The skills gap in IT is becoming one of the main challenges for the Polish economy, especially in the SME sector. Although the number of IT specialists is growing, micro and small companies still have limited access to key technological talent. The scale of the shortage is revealed in the data: over 90% of the smallest companies do not even attempt to recruit IT specialists.

The SME sector is the foundation of the Polish economy – it accounts for 98% of companies and almost half of GDP. It is dominated by the micro-enterprise segment (95.7% of active companies in Q4 2024), which affects the limited possibilities of digitalisation and access to IT specialists. In 2023, the SME sector will have 2.3 million entities, employing 6.9 million people. Most of these companies operate without their own IT departments, which hinders digital transformation and widens the skills gap, especially in the smallest companies.

At the same time, the Polish IT sector is growing dynamically and generates around 8% of GDP. In 2021/2022, it employed some 586,000 IT specialists (3.5% of the workforce), a figure which increased by 192,000 over the decade. Other estimates from 2023 put the number at 410,000 specialists and over 60,000 IT companies, placing Poland at the forefront of the CEE region.

However, the IT market is bipolar in nature. A strong export sector attracts the best professionals, offering competitive rates and interesting projects. The domestic SME segment, on the other hand, is struggling to attract them, limiting its ability to digitally transform and perpetuating a skills gap outside the IT sector.

Structure of the Polish business sector and IT specialist resources

Understanding the structure of companies in Poland and the availability of IT professionals is key to assessing the skills gap in SMEs.

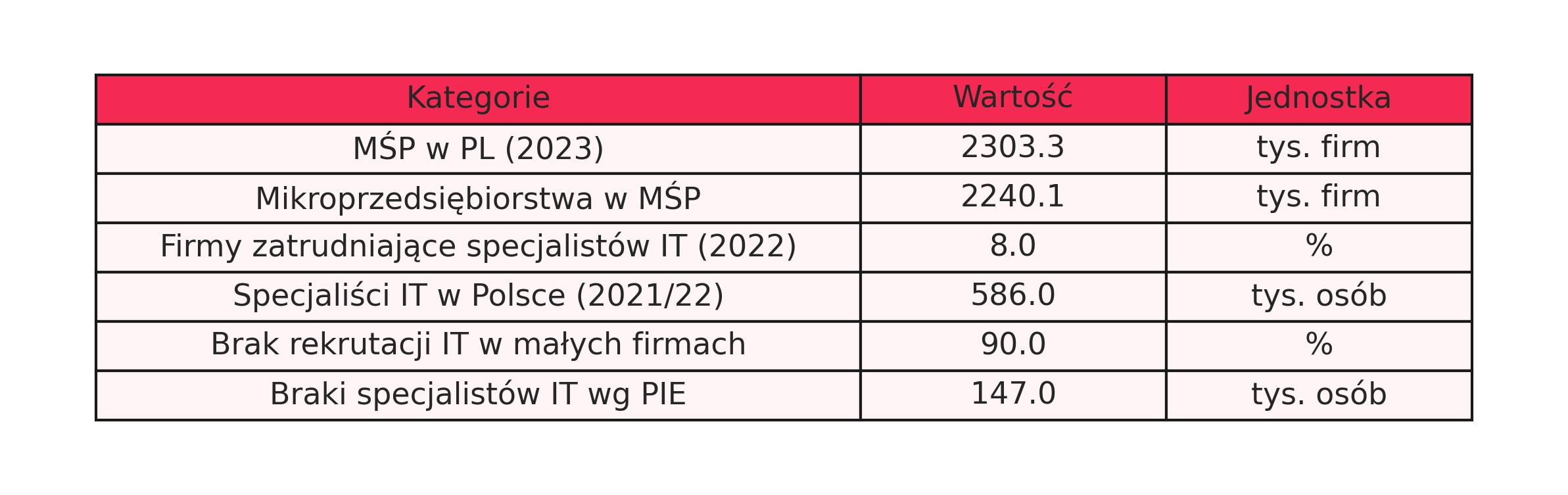

In Q4 2024, there were 2 788 814 active enterprises in Poland – 3.7% more than a year earlier. As many as 95.7% of them were micro-enterprises (up to 9 employees). In 2023, the number of non-financial enterprises was 2,307.1 thousand, of which 2,240.1 thousand were microenterprises (97.1%). The entire SME sector comprised 2 303.3 thousand entities, which accounted for 99.8% of non-financial enterprises.

