The European public sector is experiencing a transformation on an unprecedented scale. Acting as a global stress test, the pandemic exposed decades of neglect and became a powerful catalyst for change. Today, driven by a stream of funding from EU programmes, digitalisation has ceased to be an option and has become a strategic imperative.

For Polish IT companies, this opens up a historic opportunity for expansion and lucrative contracts. This is not just another wave of modernisation – it is a real, centrally-funded digital arms race.

The compass setting the course for these changes is the Digital Decade 2030 programme. In it, the European Commission has set ambitious targets: by the end of the decade, 100% of key public services are to be available online and every EU citizen should have access to a digital identity (e-ID).

The engine for these investments is the Recovery and Resilience Facility (RRF). Across the Union, we are talking about tens of billions of euros allocated directly to digitisation projects in administration, e-health or e-justice.

In this dynamic landscape, digital lead markets such as Estonia and Malta would seem to be the intuitive direction. However, the greatest potential for new, large-scale projects lies elsewhere – in countries that can be described as ‘ambitious contenders’.

These are countries which, starting from a lower base, are dynamically catching up thanks to political determination and funds from the RRF. This is where the Polish integrator has the opportunity to become not just a supplier, but a strategic partner in the national digital transformation.

Digital Europe map: leaders, stragglers and rising stars

In order to accurately identify the most promising markets, it is necessary to understand how the digital maturity of government is measured. A key tool is the annual eGovernment Benchmark report, which assesses public services in 35 European countries from the perspective of ‘life events’ such as starting a business or losing a job. It analyses services in terms of their user orientation, transparency, use of key technologies (such as e-ID) and cross-border accessibility.

The latest 2024 report draws a fascinating picture. The average score for the EU27 countries is 76 out of 100, indicating steady progress. However, the analysis divides the markets into three segments:

- Digital Leaders (Malta, Estonia, Luxembourg): Extremely mature and saturated markets. Competition is huge here and opportunities lie in highly specialised niche solutions, e.g. using AI or blockchain.

- Solid Players (Finland, Denmark, Lithuania): Countries with a high level of digitalisation, but still with room for optimisation. Tenders here can be for upgrading existing platforms or improving cross-border services.

- Ambitious Pretenders (Greece, Poland, Cyprus): This is the most interesting group from the perspective of seeking new large contracts. They are recording the highest growth rates and EU funds are driving large-scale transformation projects there.

Analysis of the data leads to a fundamental conclusion: there is a clear correlation between a high score in the Key Enablers category and overall digital maturity. Countries at the top of the ranking, such as Malta and Estonia, have advanced and widely used digital identity systems.

Without secure and convenient e-ID, administrations can only offer simple information services. Therefore, countries with digitisation ambitions but a low score in this category will have to invest in building or upgrading their identity systems first.

For the Polish integrator, this is a clear signal that tenders for e-ID, e-signature and e-credentialing systems will be an absolute priority in the ‘contender’ markets.

