We are witnessing a profound polarisation of the technology market

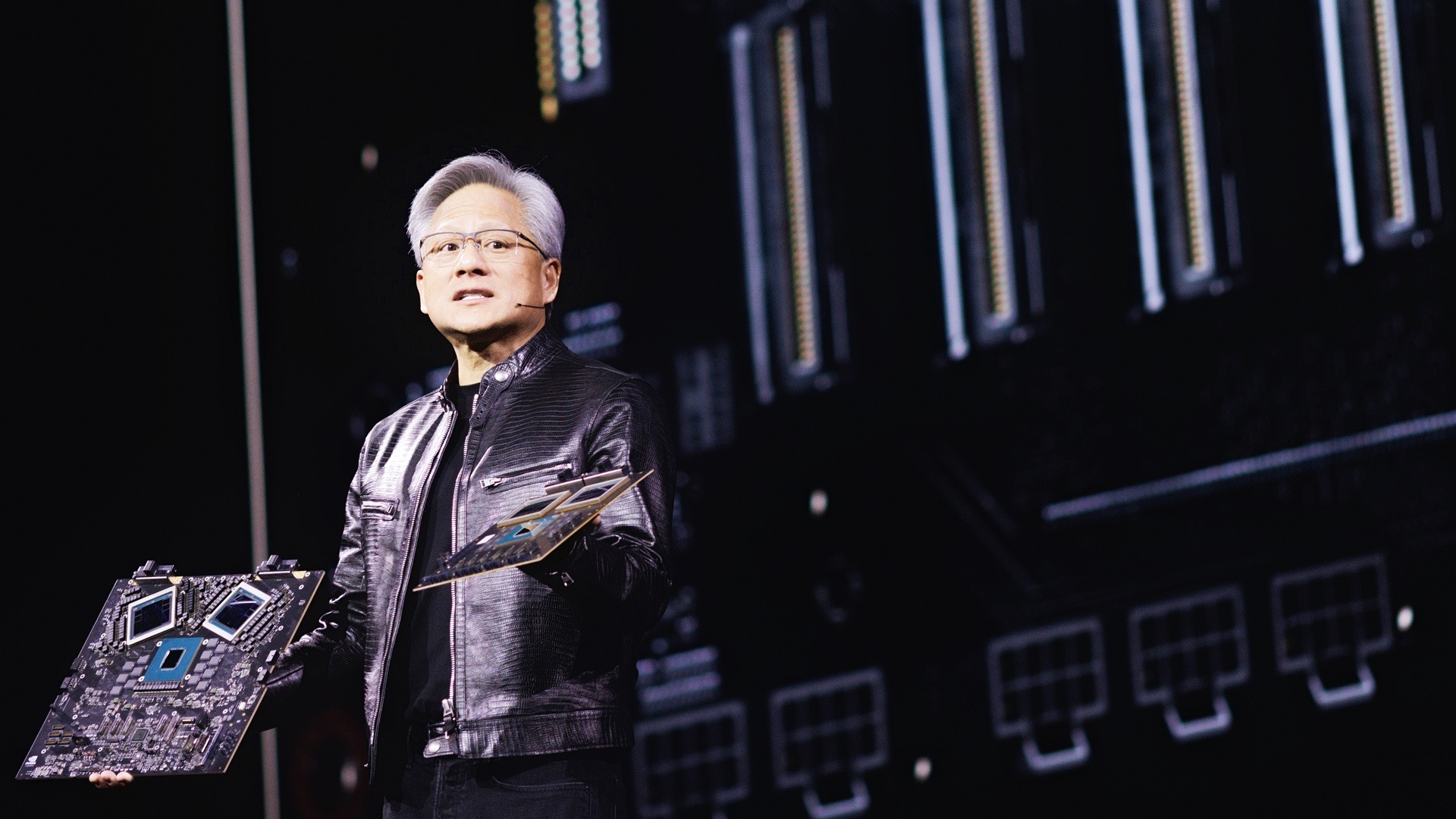

On the one hand, we are seeing segments with exponential growth. Huge investments are flowing towards building specialised computing centres for artificial intelligence. These are driven by strategic pressure and fear of losing competitiveness.

On the other hand, fundamental business systems and industry applications are in a zone of pronounced caution. Their development is hampered by a period of business uncertainty and the exhaustion of the organisation with constant change.

