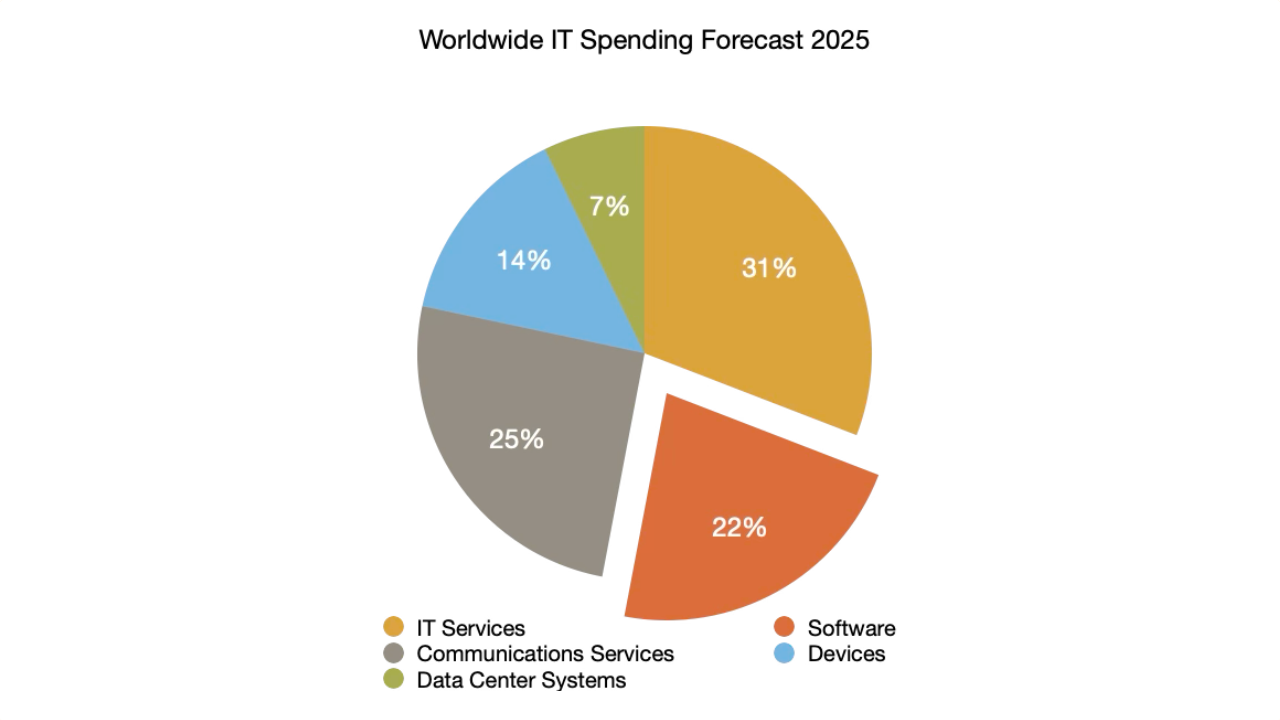

The technology landscape in 2025 presents a fascinating paradox. On the one hand, global IT spending is set to soar. Analysts at Gartner forecast an increase of 7.9 per cent to $5.43 trillion , while other forecasts predict an increase of up to 9.3 per cent to $5.74 trillion.

On the other hand, this impressive growth is taking place against a backdrop of global economic uncertainty, geopolitical risk and unprecedented pressure on CIOs to justify every penny spent.

While artificial intelligence, cyber security and cloud modernisation are the undisputed drivers of growth, the real story of 2025 is the battle for efficiency. CIOs are being forced to reallocate resources from maintaining outdated systems to strategic innovation, making budget optimisation not just a financial exercise but a key competitive strategy.

This is echoed by Gartner’s John-David Lovelock, who notes that although budgets are increasing, much of it will only be used to cover price increases, which will distort the perception of nominal spending versus real IT investment.

Anatomy of an IT budget for 2025: where does the money flow?

In order to understand how companies allocate their resources, we need to break down the typical IT budget. Although every organisation is different, analysing market trends allows us to create a representative model that sheds light on key priorities.

The lion’s share of any IT budget, at around 35%, is taken up by salaries and team-related costs. The human factor remains the largest and most important single investment, including salaries, benefits, recruitment and training.

ISG’s research indicates that almost half of all IT spend is on staff. Forrester confirms this trend, reporting that 71% of leaders expect to increase investment in staff, and Metrics’ research points to salaries as one of the main areas of cost growth. The high costs reflect the fierce competition for talent, especially in high-demand areas such as cyber security, artificial intelligence and cloud.