In the ‘Information and communication’ sector (PKD J), 180,020 companies were operating in 2023, of which 177,405 were micro-enterprises. The share of this sector increased by 4.6 percentage points compared to 2010, but still only accounts for about 2.7 per cent of the total number of companies.

Data from the Polish Economic Institute shows that more than 90% of small and micro businesses have not attempted to recruit IT specialists. This means that digital transformation in SMEs is often outsourced or not undertaken at all, exacerbating the uneven allocation of IT resources across the sector.

Number and profile of IT specialists in Poland compared to the EU

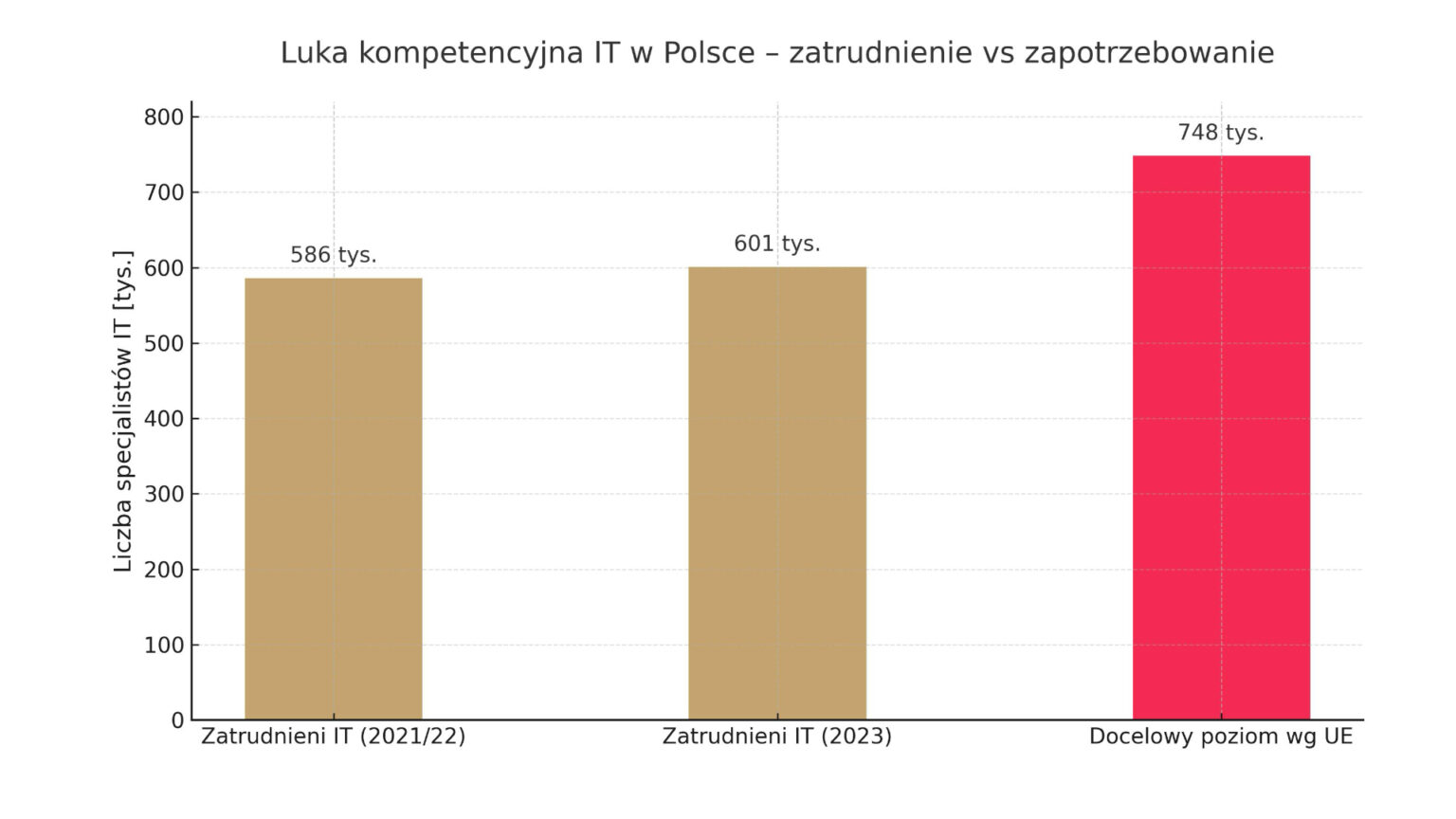

There are approximately 586,000 IT professionals working in Poland (2021/2022), representing 3.5% of the workforce – one of the lowest rates in the EU, where the average is 4.5%. Poland remains 4.5 percentage points below the leader, Sweden. Although the number of IT professionals in Poland has increased by 192,000 in a decade, the distance to the EU average remains.