The problem is that the industry is investing heavily in building powerful computing engines, but neglecting to modernise the operating systems that would make effective use of this power.

Mass computing power

There is no doubt what is catalysing the rapid growth. Gartner is straightforward about the competition to build AIyinfrastructure and the growing demand for AI-optimised servers. This is reactive action, not just calm, strategic planning.

This dynamic is being driven by the powerful narrative of a new industrial revolution requiring dedicated computing power. This is redefining perceptions of IT spending – it is no longer an operating expense, but is becoming a strategic investment of the magnitude of building a key industrial infrastructure.

Moreover, Gartner rightly points out that growth in demand for servers remains constrained by insufficient supply. This market situation inevitably leads to behaviour dictated by concerns about resource availability. Organisations are buying computing power not only because they have an immediate plan to use it, but also because they fear losing access to it in the future.

This is confirmed by analysts. Their comments suggest that current spending on generative AI is mainly coming from technology companies building the infrastructure itself. The foundations are being laid, but what about the building to stand on them?

| 2025 Expenditure | 2025 Growth (%) | 2026 Expenditure | 2026 Growth (%) | |

|---|---|---|---|---|

| Data centre systems | 489 451 | 46,8 | 582 446 | 19 |

| Equipment | 783 157 | 8,4 | 836 275 | 6,8 |

| Software | 1 244 308 | 11,9 | 1 433 037 | 15,2 |

| IT services | 1 719 340 | 6,5 | 1 869 269 | 8,7 |

| Communication services | 1 304 165 | 3,8 | 1 363 058 | 4,5 |

| General IT | 5 540 421 | 10 | 6 084 085 | 9,8 |

Stagnation

This is where we arrive at the second, slower sphere of the market, where there is a completely different business climate.

The Gartner report, the starting point of our analysis, is unequivocal on this point: growth in spending on software and services is not recovering at the same rate. In particular, industry-specific software – i.e. key systems that manage finance, logistics or production – is the most sensitive to economic fluctuations and political uncertainty.

We are faced with a fundamental paradox: management is prepared to approve a multi-million pound investment in GPU clusters, but at the same time postpones the decision to upgrade an ageing ERP or CRM system.

How is this possible? The answer lies in the redistribution of resources and human factors.

Firstly, IT budgets are not unlimited. Other market analyses indicate that the projected growth in total IT budgets for 2025 is modest, often ranking below the historical average. So if AI spending is growing exponentially, and the overall budget is growing linearly, this must mean that AI investments are eating up resources at the expense of other projects.

Secondly, there is decision-making marasm in organisations. After years of intensive digital transformation, necessitated by the pandemic, managers show less willingness to embark on further complex, multi-year modernisation projects.

The syndrome of disappointed expectations

This growing gap between the pace of infrastructure investment and the readiness of business applications leads us straight into a trap. It’s a scenario where initial enthusiasm collides with the hard realities of implementation, leading to deep disappointment.

Many organisations may soon be faced with having state-of-the-art AI centres idling. The reason is simple: artificial intelligence algorithms require fuel in the form of high-quality, structured data. This data, on the other hand, is very often stuck in outdated, monolithic legacy systems – the very ones in the stagnant area.

AI to optimise the supply chain? A great idea, provided logistics systems provide real-time data. AI is to personalise customer interactions? A modern, integrated CRM system is essential for this.

Analysts, commenting on the PC market, note that new AI-ready PCs do not yet have the key applications that would justify replacing the hardware. The same principle, albeit on a much larger scale, applies to data centres. We are building infrastructure for applications that have not yet been developed, while neglecting to upgrade the systems that are essential to their operation.

Strategy = integration

This dual model of the IT market is inefficient in the long term and has high strategic risks. In 2026, the competitive advantage will not be built by those organisations that merely amassed the most computing power. The winners will be those who have been able to deeply and strategically integrate it into their core business processes.

This means that the biggest challenge for IT directors today is not the technology purchase itself. It is ensuring investment consistency.

The role of the CIO is evolving. From a technology manager, it is becoming a key strategist, responsible for synchronising rapid infrastructure development with the necessary modernisation of business foundations.

If this synchronisation does not happen, the projected $6 trillion, rather than a testament to a revolution, will become a monument to a global investment in potential that has never been fully realised.