5 billion in capital expenditure was located. However, dynamics at 103.9% means in practice stagnant development, taking into account producer inflation. The industry is investing heavily, but still mainly in ‘hard’ machinery and production lines. Digitalisation in this sector is insular – it is implemented where it directly reduces the cost of manufacturing a product (robotisation) and less frequently where it builds new value (AI, Data Driven Manufacturing).

ICT sector paradox: Why is investment falling?

The most surprising data in the CSO reports is the decline in investment dynamics in the ‘Information and Communication’ section alone (a fall of around 15% year-on-year in real terms). Does this indicate a crisis in the technology industry?

On the contrary. This signals a fundamental change in the business model that the IT industry needs to understand. Technology companies (software houses, service providers) are migrating fastest from the CapEx model (investment in fixed assets, e.g. own server rooms) to the OpEx model (operating costs, e.g. cloud). Instead of buying servers (which the CSO sees as an investment), companies are renting computing power from hyperscalers (which is not shown in this column). This is confirmed by the dynamic growth of the cloud market in Poland – by 34% year-on-year, to nearly PLN 4 billion. The decline in IT ‘investment’ is therefore in fact evidence of… growing technological maturity of this sector.

Verifying the myths: AI and the cloud in practice

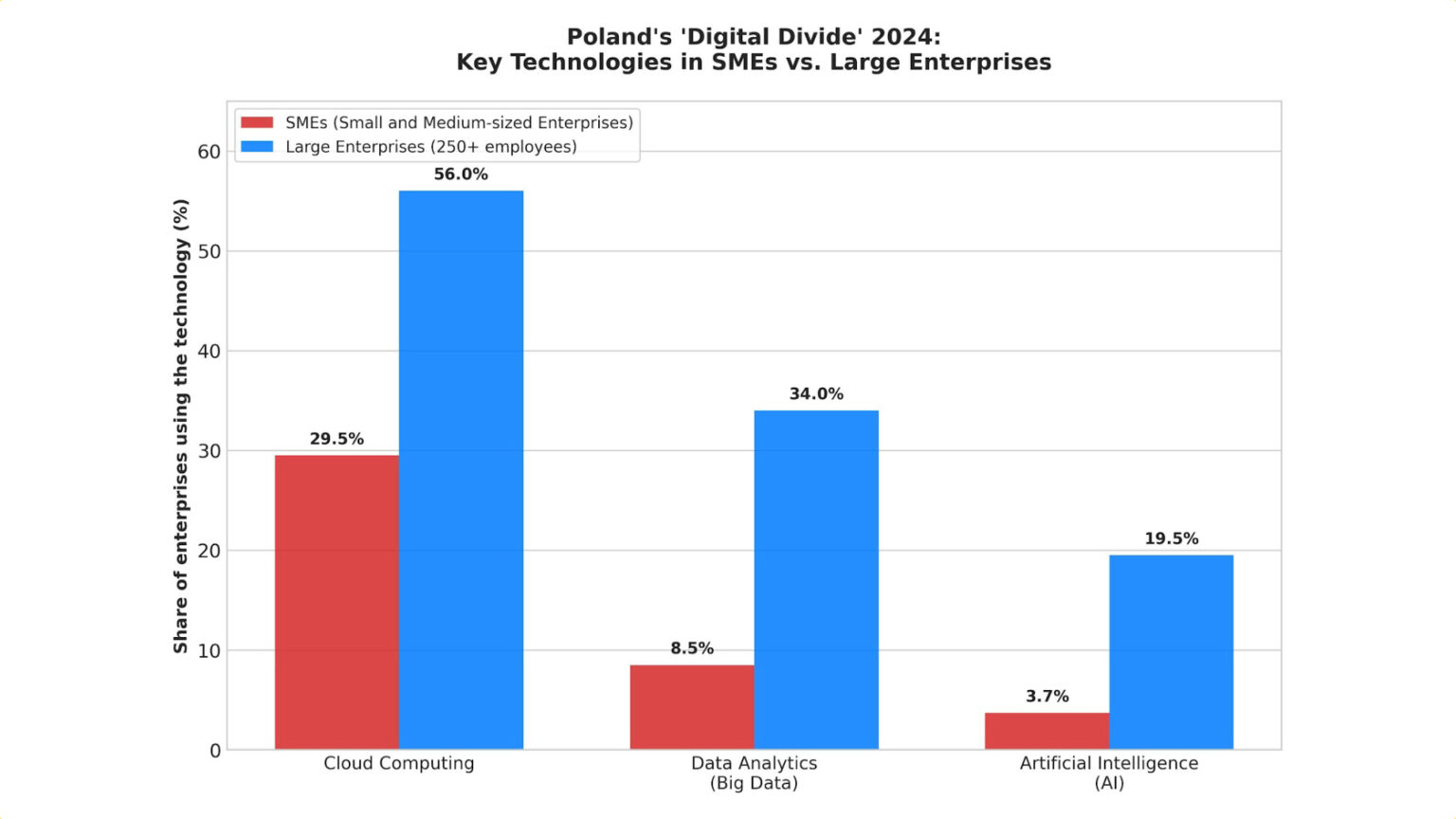

If we look beyond finances, to the real use of technology, the picture of Polish digitalisation becomes more stark.

1. cloud computing: 45.2% of companies in Poland were using it in 2023. The result seems decent until we look deeper into the statistics. The dominant use is email (82.7% of cloud users) and file storage. Advanced uses, such as cloud databases (43%) or computing power for applications (25%), are still the domain of the big players.

2 AI: Here the gap between declarations and reality is the largest. Although market reports suggest that as many as 83% of industrial companies are planning to invest in AI , hard data from Eurostat and the Central Statistical Office bring them down to earth. In 2023, only 5.9% of Polish companies will have made real use of artificial intelligence technologies. This gives us one of the last places in Europe (with an EU average of around 8% and leaders such as Denmark with 27.6%).

SMEs in a technological debt trap

A key problem in the Polish IT market is the barrier to entry for the SME sector. While large corporations (250+ employees) have cloud adoption rates of 78%, the SME sector is only 44%.

The main barrier is no longer just a lack of capital, but a lack of strategy. As many as 51% of small businesses operate without a formalised digital transformation plan. As a result, IT investment in SMEs is often haphazard, forced by failures or regulations (e.g. KSeF), rather than a desire to build competitive advantage. An additional inhibitor is data waste – in industry, up to 56% of operational data is not used analytically in any way.