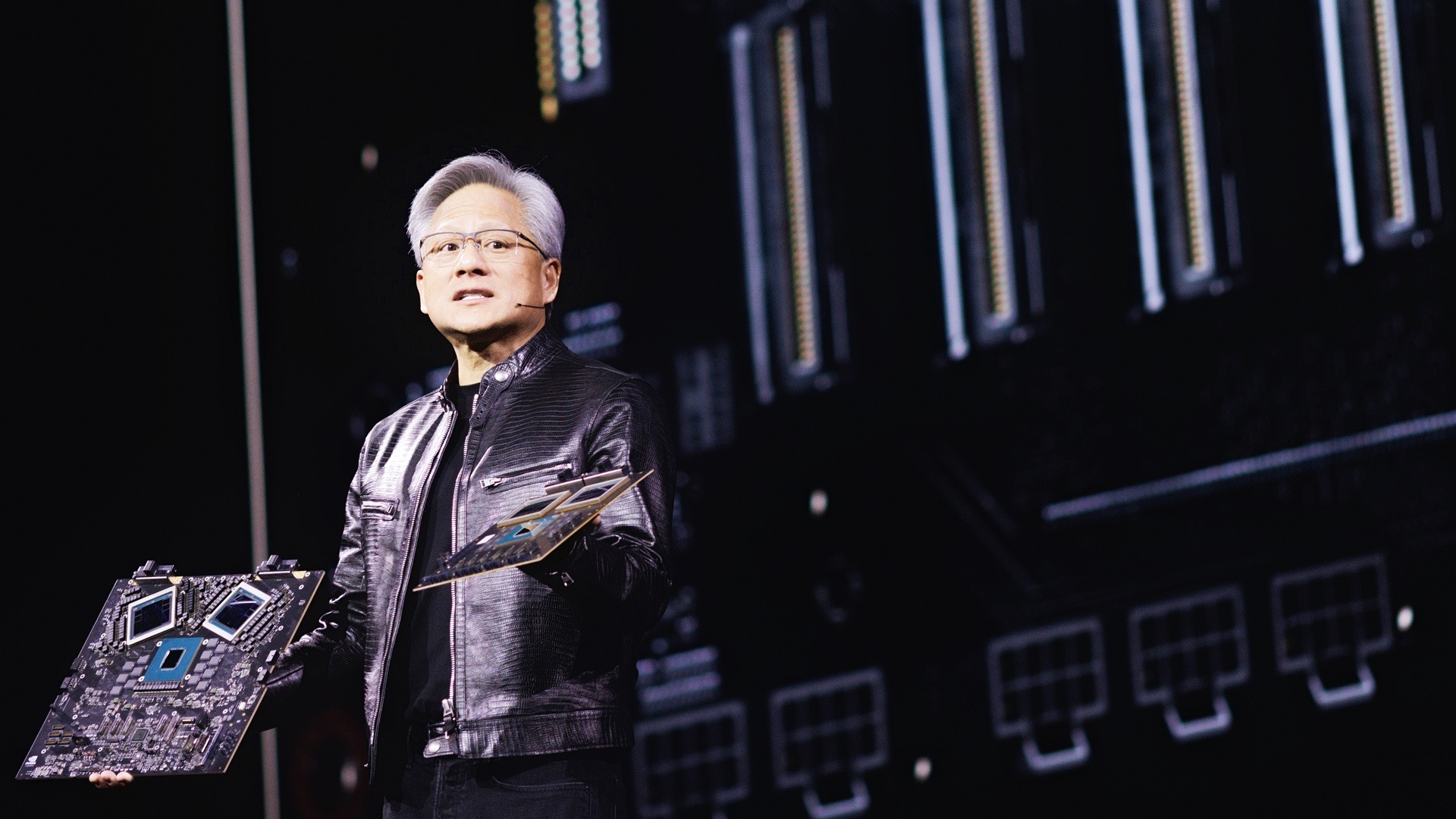

The IT hardware sector, which had been riding the wave of artificial intelligence promises for the past few quarters, collided with hard market reality on Tuesday. Morgan Stanley analysts, in a note that immediately cooled sentiment on Wall Street, downgraded the entire industry to ‘cautious’. This is a clear signal to CFOs and investors that the period of easy gains is over, and 2026 could bring a painful review of sales plans.

Investment bank experts warn of the formation of what they have termed a ‘perfect storm’. It is made up of three critical factors: a marked slowdown in demand, recurring component cost inflation and over-inflated valuations of technology companies. The floor reaction was instantaneous. The shares of infrastructure giants such as Hewlett Packard Enterprise, Dell Technologies and NetApp dived by around 5 per cent, dragging the entire industry index down with them. Logitech also came under pressure, with its recommendation downgraded to ‘underweight’.

For business decision-makers, however, the most relevant information comes not from the stock prices themselves, but from the hard data underlying this discount. A recent Morgan Stanley survey indicates that corporate IT leaders plan to increase hardware budgets in 2026 by just a token 1 per cent, the weakest reading in 15 years, excluding the anomaly of the pandemic period. What’s more, surveys of sales intermediaries (VARs) suggest that between 30 and 60 per cent of business customers are prepared to drastically reduce planned purchases of servers, PCs and storage if manufacturers continue to pass on rising component costs.

While investment in AI-dedicated infrastructure remains a bright spot on the spending map, it cannot fully offset broader macroeconomic concerns. Uncertainty is compounded by the Donald Trump administration’s tariff announcements and rising memory prices, as highlighted by Citigroup in its separate analysis. Analysts conclude that with such elastic demand and rigid production costs, the risk of a downward earnings revision for 2026 is now higher than ever. For companies, this means they need to revise their purchasing strategies and prepare for tougher negotiations with technology suppliers, who will struggle to maintain margins.