Only 15.5% of IT professionals in Poland are women, compared to an EU average of 19.1%. Such a low representation of women limits the inflow of new talent and makes it difficult to reduce the skills gap. Increasing the number of graduates in STEM fields is not enough without measures to level the playing field through educational and promotional initiatives.

Self-employment in IT and availability of talent for SMEs

At the end of 2023, there were 219,000 IT software and consultancy businesses, of which 193,000 (90%) were sole proprietorships (JDG). Many self-employed provide services to large companies and foreign clients, taking advantage of the flexibility and higher rates offered by B2B contracts.

This model limits the availability of experts to SMEs, which have smaller budgets, less advanced projects and weaker JDG experience. As a result, the most sought-after specialists are often beyond the reach of domestic SMEs, widening the skills gap – despite the large number of IT-talents in Poland.

The skills gap in IT: challenges for SMEs

The shortage of IT specialists is one of the main development challenges in Poland, particularly affecting the SME sector. The problem is structural and multifactorial in nature.

The Polish Economic Institute (PIE) estimates that Poland lacks 147,000 IT specialists to reach the EU average level of employment in this area, or 25,000 in relation to the potential of the economy. As many as 42% of IT vacancies are difficult to fill, and 64% of companies have hired fewer specialists than planned. Staff shortages translate into real losses: 20% of companies have had to abandon projects due to skills shortages.

In SMEs, the scale of the problem is particularly evident. According to PIE, only 4% of companies in Poland hired an IT specialist (2020), and in 2022 only 8% were recruiting in this area. More than 90% of small and micro businesses were not looking for IT specialists at all. This shows that the skills gap is not just down to a lack of candidates, but also a lack of awareness, resources or willingness of companies to invest in IT competencies.

The so-called ‘hidden gap’ means that many SMEs are opting out of digital transformation or undertaking it in a reactive manner, limiting their competitiveness and adaptability. Official vacancy rates (e.g. 3.85% in the Information and Communication sector) do not fully reflect the scale of these unmet needs across the SME sector.

Main causes of the skills gap in IT

- Education system – The number of STEM graduates in Poland has been falling since 2017. 3.5 times as many such graduates are needed to close the gap in IT. Although IT attracted more than 43,000 applicants in the 2023/24 academic year, many students drop out of further education due to high salaries already during their studies.

- Job market and salary pressure – IT professionals are among the best paid in Poland – in 2021, the lower median spread was PLN 13,000 net, the upper median was PLN 18,400. In 2022, the average salary in the ‘Information and Communication’ sector is PLN 11,133 gross, and forecasts for 2025 indicate an average of PLN 8821.25 gross. The best (DevOps, data analysts) can earn up to PLN 27.7k. Although these rates are high in Poland (on average around PLN 19k gross), they are three times lower than in the US – which drives remote job offers from abroad.

Large IT companies, especially export companies, are able to pay competitively.In contrast, SMEs, operating on local margins, are unable to withstand the pressure of wages, which closes off their access to specialists. This drives the cycle: lack of resources → lack of specialists → lack of transformation → lack of growth → lack of resources. - Low digital competences of the population – Only 43% of Poles have basic or secondary digital skills (2021), which places Poland third from last in the EU (average: 59%). Poor digital competences of employees hinder business development and recruitment and limit demand for IT services.

Consequences of the shortage of IT specialists for SMEs

The shortage of IT professionals has serious, multidimensional effects on the functioning and competitiveness of small and medium-sized companies:

- Greater risk of cyber threats – Lack of in-house IT increases the risk of failures, poor system performance and hacking attacks. As many as 70% of companies in Poland have experienced a data security incident and the average cost of an attack is more than PLN 1 million.

- Decline in productivity and innovation – The IT skills deficit limits SMEs’ operational agility and ability to innovate and adapt to market changes.

- Project constraints – 20% of companies have had to refuse assignments due to staff shortages and 61% have exceeded planned deadlines.Employee overload – In companies without sufficient IT support, employees often work beyond the norm: 40% do it sometimes, 16% often and 3% very often. According to SW Research, 44% of SME entrepreneurs work more than 40 hours a week – indicating a potential role for AI in relieving their workload.

Cumulative impact of the IT skills gap on SMEs

IT staff shortages translate into higher risk of cyber threats, lower operational efficiency, reduced innovation and lost business opportunities. Together, they inhibit the growth potential of SMEs.

