The customer relationship management(CRM) software market is a strategic battleground, valued at more than $80 billion in 2024, making it the largest enterprise software category.

At the head of this empire for more than a decade has been Salesforce, the undisputed leader, which analysts at IDC have crowned king of the market for the twelfth consecutive year. The platform is used by more than 150,000 companies, including around 90 per cent of Fortune 500 corporations, and its market share is greater than that of its four largest competitors combined.

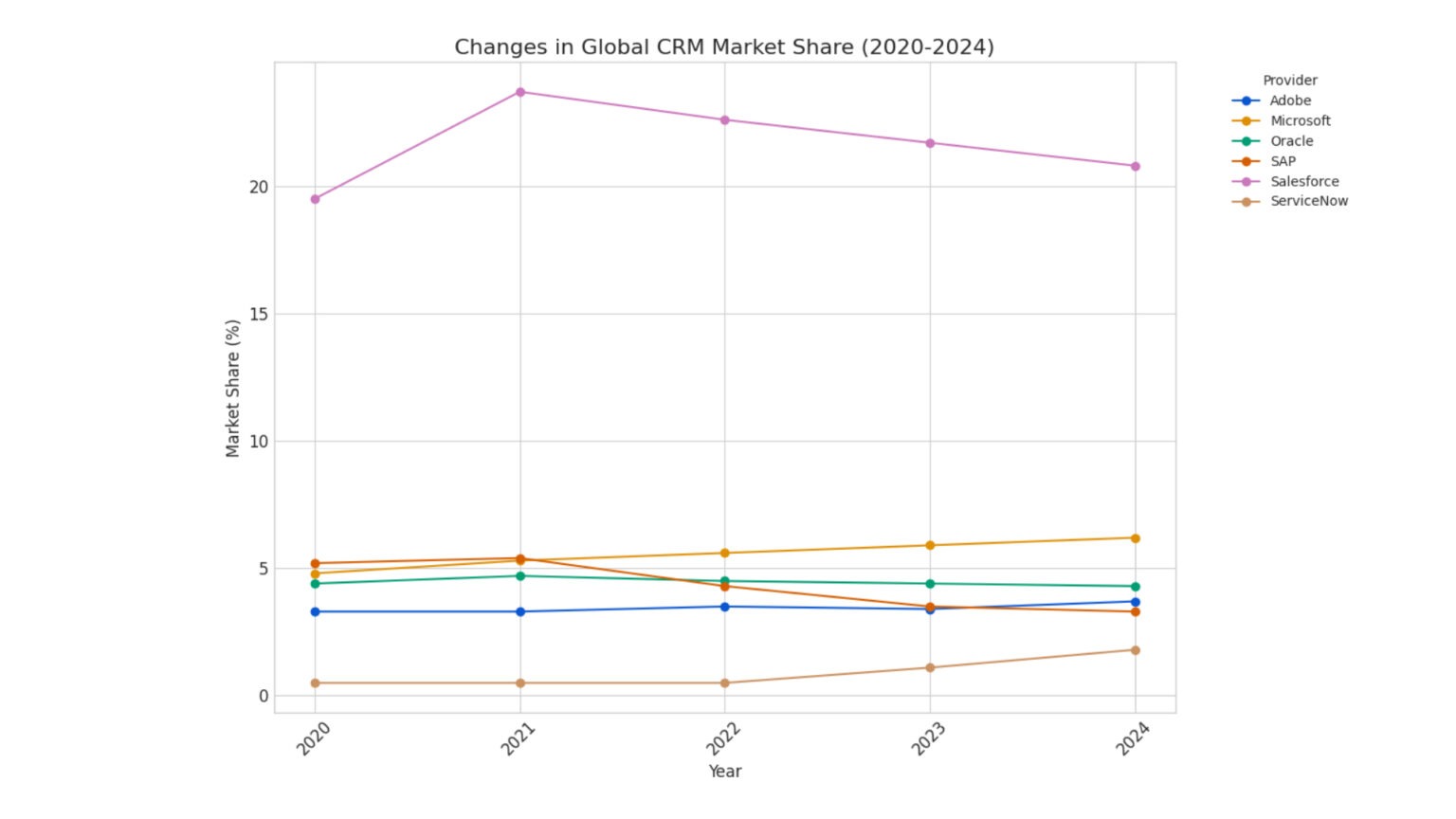

However, even the most powerful kingdoms are not forever. Although Salesforce’s revenues continue to grow, its percentage market share has started to decline slightly – from 21.7% in 2023 to 20.7% in 2024. This subtle but significant signal shows that the strategic landscape is changing.

The resurgence of an ecosystem giant in the form of Microsoft, the emergence of a disruptor from another domain such as ServiceNow, and the relentless pressure of the AI revolution are creating the biggest challenge to the Salesforce hegemony in years. Are we witnessing the beginning of the end of the Salesforce era, or merely temporary turbulence?

Anatomy of domination: how Salesforce built its empire

Understanding today’s challenges requires an analysis of the foundations of Salesforce’s power. Its dominance is the result of a consistent strategy based on three pillars:

- Cloud pioneering: As one of the first players to bet on the Software-as-a-Service (SaaS) model, Salesforce gained a huge advantage by eliminating the need for customers to invest in costly infrastructure

- An unparalleled ecosystem (AppExchange): the creation of AppExchange was a strategic masterstroke. By enabling thousands of developers to create their own extensions, Salesforce built a self-perpetuating economy around its platform that made the system extremely ‘sticky’ – difficult and expensive to abandon.

