The global video conferencing market, growing by 5% a year despite economic uncertainty, is proving its strength. However, the real revolution is happening behind the scenes. While the market is becoming increasingly ‘commoditised’, the key to victory is no longer just image quality, but strategic alliances, artificial intelligence and the conquest of the gigantic, still undeveloped potential of meeting rooms.

The paradox of growth – labour transformation instead of product revolution

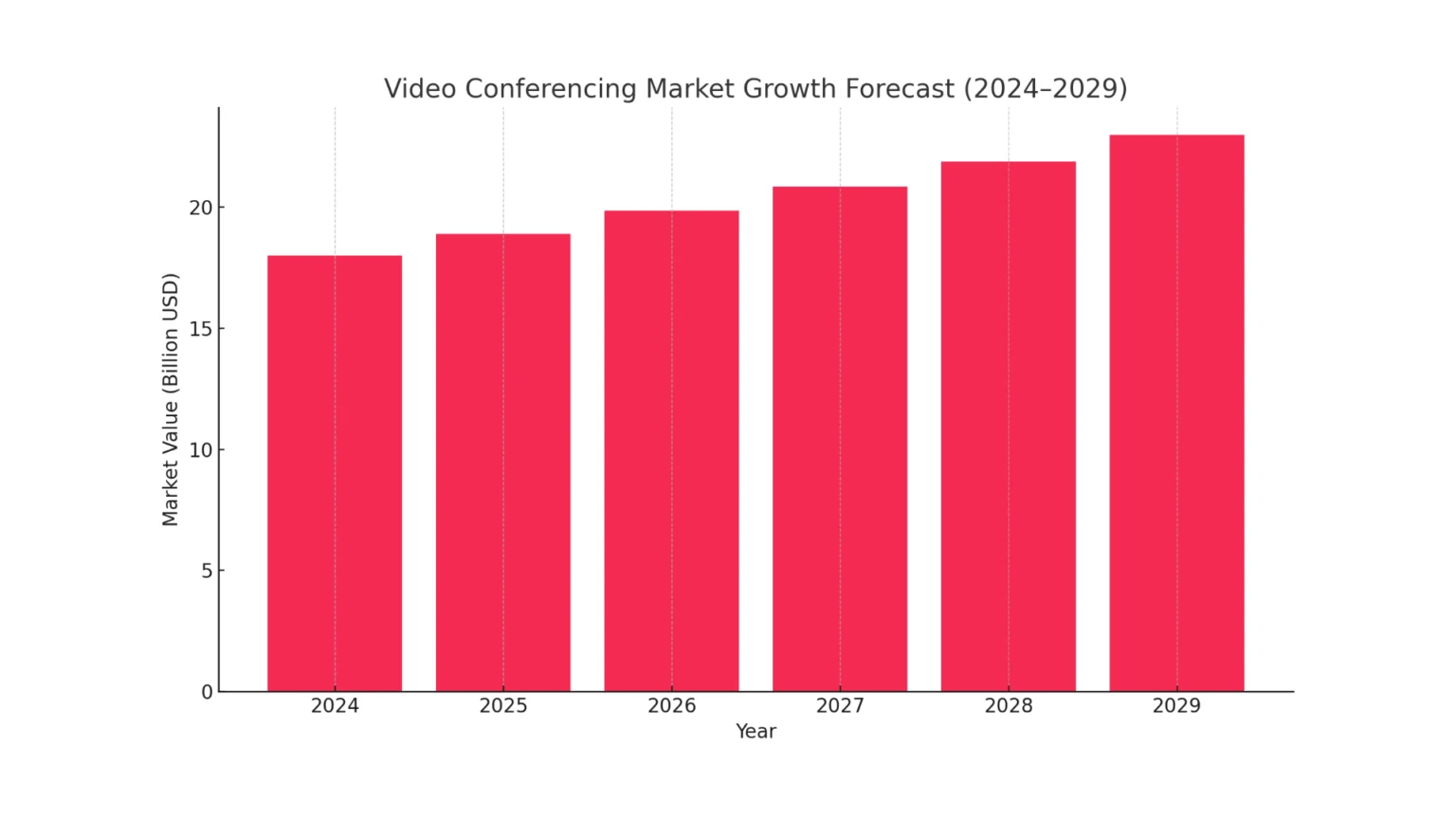

At first glance, the video conferencing market seems to defy logic. Despite a difficult geopolitical and economic environment, it reached $18 billion in 2024, recording 5% year-on-year growth. Analysts forecast that this pace will be maintained, with the prospect of reaching $21 billion by 2029. Other analyses are even more optimistic, pointing to the value of the market reaching between $24 billion and even $60 billion by the beginning of the next decade.

At the same time, the same market is becoming a victim of its own success. The market is becoming increasingly commoditised, with very little product differentiation between vendor offerings. Basic features such as HD video, screen sharing and chat have become standard. So if the driver of growth is not a product revolution, what is? The answer is clear: a fundamental and permanent transformation of the global working model. Companies are no longer buying a virtual meeting tool; they are investing in a strategic infrastructure to connect dispersed teams, increase productivity and ensure business continuity. Video conferencing has become the communications backbone of the modern organisation, and the value has shifted from product features to its role in the wider business ecosystem.

Growth is also being driven by expansion into new markets. While North America (42% subscription market share) appears saturated, Asia and Oceania (25% share) are showing ‘promising growth’. At the same time, the market is deepening its penetration in sectors such as healthcare, education and finance, demonstrating that video conferencing has moved far beyond traditional corporate applications.

Microsoft: architect of the new ecosystem

In a market where victory depends on control of the entire ecosystem, no one plays the game more effectively than Microsoft. Its strategy is a textbook example of ‘platformisation’, where the goal is not to sell Teams applications, but to dominate the entire value chain.