As the SME sector generates almost half of Poland’s GDP, its digital stagnation negatively affects the pace of economic development and the country’s level of digital maturity. Therefore, solving the IT skills gap is not only an industry challenge, but a key macroeconomic priority for Poland’s future competitiveness and prosperity.

Forecasts and key trends on the Polish IT and labour market

IT spending – globally and locally

According to Gartner, global IT spending will reach US$5 trillion in 2024 (+6.8% y-o-y), rising to US$5.61 trillion in 2025 (+9.8%). Growth is driven by investments in software, IT services, public cloud (+20%) and cyber security. Spending on artificial intelligence is also becoming key.

The Polish ICT market reached USD 24.5 billion (+11.4%) in 2022, of which the IT sector accounted for USD 18 billion (+14.7%). In 2023, the IT market was forecast to decline by 3%, mainly through lower hardware sales. The cloud market is growing rapidly – USD 1.3bn in 2022 (+30%), with a projected CAGR of 22.7% to 2027.

Companies’ new approach to technology

Despite global uncertainty and a drop in spending in 2023, the long-term trend is positive. Technology is no longer a discretionary cost – today it is a key investment in business efficiency, optimisation and resilience.

This sustained demand for IT, even during the downturn, implies constant – albeit changing – staffing needs. The IT job crisis of 2023 was a correction and a shift in demand towards more specialised roles, rather than a permanent decline in employment.

Evolution of IT competences and new market needs

Generative AI (GenAI) is gaining traction, with 29% of companies using it in 2024 (up from 9% y-o-y) and 97% of CEOs anticipating its business impact. 99% of organisations plan to increase their investment in AI, and the AI agent market is expected to grow from $5.1bn (2023) to $47.1bn (2030).

The biggest growth in demand is in the areas of cyber security (+126% y/y), systems architecture (+84%), AI integration (+63%). Key technologies are AI/ML, cloud (AWS, Azure, GCP), DevOps (CI/CD, Kubernetes), Big Data (SQL, NoSQL, Spark), and the most popular languages are Python, JavaScript, Java and Rust. There is also a growing demand for testers and technical support.

Soft skills are also in demand: analytical thinking (70%), flexibility (65%), AI/ML skills (70%), cyber security (65%) and adaptation to new tools (59%).

GenAI is changing the demand for skills – it’s less about a shortage of general IT professionals, more about a shortage of experts with advanced AI and cyber security skills. This is a particular challenge for SMEs, which are struggling to attract or retrain staff in a rapidly changing environment.

Employment prospects for IT and SMEs up to 2030

Poland’s IT labour market stabilises after correction. ManpowerGroup’s Q2 2025 forecast indicates +21% net hiring, with the highest growth in SMEs: +26% in small companies and +20% in medium-sized ones. The main reasons are company growth (43%) and market expansion (29%).

Poland’s IT industry is growing – 410,000 professionals and 60,000 companies. AI will increase productivity and GDP, but it can also automate 14% of jobs and transform 32%. Poland, as an IT service provider, stands to gain more than Western countries.

The increasing propensity of SMEs to hire IT specialists signals a breakthrough: a shift away from survival to investment in internal technological competence. It’s a key step towards digital maturity and containment5. Strategies and initiatives to close the skills gap in SMEs

In view of the growing IT gap, especially in the SME sector, comprehensive measures – from financial support to educational programmes and cross-sector cooperation – are key.

The Polish IT market is growing dynamically, but SMEs face a serious skills gap. The dominance of micro-enterprises and the prevalence of self-employment in the IT industry create unique barriers to talent.

Key findings:

- Structural gap in SMEs: More than 90% of small companies do not recruit IT professionals. The problem is not just a lack of candidates, but also a lack of strategy and awareness of digitalisation, which limits their growth.

- Dualism of the IT market: Export IT companies attract the best professionals, mainly in a B2B model. SMEs outside the industry are unable to compete on wages, exacerbating labour market segmentation.

- Competency shift: There is a growing demand for AI, cyber security and systems architecture specialists. For SMEs, retraining employees or acquiring such competences is particularly difficult.

- Costs and risks: IT staff shortages increase the risk of cyber threats (70% of companies have experienced them), reduce productivity, lead to overloads and hold up projects – affecting companies’ competitiveness and national GDP.

- New recruitment trend: forecasts for 2025 show a growing willingness of SMEs to hire IT professionals, which may signal a breakthrough in the approach to building in-house digital competence.