Another significant segment, occupying around 20% of the budget, is software, dominated by subscription models (SaaS) and licences. This includes key enterprise platforms (ERP, CRM), collaboration tools and specialised applications.

Gartner predicts that software spending will increase by a solid 10-14%, driven by investments in AI-based features and the need to upgrade legacy applications. At the same time, CIOs are focusing on platform consolidation to combat the sprawl of SaaS applications and reduce unnecessary spending.

Cloud and infrastructure, accounting for around 15 per cent of expenditure, form the foundational layer of modern IT. This category includes the costs of public cloud providers (IaaS, PaaS), private cloud environments and other hardware in local data centres.

Spending in this area is growing rapidly, driven by digital transformation initiatives, support for hybrid working and, most importantly, the need for scalable computing power for AI workloads. IDC forecasts that spending on cloud services alone will reach $1.3 trillion by 2025.

Cyber security, once a smaller budget line item, is now a priority at board level and consumes around 12% of resources. It is a non-negotiable component of the budget, driven by the explosion of AI-driven threats and a wave of stringent new regulations such as DORA and the Cyber Resilience Act.

Industry benchmarks indicate that security spending accounts for between 10% and 15% of the total IT budget in large enterprises.

Approximately 10% of the budget is allocated to new projects and innovation, i.e. activities aimed at business development.

These are dedicated funds for strategic initiatives that generate new revenues or transform business processes, including digital product development and experimentation with new technologies such as GenAI.

The last category, with a share of around 8%, is maintenance and external operations.

This includes non-wage costs associated with day-to-day operations, such as managed service provider (MSP) fees and outsourcing contracts for routine tasks

Key drivers of growth: what drives investment?