The starting point is the dominant 49% market share of paid virtual meeting services. The source of this power is the deep integration of Teams into the Microsoft 365 ecosystem, making it an integrated functionality rather than an additional expense for millions of companies. The second pillar of the strategy is the Device Certification Programme for Microsoft Teams. On the surface it is a quality control mechanism, but in reality it is a powerful strategic control tool. By setting rigorous standards, Microsoft de facto dictates the development roadmap for equipment manufacturers (OEMs) such as Logitech, Poly and Yealink, who must align their products with the giant’s vision in order to gain access to its huge customer base.

The strategy is complemented by a global network of implementation partners, motivated by the specialisation “Meetings and Meeting Rooms for Microsoft Teams” , and a smart licensing model. By offering a free Teams Rooms Basic licence and a paid Teams Rooms Pro licence, Microsoft is encouraging deeper integration. It is the Pro version that unlocks the full capabilities of the ecosystem, including advanced AI features, dual-screen support and, from an IT perspective, key remote management and analytics, closing the monetisation cycle.

Hidden treasure: the battle for the conference room

The real battle for the future of the video conferencing market is not about personal licences, but about physical meeting rooms. This is where the gigantic untapped potential lies. Omdia’s data is clear: only 28% of all meeting rooms worldwide have any form of video conferencing equipment, and only 6.25% of these are fully standardised, native rooms such as Microsoft Teams Rooms or Zoom Rooms. This means that around 72% of the rooms are a technology desert.

In response to this market opportunity, two philosophies of room fit-out have crystallised:

- Native systems (e.g. Microsoft Teams Rooms, Zoom Rooms): They rely on standardisation, simplicity and central management by IT. They offer a consistent user experience (‘one-touch join’) and high security, but at the expense of flexibility and the risk of dependence on a single provider.

- BYOD/BYOM (Bring Your Own Device/Meeting) systems: Prioritise flexibility, allowing users to use their own laptops and any software. They are cheaper to implement, but generate potential security risks and compatibility issues, putting a strain on support departments.