- Growth through acquisitions: Acquisitions such as Tableau ($15.7bn) and Slack ($27.7bn) were not just technology purchases, but strategic moves to take control of key areas: data analytics and corporate communications.

In the face of new threats, Salesforce is investing billions in the development of its Einstein AI platform, as evidenced by its recent $14bn acquisition of Convergence AI, a company specialising in customer behaviour prediction.

However, it is the strategy that has been the source of Salesforce’s strength – aggressive acquisitions – that may prove to be its Achilles’ heel. It has led to a powerful but architecturally inconsistent portfolio.

Instead of a single, unified platform, Salesforce offers a collection of interconnected ‘clouds’, creating fundamental challenges around data unification – a key prerequisite for successful AI implementation.

The giant’s awakening: Microsoft Dynamics 365 and the power of the ecosystem

Microsoft has been seen as one of many contenders over the years, but its recent moves make it the most serious rival to Salesforce. Microsoft’s strategy is not to win in a direct comparison of CRM functions.

Instead, the company is aiming to make Dynamics 365 the natural choice for the millions of businesses already in its ecosystem.

The key is seamless, native integration with Microsoft 365, Teams, Power BI and the Azure cloud. Central to this strategy is Copilot, the intelligence layer that permeates all Microsoft applications.

Copilot in Outlook analyses the content of the email and automatically suggests the creation of a new sales opportunity in Dynamics 365. In Teams, it generates a summary of the meeting, which immediately goes into the CRM. This deep, contextual integration creates a productivity loop that Salesforce cannot easily copy.

What’s more, Microsoft actively competes with a lower total cost of ownership (TCO) and flexibility. Case studies of companies that have switched from Salesforce to Dynamics 365 often highlight a 30-60% reduction in unnecessary customisation and a significant acceleration in reporting cycles.

For IT directors grappling with application chaos, Microsoft’s proposition – the consolidation of vendors into a single, cohesive ecosystem – is extremely tempting.

An attack from another field: ServiceNow and the workflow revolution

ServiceNow’s entry into the CRM market is one of the most exciting developments in the industry in years. The company is not trying to compete with Salesforce on its terms. Instead, it is proposing a fundamentally different approach. Traditional CRMs are ‘systems of record’ (SOS).

ServiceNow positions itself as a ‘system of action’ (system of action) that aims to orchestrate and automate activities across the company to deliver on the promise made to the customer.

At the heart of ServiceNow’s competitive advantage is its architecture. Unlike Salesforce, ServiceNow has grown organically from the start, based on the philosophy of ‘one platform, one data model, one architecture’.This approach eliminates integration complexity and creates an ideal environment for artificial intelligence.

ServiceNow’s unique positioning stems from its roots in IT service management (ITSM). The company transfers its expertise in automating complex, internal processes to customer-facing processes such as customer service management (CSM) and field service management (FSM).

This strategy is particularly attractive to industries with complex after-sales processes, such as telecommunications and financial services. ServiceNow is trying to change the rules of the game, arguing that the real value lies not in the sale itself, but in delivering on the promise made to the customer.

The old guard on the defensive: the position of Oracle and SAP

While the battle is being fought at the forefront, market veterans Oracle and SAP are fighting their own battle to defend their territories. Oracle’s strategy is based on lower TCO and offering a fully integrated suite of front-office (CX/CRM) and back-office (ERP, HCM) applications.

This is attractive to companies already entrenched in the Oracle ecosystem, as evidenced by the ‘Leader’ position in Gartner’s Magic Quadrant.

SAP’s approach is similar and focuses on leveraging the giant S/4HANA ERP customer base. The SAP CX value proposition lies in the promise of seamless, native integration with key financial and logistics data residing at the heart of the enterprise.

For an existing SAP customer, choosing an integrated CRM from the same supplier is often the path of least resistance.

The future of the kingdom

The battle for the CRM throne is no longer just about functionality. The future will be decided by the clash of fundamentally different technological philosophies.

An analysis of the major players’ strategies reveals three key axes of competition: platform versus application, embedded AI versus AI as a layer, and the central role of data.

Given these trends, three likely scenarios can be outlined for the coming years:

- Erosion of the Status Quo: Salesforce maintains its leadership position, but its market share continues to slowly decline. Microsoft consolidates in second position and ServiceNow is gaining a significant niche in industries with complex service processes.

- Power duopoly: Microsoft’s ecosystem advantage proves decisive. The company is significantly closing the gap with Salesforce, creating a clear two-horse race

- The New Triumvirate: ServiceNow’s workflow-focused approach has been so successful that it is redefining parts of the market, making the company a third, undisputed top-level player.

The final verdict? The title of ‘best CRM’ is no longer universal. The optimal choice depends on a company’s strategic centre of gravity.

If you prioritise best-in-class, sales-focused customer engagement, backed by the world’s largest app ecosystem, Salesforce remains the default leader.

If the aim is to maximise productivity across the organisation and leverage existing Microsoft technology investments, Dynamics 365 offers a powerful, integrated and often more cost-effective proposition.

If your business model is based on complex, multi-departmental service and after-sales support processes, ServiceNow presents a fundamentally different and potentially much more effective approach.

The final piece of advice for decision-makers is: don’t evaluate CRM platforms solely on the basis of their functions today. Analyse their fundamental architectural philosophy and its alignment with your company’s long-term strategy in the areas of data, AI and automation. In this new era, it is these foundations that will determine future success.