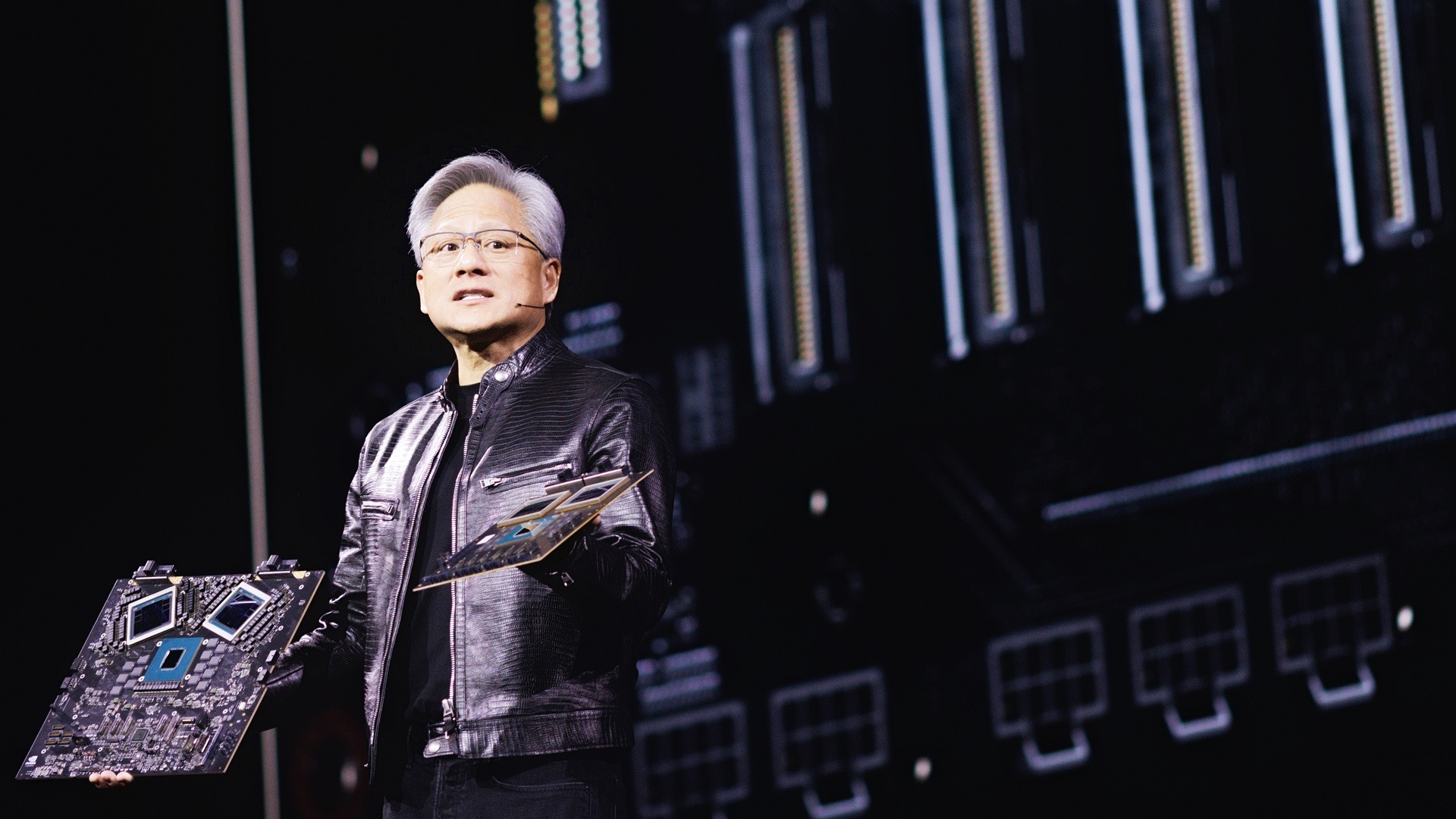

Three powerful forces are shaping priorities in IT spending in 2025. The first is artificial intelligence, which has become a real catalyst for change. Paradoxically, although generative AI is entering what Gartner calls the ‘pit of disillusionment’, meaning more moderate expectations, spending on it is accelerating.

This signifies a maturing of the market, where investments are shifting from experimentation to pragmatic deployments. CIOs are investing in foundational infrastructure, such as AI-optimised servers, and in software with AI features built in. According to the research, 63% of CIOs plan to spend on AI/ML in 2025, making this area the third most important priority.

The second driver is cyber security, which has ceased to be seen as a cost centre and has become a prerequisite for business. This is a top priority for CIOs for the fourth year in a row.

Spending is being driven by an increase in cyber attacks, now amplified by AI, and by stringent new regulations such as the EU DORA regulation and the Cyber Resilience Act, which are forcing a proactive security posture.

Budgets are mainly flowing into security services, cloud native application protection platforms (CNAPP) and identity and access management (IAM).

The third driving force is the cloud and modernisation, seen as the only way to escape technology debt. Older systems are a major burden, with Deloitte research suggesting that as much as 56% of IT spend goes on maintenance.

The cloud offers the agility, scalability and cost efficiency needed to compete. The PwC report identifies the modernisation of cloud platforms as a key objective for CIOs in 2025. The strategic goal is to move from simply moving workloads to building native applications in the cloud, which is reflected in the huge growth of the IaaS market.

Strategic dilemma: the balance between retention and innovation

The biggest challenge for IT leaders remains the age-old dilemma: how to balance spending on maintaining existing systems (‘Run’) with investing in innovation to drive growth (‘Grow’).

Many organisations are stuck in a cycle where 70 per cent or more of their budget is absorbed by simply ‘keeping the lights on’, leaving few resources for digital transformation. This operational burden is the biggest single barrier to growth.

This problem is compounded by inflationary pressures. As Gartner’s John-David Lovelock points out, increases in budgets are often swallowed up by rising supplier prices and wages, meaning that even with larger budgets, the funds available for new initiatives can shrink.

This creates the ‘illusion of increased spending’, while the real value derived from investments remains stagnant.

The combination of operational burden and inflationary pressures is forcing a radical change in IT financial management. CIOs can no longer win by simply asking for bigger budgets. They must win by reallocating existing resources more efficiently. The only way to fund necessary innovation is to aggressively cut maintenance costs.

This elevates cost optimisation from a tactical exercise to a core strategic function. Strategies such as consolidating SaaS platforms, automating routine tasks, implementing rigorous cloud-based financial management (FinOps) and upgrading legacy systems are becoming key to unlocking capital for innovation .

Budget as a compass for innovation

The budget landscape for 2025 is characterised by growing but constrained budgets, dominated by talent, software and cloud spending. These investments are driven by the imperatives of artificial intelligence, cyber security and modernisation. The main challenge remains the same: striking a balance between the cost of living and funding innovation.

To meet these challenges, IT leaders need to adopt a new approach. Value-based budgeting needs to be introduced, where every investment is linked to a measurable business outcome.

Artificial intelligence should be treated not as a technology project but as an organisational change, requiring a solid foundation of data management and competence. Cost optimisation must become the engine of innovation, creating a self-financing growth mechanism through the reallocation of savings.

Finally, digital resilience, built by strategic investment in cyber security, should be seen not as a cost, but as a competitive advantage that builds trust and enables faster innovation. In 2025, the IT budget ceases to be just a financial statement and becomes a strategic compass that sets the company’s course in the present day.