The market quickly realised that the ‘either-or’ choice was suboptimal. In response, a third way is emerging: all-in-one video bars, often based on Android. These devices, offered by companies such as AVer, operate in dual mode. They can function as a native, centrally managed Teams or Zoom room and, at the same time, when connected to a laptop via USB, switch to BYOD mode, becoming a high-quality peripheral for any application. This solution reconciles the conflicting interests of IT and users, making it the likely dominant architecture for meeting rooms in the future.

Alliances in the shadow of giants

In a market reality dominated by platform giants, a ‘lone wolf’ strategy is a recipe for failure. The value for the customer is shifting to the holistic, integrated experience that results from the synergy between software and hardware. Strategic alliances are becoming an absolute necessity.

Integrated ecosystem model: Logitech and Microsoft

The partnership between Logitech and Microsoft is an exemplary example of deep vertical integration. Logitech offers a wide range of ‘Certified for Teams’ devices, covering every conceivable need. Key here is the joint innovation in the area of AI. Advanced software functions, such as IntelliFrame and Copilot in Teams, require high-quality data from the hardware. Therefore, Logitech’s hardware innovations, such as smart cameras or RightSound 2 audio technology, are designed to enhance Microsoft’s AI services, creating a true symbiosis.

The open ecosystem model: Poly (HP) and Zoom

The strategy of Zoom and its key hardware partner, Poly, is an alternative to Microsoft’s closed garden. It focuses on openness and hardware innovation. Poly’s DirectorAI smart camera technology becomes a powerful hardware argument for choosing the Zoom Rooms ecosystem. Interoperability is also a key element of the strategy.

A future defined by AI and ecosystems

Analysis of the video conferencing market leads to a clear conclusion: the era of video conferencing as a standalone application is over. The future belongs to intelligent, integrated collaboration platforms, and success will be determined by the strength and cohesion of an ecosystem in which the battle for the meeting room becomes a strategic objective.

The new frontier of differentiation and a key driver of value is becoming artificial intelligence. As core functions become commoditised, it is AI-driven capabilities – such as automated meeting summaries , intelligent speaker tracking and predictive analytics – that will drive competitive advantage. The future of meetings is not just about being able to see and hear each other, but having an intelligent assistant that understands the context of the conversation and actively supports team productivity. The $18 billion market is just the tip of the iceberg. The real prize is the creation of a technology infrastructure that will support trillions of hours of virtual and hybrid collaboration in the coming decade. That prize will be won – or lost – right in the boardrooms of the future.

| Strategic feature | Microsoft Teams ecosystem | Ecosystem Zoom |

|---|---|---|

| The main challenge | Providing flexibility in a multi-platform world. | Competing with the distribution strength and bundled offerings of Microsoft. |

| Dominant Business Model | Selling an integrated platform (Microsoft 365) where Teams is a key element. | Selling communication services as ‘best-of-breed’, with an increasing emphasis on the platform (Zoom Workplace). |

| Hardware strategy | Ecosystem control through a rigorous ‘Certified for Teams’ certification programme. | Building alliances with leading equipment manufacturers (e.g. Poly, Neat, DTEN) and promoting equipment innovation. |

| Approach to the Conference Room | Priority for native, standardised ‘Microsoft Teams Rooms’ for consistency and management by IT. | Strong support for ‘Zoom Rooms’, but also a strong emphasis on flexibility and interoperability with other platforms. |

| Key Partners | Hardware: Logitech, Poly, Crestron, Yealink. Channel: Global network of partners with ‘Meetings and Meeting Rooms’ certification. | Hardware: Poly (HP), Logitech, Neat, DTEN. Interoperability: Pexip. |

| AI strategy | Deep integration with Copilot, leveraging data from across the M365 ecosystem. Hardware-based AI (IntelliFrame) enhances AI in the cloud. | Development of own AI Companion and intelligent functions (e.g. Zoom Intelligent Director) in close cooperation with hardware partners. |

| Core Strength | Network effect and customer attachment to an integrated Microsoft 365 package. | Perceived ease of use, flexibility and strong branding in video communication. |