Beyond the ranking – identification of markets with the highest growth potential

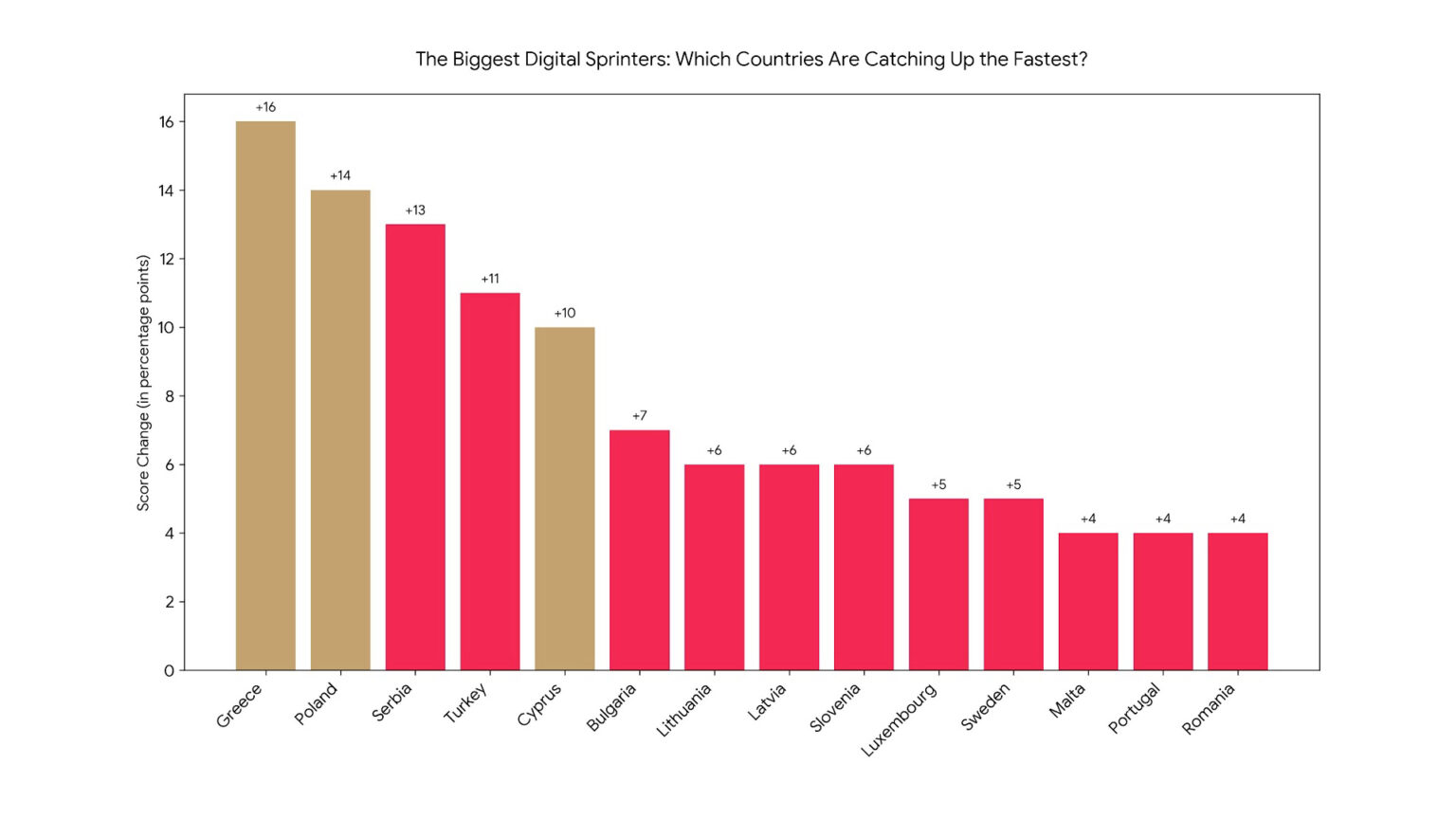

A static ranking does not tell the whole story. The real value lies in analysing the dynamics of change. It is not the leaders that generate the greatest demand, but the countries that have made the biggest leap in rankings in recent years.

Greece: the absolute leader in dynamism. In just four years, Greece has improved its ranking by 16 points – the biggest jump in the whole of Europe. The country, which until recently was seen as a digital marauder, is now pursuing an ambitious transformation programme, fuelled by significant funding from the RRF.

Poland: With an increase of 14 points, Poland is the runner-up for growth in the EU. This proves that our domestic market is also undergoing intensive investment and is an extremely attractive field.

Cyprus: with an impressive rise of 10 points, Cyprus is another market to watch. Like Greece, starting from a lower base, Cyprus is investing in the fundamentals of the digital state.

Where does this remarkable dynamic come from? It is the result of a synergy of political will and a powerful financial injection from the EU’s Reconstruction and Resilience Facility (RRF). More importantly, these countries’ investments are not in niche improvements, but in fundamental, large-scale systems, such as the construction of central registries, the implementation of national e-service platforms or the creation of digital identity systems.

For large IT integrators, these are ideal opportunities to win flagship contracts.

Poland compared to Europe – the domestic market as a springboard for success

Poland’s impressive rise in the eGovernment Benchmark ranking proves that great opportunities lie just beyond the threshold. Experience gained on home ground can become the most valuable capital in international expansion.

Poland’s digital administration is a picture of contrasts. On the one hand, we are a European leader in certain areas, e.g. in terms of online access to medical data. On the other hand, there is still a large gap between central and local administration, and cross-border services need to be improved. These weaknesses are at the same time huge market niches.

A key driver of the transformation in Poland is the National Recovery Plan (NERP). Out of a total pool of EUR 59.8 billion, as much as 21.3% (around EUR 12.7 billion) has been earmarked for digital purposes. This is a gigantic stream of money that will be invested in cyber security (EUR 532 million), digitisation of administration (EUR 100 million) or digital education (EUR 1.2 billion).

Polish IT companies should use the domestic market as a testing ground. Every successful project carried out in Poland under the KPO becomes a powerful ‘export ticket’. A Polish company that successfully implements a KPO-funded project gains invaluable know-how.

It can then offer the same proven solution to a Greek ministry or a Cypriot government agency, arguing that it understands perfectly the specifics of RRF-funded projects. This is a powerful competitive advantage.

From analysis to contract

The theoretical analysis materialises in the form of specific public contracts, which can be found on the Tenders Electronic Daily (TED) portal – the official EU platform with free access to thousands of advertisements. Systematic monitoring of the portal is not only a way to find orders, but also a form of market intelligence.

Here are examples that support these claims:

- Greece – AI-based innovation: the Greek Ministry of Digitalisation has launched a tender with an estimated value of €19.1 million for the implementation of AI-based solutions in public administration. This is perfect evidence of a ‘technological leap’ – a country catching up with the most advanced technologies right away.

- Cyprus – Building Data Foundations: A health insurance organisation in Cyprus is looking for a contractor to create, implement and maintain a data warehouse. This is an example of a foundational project that demonstrates the huge demand for building key elements of the data infrastructure.

- Poland – Cyber Security at Local Level: The tender launched by the Municipality of Lagiewniki to upgrade its cyber security illustrates a market niche at the local government level. Hundreds of similar, smaller tenders create a huge, fragmented market, ideal for medium-sized IT companies.

Armed with experience and high-calibre specialists, Polish technology companies today have a historic opportunity to become not just contractors, but key architects of this change, building their position on the international stage for years to come.